Read/Write Data API Specification - v2.0.0

Version Control

| Version | Date | Author | Comments |

|---|---|---|---|

| 2.0-rc1 | Open Banking Read/Write API Team | This is the initial draft version for rc1 | |

| 2.0-rc2 | Open Banking Read/Write API Team | Moved Usage Examples from Account and Transactions Specification to this page Updated the Response Headers section to state the x-fapi-interaction-id should be generated if required. Matches FAPI specification. Clarified that x-fapi-financial-id corresponds to the organization id of the ASPSP in the Open Banking Directory. Clarified that x-jws-signature is only valid for some APIs. Removed x-jws-signature from examples. Changes to the Message Signing section to:

Added error code 415 Unsupported Media Type, for invalid Content-Type header value | |

| 2.0-rc3 | Open Banking Read/Write API Team | This is the initial draft version for rc3. Updates:

Errata:

| |

| 2.0.0 | Open Banking Read/Write API Team | This is the baseline version. No changes from v2.0-rc3, other than addition of release note. |

Release Note

This release note explains what's new in Read/Write Data API Specifications v2.0.0.

For clarity, the specifications have now been divided as follows:

| Specification | Changes in this release |

|---|---|

Read/Write Data API Specification Provides a description of the elements that are common across all the Read/Write Data APIs. (This should be read in conjunction with the latest individual Account & Transaction and Payment Initiation API Specifications as below). | Minor clarifications and amendments (see Version Control above). |

Account and Transaction API Specification Describes the flows and payloads for the ‘Read’ Data APIs. (This should be read in conjunction with the Read/Write Data API Specification as above). | Changes have been made to the Account and Transaction API Specification to support Open Data and to extend the API to cover other PSD2 in-scope payment accounts. Changes as summarised below. |

Payment Initiation API Specification Describes the flows and payloads for the ‘Write’ Data APIs. (This should be read in conjunction with the Read/Write Data API Specification as above). | No changes have been made to the Payment Initiation API in this release. ASPSPs and TPPs should refer to v1.1.0. of the Payment Initiation API Specification. |

Key Changes

Account and Transaction API Specification v2.0.0.

Supporting Open Data for standardised back-book products (Personal Current Accounts ‘PCA’ and Business Current Accounts ‘BCA’)

For PCA and BCA accounts, v1 of the read/write API specifications included a 'products' endpoint within the Account Information and Transaction API. This enabled a referential model, where a TPP could access the PSU's account and retrieve the product ID for on-sale accounts. This ID could then be used to reference the corresponding product information in the Open Data standard. Version 2 extends the capability of the ‘products’ endpoint within the Account Information and Transaction API so TPP’s can directly access key product data for PSU’s who have a back book product, in the event the back-book product is not available in the Open Data standard.

High level changes from v1.1 include:

- Restructure of the top level OBReadProduct2 as follows:

- ProductName

- ProductId

- AccountId

- SecondaryProductId

- MarketingStateId

- ProductType

- Extended ProductType enumeration:

- Additional PCA object

- Additional BCA object

Extension to PSD2 in-scope accounts (sterling)

Version 2.0.0 extends the Account and Transaction API to cover other PSD2 in-scope payment accounts (limited to GBP accounts) in addition to personal and business current accounts covered by v1. These additional payment accounts are as follows:

- Payments enabled flexible savings accounts

- Payments enabled deposit accounts

- Payments enabled loan accounts

- Payments enabled mortgage accounts

- e-money accounts

- Credit card accounts

- Charge card accounts

High level changes from v1.1 include:

- Additional resources and related permissions codes:

- AccountRequests (authorisations for access to the account)

- Statements (associated information for each statement on the account)

- Offers (offers available on the account)

- Party (name and address or logged in user or account owner)

- ScheduledPayments (single one-off payment scheduled for a future date)

- Restructure of specifications into a sub-page for each resource.

- Added definition regarding optionality.

- Clarification for filtering that if a DateTime is specified in the filtering request with a timezone - the timezone component must be ignored by the ASPSP.

- Extended behaviour of the TransactionFromDateTimeand TransactionToDateTime to the statements resource.

Implementation Timelines

As per the CMA’s Notice of approval of changes to the Agreed Timetable and Project Plan (Retail Banking Market Investigation Order 2017) published on 22 November 2017, the implementation of this standard by ASPSPs will be split as follows:

- Relating to the amended CMA Order: each of the CMA9 to implement the following by end August 2018:

- the products endpoint to cater for Open Data back-book products (using either one or both of the referential or direct access methods)

- update of existing Account and Transaction v1.1 endpoints to v2 for PCA and BCA accounts only.

- Relating to PSD2 scope overall: any ASPSP adopting the OB standard for any PSD2 in-scope payment account products, should implement the relevant endpoints for each of those products in line with RTS timelines (TBC 2019).

Overview

The Read/Write Data API Specification provides a description of the elements that are common across all the Read/Write Data APIs.

This specification should be read in conjunction with the individual Read/Write API Specifications for Payment Initiation, Account & Transaction Information & Confirmation of Funds.

Document Structure

This document consists of the following parts:

Overview: Provides an overview of the scope of the API and the key decisions and principles that contributed to the specification.

Basics: The section begins with an introduction to how the APIs are used.

Security & Access Control: Specifies the means for TPPs and PSUs to authenticate themselves and provide consent.

Data Model: Describes the data model for the API payloads.

Design Principles

RESTful APIs

The API adheres to RESTful API concepts where possible and sensible to do so.

However, the priority is to have an API that is simple to understand and easy to use. In instances where following RESTful principles would be convoluted and complex, the principles have not been followed.

References:

- The highest level Data Description Language used is the JSON Schema : http://json-schema.org/

- Best Practice has also been taken from the Data Description Language for APIs; JSON API : http://jsonapi.org/

- The Interface Description Language used is the Swagger Specification version 2.0 (also known as Open API) : http://swagger.io/ and

Standards

The OBIE principles for developing API standards:

- OBIE will adopt existing standards where relevant/appropriate to minimise re-inventing the wheel.

- The Standards currently being reviewed include ISO20022, and FAPI.

- OBIE will favour developer/user experience over and above adoption of existing Standards, in order to create a more future proof Standard.

- OBIE will work with other relevant bodies to align with, contribute to and/or adopt other Standards work, especially relating to creation of Standards around APIs and JSON payloads.

ISO 20022

The CMA Order requires the CMA9 Banks to be aligned with the Regulatory and Technical Standards (RTS) under PSD2.

A previous draft of the EBA RTS required that the interface "shall use ISO 20022 elements, components or approved message definitions". In keeping with that requirement, the API payloads are designed using the ISO 20022 message elements and components where available.

The principles we have applied to re-use of ISO message elements and components are:

- Where relevant - the API payloads have been flattened so that they are more developer friendly. This has been a request from the developer community, and the stakeholders involved in the design workshop.

- Only elements that are required for the functioning of the API endpoint will be included in the API payload. API endpoints are defined for specific use-cases (not to be generically extensible for all use-cases).

- We will modify ISO 20022 elements where the existing standard does not cater for an API context (such as filtering, pagination etc.). An example is having latitude and longitude in decimal format - as this is how developers will work with latitude and longitude; or using simple types (e.g., a single date-time field) instead of a complex type (e.g., a choice field with a nesting of date and time).

Extensibility

It is intended that the API flows will be extended to cater for more complex use-cases in subsequent releases - and we have kept this in mind during the design.

Idempotency

Idempotency is difficult to implement consistently and leverage consistently.

As a result, idempotency is used sparingly in the Open Banking API specifications; with a preference to allow TPPs to simply re-submit a request under failure conditions.

APIs have been defined to be idempotent, where not doing so would cause a poor PSU user-experience or increase false positive risk indicators.

Message Signing

Digital signatures will facilitate non-repudiation for Open Banking APIs.

However, the solution for digital signatures (if required in a future release) has been agreed and the approach required to achieve this is described in Basics / Message Signing.

Agnostic to Payment Schemes

The API will be designed so that it is agnostic to the underlying payment scheme that is responsible for carrying out the payment.

As a result, we will not design field lengths and payloads to only match the Faster Payments message, and will instead rely on the field lengths and definitions in ISO 20022. Due diligence has been carried out to ensure that the API has the necessary fields to function with Bacs payments - as per agreed scope.

We will provide further mapping guidance to ensure that differences are understood between the Open Banking Payment API standard, and FPS and Bacs schemes where applicable.

Status Codes

The API uses two status codes that serve two different purposes:

- The HTTP Status Code reflects the outcome of the API call (the HTTP operation on the resource). The Security Working Group has stated that granular error codes may expose threat vectors - so these are limited to the HTTP Status Codes.

- A Status field in some of the resource payloads reflects the status of resources.

Unique Identifiers (Id Fields)

A REST resource should have a unique identifier (e.g. a primary key) that may be used to identify the resource. These unique identifiers are used to construct URLs to identify and address specific resources.

However, considering that some of the resources described in these specifications do not have a primary key in the system of record, the Id field will be optional for some resources.

An ASPSP that chooses to populate optional ID fields must ensure that the values are unique and immutable.

Definition of Optionality

For endpoints and fields within each resource, the following definitions apply:

- 'Mandatory' endpoints or fields marked must be implemented by the ASPSP.

- 'Conditional' endpoints or fields must be implemented by the ASPSP if these are made available to the PSU in the ASPSP's existing Online Channel (subject to Note 1 below).

- 'Optional' endpoints may be implemented by the ASPSP.

'Online Channel' refers to the superset of the ASPSPs website interface or mobile application (i.e. any information provided to the PSU in either channel).

Notes

- It is up to each ASPSP to make their own regulatory interpretation, based on eg PSD2, as to which of the ‘Conditional’ endpoints and fields must be implemented.

- ASPSPs are free to decide whether to implement any of the ‘Optional’ endpoints and fields.

- ASPSPs must make documentation available to TPPs as to which conditional and optional endpoints and fields are implemented for this specification. The method for providing this documentation will be covered in the implementation guidelines.

Basics

Actors

| Actor | Abbreviation | Type | Specializes | Description |

|---|---|---|---|---|

| Payment Service User | PSU | Person | N/A | A natural or legal person making use of a payment service as a payee, payer or both (PSD2 Article 4(10)) |

| Payment Service Provider | PSP | Legal Entity | N/A | A legal entity (and some natural persons) that provide payment services as defined by PSD2 Article 4(11) |

| Account Servicing Payment Service Provider | ASPSP | Legal Entity | PSP | An ASPSP is a PSP that provides and maintains a payment account for a payment services user (PSD 2 Article 4(15). The CMA 9 are all ASPSPs. |

| Third Party Providers / Trusted Third Parties | TPP | Legal Entity | PSP | A party other than an ASPSP that provides payment related services. The term is not actually defined in PSD2, but is generally deemed to include all payment service providers that are 3rd parties (the ASPSP and the PSU to whom the account belongs being the first two parties). References to a "TPP" in the specification relate to a piece of registered software with an ASPSP (with a specific client_id). |

| Payment Initiation Service Provider | PISP | Legal Entity | TPP | A TPP that provides Payment Initiation Services. PSD2 does not offer a formal definition. Article 4(18) quite circularly defines a PISP as a PSP that provides Payment Initiation Services. |

Account Information Service Provider | AISP | Legal Entity | TPP | A TPP that provides Account Information Services. Again, PSD2 defines AISPs in Article 4(19) circularly as a PSP that provides account information services |

| Card Based Payment Instrument Issuer | CBPII | Legal Entity | TPP | A TPP that issues card based payment instruments to PSUs and requires access to the Confirmation of Funds API. |

Character Encoding

The API requests and responses must use a UTF-8 character encoding. This is the default character encoding for JSON (RFC 7158 - Section 8.1)

However, an ASPSP's downstream system may not accept some UTF-8 characters, such as emoji characters (e.g. "Happy Birthday 🎂🎂!" may not be an acceptable Payment Reference). If the ASPSP rejects the message with a UTF-8 character that cannot be processed, the ASPSP must respond with an HTTP 400 (Bad Request) status code.

Date Formats

All dates in the JSON payloads are represented in ISO 8601 date-time format. All date-time fields in responses must include the timezone. An example is below:

2017-04-05T10:43:07+00:00

All dates in the HTTP headers are represented as RFC 7231 Full Dates. An example is below:

Sun, 10 Sep 2017 19:43:31 UTC

All dates in the JWT claims are expressed as a JSON number representing the number of seconds from 1970-01-01T0:0:0Z as measured in UTC until the date/time.

//Sun, 12 Feb 2018 14:45:00 UTC 1518446700

Resource URI Path Structure

The resources defined by these APIs may be addressed through a path structure consisting of the following parts:

- An optional ASPSP specific path prefix

- The constant string "open-banking"

- The version of the APIs expressed as /v[major-version].[minor-version]/

- The resource name

Examples:

/superbank/open-banking/v2.0/payments

/open-banking/v2.0/account-requests

/apis/open-banking/v2.1/accounts

Headers

Request Headers

| Header Value | Notes | POST Requests | GET Requests | DELETE Requests |

|---|---|---|---|---|

| x-fapi-financial-id | The unique id of the ASPSP to which the request is issued. The unique id will be issued by OB and corresponds to the Organization Id of the ASPSP in the Open Banking Directory. | Mandatory | Mandatory | Mandatory |

| x-fapi-customer-last-logged-time | The time when the PSU last logged in with the TPP. | Optional | Optional | Optional |

| x-fapi-customer-ip-address | The PSU's IP address if the PSU is currently logged in with the TPP. | Optional | Optional | Optional |

| x-fapi-interaction-id | An RFC4122 UID used as a correlation id. If provided, the ASPSP must "play back" this value in the x-fapi-interaction-id response header. | Optional | Optional | Optional |

| Authorization | Standard HTTP Header; Allows Credentials to be provided to the Authorisation / Resource Server depending on the type of resource being requested. For OAuth 2.0 / OIDC, this comprises of either the Basic / Bearer Authentication Schemes. | Mandatory | Mandatory | Mandatory |

| Content-Type | Standard HTTP Header; Represents the format of the payload being provided in the request. This must be set to application/json. If set to any other value, ASPSP must respond with a 415 Unsupported Media Type. | Mandatory | Do not use | Do not use |

| Accept | Standard HTTP Header; Determine the Content-Type that is required from the Server. If specified, it must have the value If set to an unacceptable value the ASPSP must respond with a 406 Not Acceptable. If not specified, default is application/json | Optional | Optional | Do not use |

| x-idempotency-key | Custom HTTP Header; Unique request identifier to support idempotency. Mandatory for POST requests to idempotent resource end-points. Must not be specified for other requests. | Optional | Do not use | Do not use |

| x-jws-signature | Header containing a detached JWS signature of the body of the payload. Refer to resource specific documentation on when this header must be specified. | API specific | API specific | API specific |

(Reference: Section 6.3 - Financial API — Part 1: Read Only API Security Profile (Implementer’s Draft).)

Whether the PSU is present or not-present is identified via the x-fapi-customer-ip-address header. If the PSU IP address is supplied, it is inferred that the PSU is present during the interaction.

The implications to this are:

- ASPSPs will need to rely on AISPs assertion.

- As agreed at TDA (18/05), it will be up to the ASPSPs to interpret the 4-times customer not present rule - to be within the “spirit” of the RTS requirement.

- This is dependent on GDPR considerations on the AISP passing a PSU's IP address to an ASPSP.

Response Headers

| Header Value | Notes | Mandatory? |

|---|---|---|

| Content-Type | Standard HTTP Header; Represents the format of the payload returned in the response. The ASPSP must return Content-Type: application/json as a content header for all endpoints, except the GET ../statements/{StatementId}/file endpoint, where it is up to the ASPSP to specify available options. | Mandatory |

| x-jws-signature | Header containing a detached JWS signature of the body of the payload. Refer to resource specific documentation on when this header must be returned. | API specific |

| x-fapi-interaction-id | An RFC4122 UID used as a correlation id. The ASPSP must set the response header | Mandatory |

| Retry-After | Header indicating the time (in seconds) that the TPP should wait before retrying an operation. The ASPSP should include this header along with responses with the HTTP status code of 429 (Too many requests). | Optional |

Return & Error Codes

The following are the HTTP response codes for the different HTTP methods - across all Read/Write API endpoints.

Situation | HTTP Status | Notes | Returned by POST | Returned by GET | Returned by DELETE |

|---|---|---|---|---|---|

| Query completed successfully | 200 OK | No | Yes | No | |

| Normal execution. The request has succeeded. | 201 Created | The operation results in the creation of a new resource. | Yes | No | No |

| Delete operation completed successfully | 204 No Content | No | No | Yes | |

Request has malformed, missing or non-compliant JSON body or URL parameters | 400 Bad Request | The requested operation will not be carried out. | Yes | No | No |

Authorization header missing or invalid token | 401 Unauthorized | The operation was refused access. Re-authenticating the PSU may result in an appropriate token that may be used. | Yes | Yes | Yes |

Token has incorrect scope or a security policy was violated. | 403 Forbidden | The operation was refused access. Re-authenticating the PSU is unlikely to remediate the situation. | Yes | Yes | Yes |

| The TPP tried to access the resource with a method that is not supported. | 405 Method Not Allowed | Yes | Yes | Yes | |

| The request contained an Accept header other than permitted media types and a character set other than UTF-8 | 406 Not Acceptable | Yes | Yes | Yes | |

| The operation was refused because the payload is in a format not supported by this method on the target resource. | 415 Unsupported Media Type | Yes | No | No | |

| The operation was refused as too many requests have been made within a certain timeframe. | 429 Too Many Requests | Throttling is a NFR. The ASPSP should include a Retry-After header in the response indicating how long the TPP must wait before retrying the operation. | Yes | Yes | Yes |

| Something went wrong on the API gateway or micro-service | 500 Internal Server Error | The operation failed. | Yes | Yes | Yes |

An ASPSP MAY return other standard HTTP status codes (e.g. from gateways and other edge devices) as described in RFC 7231 - Section 6.

400 (Bad Request) v/s 404 (Not Found)

When a TPP tries to request a resource URL with a resource Id that does not exist, the ASPSP must respond with a 400 (Bad Request) rather than a 404 (Not Found).

e.g., if a TPP tries to GET /payments/22289 where 22289 is not a valid PaymentId, the ASPSP must respond with a 400.

When a TPP tries to request a resource URL that results in no business data being returned (e.g. a request to retrieve standing order on an account that does not have standing orders) the ASPSP must respond with a 200 (OK) and set the array to be empty.

If the TPP tries to access a URL for a resource that is not defined by these specifications (e.g. GET /card-accounts), the ASPSP may choose to respond with a 404 (Not Found).

If an ASPSP has not implemented an optional API, it must respond with a 404 (Not Found) for requests to that URL.

The table below illustrates some examples of expected behaviour:

| Situation | Request | Response |

|---|---|---|

| TPP attempts to retrieve a payment with a PaymentId that does not exist | GET /payments/1001 | 400 (Bad Request) |

| TPP attempts to retrieve a resource that is not defined | GET /bulk | 404 (Not Found) |

TPP attempts to retrieve a resource that is in the specification, but not implemented by the ASPSP. e.g., an ASPSP has chosen not to implement the status API endpoint for payment-submissions | GET /payment-submissions/1002 | 404 (Not Found) |

| TPP attempts to retrieve standing orders for an AccountId that exists, but does not have any standing orders | GET /accounts/1000/standing-orders | 200 OK {

"Data": {

"StandingOrder": []

},

"Links": {

"Self": "https://api.alphabank.com/open-banking/v1.0/accounts/1000/standing-orders/"

},

"Meta": {

"TotalPages": 1

}

} |

403 (Forbidden)

When a TPP tries to access a resource that it does not have permission to access, the ASPSP must return a 403 (Forbidden).

The situation could arise when:

- The TPP uses an access token that does not have the appropriate scope to access the requested resource.

- The TPP attempted to access a resource with an Id that it does not have access to. e.g., an attempt to access GET /payments/1001 where a payment resource with id 1001 belongs to another TPP.

- The TPP tries to access an account/transaction resource, the TPP does not have a consent authorisation with the right Permissions to access the requested resource. e.g., an attempt to access GET /standing-orders when the ReadStandingOrdersBasic permission was not included in the consent authorisation.

- The TPP tries to access an account/transaction resource and the TPP does not have a consent authorisation for the AccountId. e.g., an attempt to access GET /accounts/2001 or GET /accounts/2001/transactions when the PSU has not selected AccountId 2001 for authorisation.

When the TPP uses an access token that is no longer valid, the situation could potentially be remedied by asking the PSU to re-authenticate. This should be indicated by a 401 (Unauthorized) status code.

429 (Too Many Requests)

When a TPP tries to access a resource too frequently the ASPSP may return a 429 (Too Many Requests). This is a Non Functional Requirement and is down to individual ASPSPs to decide throttling limits.

This situation could arise when:

- A TPP decides to implement "Real Time Payment Status" functionality for its users and implements this badly by polling a GET endpoint or an Idempotent POST endpoint once-per-second constantly to provide pseudo "real-time" Status updates to the user.

- A TPP decides to use the Single Immediate Payment endpoint as if it were a BATCH payment facility and sends 1,000 payment requests in a very short space of time.

Pre-Conditions

The following pre-conditions must be satisfied in order to use these APIs:

Pre-conditions for TPPs

- The TPP must have completed onboarding on the Open Banking Directory.

- The TPP must have registered one or more software statements with the Open Banking Directory.

- To use the Payment Initiation APIs, the the software statement must have "payments" as one of the permitted scopes.

- To use the Account/Transaction APIs, the software statement must have "accounts" as one of the permitted scopes.

- To use the Confirmation of Funds APIs, the software statement must have "fundsconfirmations" as one of the permitted scopes.

- The TPP must have valid network and signing certificates issued by Open Banking.

- The TPP must have completed registration with each of the ASPSPs that it wants to transact with and have been issued with a client-id.

Pre-conditions for ASPSPs

- The ASPSP must have completed onboarding on the Open Banking Directory.

- The ASPSP must have valid network and signing certificates issued by Open Banking.

Idempotency

If idempotency is implemented for an API endpoint:

- The x-idempotency-key provided in the header must be at most 40 characters in size. If a larger x-idempotency-key length is provided, the ASPSP must reject the request with a status code is 400 (Bad Request).

- The PISP must not change the request body while using the same x-idempotency-key. If the TPP changes the request body, the ASPSP must not modify the end resource. The ASPSP may treat this as a fraudulent action.

- The ASPSP must treat a request as idempotent if it had received the first request with the same x-idempotency-key from the same TPP in the preceding 24 hours.

- The ASPSP must not create a new resource for a POST request if it is determined to be an idempotent request.

- The ASPSP must respond to the request with the current status of the resource (or a status which is at least as current as what's available on existing online channels) and a HTTP status code of 201 (Created).

- The TPP must not use the idempotent behaviour to poll the status of resources.

- The ASPSP may use the message signature, along with the x-idempotency-key to ensure that the request body has not changed.

Message Signing

Overview

This section provides an overview of how message signing is implemented for the Open Banking Read/Write APIs.

The APIs require TLS 1.2 Mutual Authentication and this may be used as a means of non-repudiation. However, it would be difficult to maintain digital records and evidence of non-repudiation if the API only relied on TLS 1.2.

A solution for non-repudiation that does not rely on TLS, would be achieved by providing a JWS with detached content (as defined in RFC 7515 - Appendix F) in the HTTP header of each API request.

The HTTP body would form an un-encoded payload as defined in RFC 7797.

The JWS would be signed using an algorithm that supports asymmetric keys.

A request would be signed by a TPP's private key and a response would be signed by the ASPSP's private key.

OB Directory will provide and host the necessary certificates containing the corresponding public keys so that the signature may be verified.

Not all API requests and responses are signed. Whether message signing is mandatory, supported or not supported is documented along with each API.

Specification

The TPP must sign the HTTP body of each API request that requires message signing.

The ASPSP must sign the HTTP body of each API response that requires message signing.

The ASPSP should verify the signature of API requests that it receives before carrying out the request. If the signature fails validation, the ASPSP must respond with a 400 (Bad Request).

The ASPSP must reject any API requests that should be signed but do not contain a signature in the HTTP header with a 400 (Bad Request) error.

The TPP should verify the signature of API responses that it receives.

The signer must sign the message with one of the following algorithms:

- PS256

- ES256

- RS256

The signer must use a valid signing certificate issued by Open Banking to the signer.

It should be noted that:

- At present, Open Banking does not issue EC certifcates and as a result, it will not be possible to use ES256

- RS256 is not recommended by FAPI. However, PS256 support is not widespread and RS256 has been permitted as an interim measure. It is likely to be deprecated in the future.

Process for Signing a Payload

Step 1: Identify the Private Key and Corresponding Signing Certificate to be Used for Signing

The signer must use a private key that has a corresponding digital certificate (that contains the corresponding public key) issued by OB.

The signing certificate must be valid at the time of creating the JWS.

Step 2: Form the JOSE Header

The JOSE header for the signature must contain the following fields

Claim | Description |

|---|---|

alg | The algorithm that will be used for signing the JWS. The list of valid algorithms is here https://tools.ietf.org/html/rfc7518#section-3.1. The algorithms that will be supported by OB will be specified in the future. |

| typ | This is an optional claim. If it is specified, it must be set to the value "JOSE" |

| cty | This is an optional claim. If it is specified, it must be set to the value "json" or "application/json". |

kid | This must match the certificate id of the certificate selected in step 1. |

| b64 | This must have the boolean value false. This indicates that the message payload is not base64 url encoded. |

| http://openbanking.org.uk/iat | This must be a JSON number representing the number of seconds from 1970-01-01T0:0:0Z as measured in UTC until the date/time. This is a private header parameter name. (See RFC 7515 - Private Header Parameter Names) |

| http://openbanking.org.uk/iss | This must be a string containing the id of the TPP. This must match the dn of the signing certificate. This is a private header parameter name. (See RFC 7515 - Private Header Parameter Names) |

| crit | This must be a string array consisting of the values "b64", "http://openbanking.org.uk/iat", "http://openbanking.org.uk/iss" This indicates that the JWS signature validator must understand and process the three additional claims. |

Step 3: Compute the JWS

The signer must compute the signature as a detached JWS as defined in RFC 7515, Appendix F

"One way to do this is to create a JWS in the normal fashion using a representation of the content as the payload but then delete the payload representation from the JWS and send this modified object to the recipient rather than the JWS."

...Note that this method needs no support from JWS libraries, as applications can use this method by modifying the inputs and outputs of standard JWS libraries.

Step 4: Add the JWS as a HTTP Header

The signer must include an HTTP header called x-jws-signature with its value set to the signature computed in Step 3.

x-jws-signature: V2hhdCBoYXRoIGdvZCB3cm91Z2h0ID8=..QnkgR2VvcmdlLCBzaGUncyBnb3QgaXQhIEJ5IEdlb3JnZSBzaGUncyBnb3QgaXQhIE5vdyBvbmNlIGFnYWluLCB3aGVyZSBkb2VzIGl0IHJhaW4/

Process for Verifying a Signature

Step 1: Extract the components from the JWS

The verifier must extract and decode the JOSE header and signature from the JWS provided in the x-jws-signature.

Step 1: Validate the JOSE Header and Certificate

The verifier must validate the JOSE header to ensure that it is a valid json object with only the claims specified in Process for Signing a Payload - Step 2.

The verifier must validate that the typ header if specified has the value JOSE.

The verifier must validate that the cty header if specified it resolves to application/json.

The verifier must ensure that the specified alg is one of the algorithms specified by OB.

The verifier must ensure that the specified kid is valid and a signing certificate with the specified key id can be retrieved from the OB directory.

The verifier must ensure that the b64 claim is set to false.

The verifier must ensure that the http://openbanking.org.uk/iat claim has a date-time value set in the past.

The verifier must ensure that the http://openbanking.org.uk/iss claim matches the dn of the certificate.

The verifier must ensure that the crit claim does not contain additional critical elements.

Step 3: Verify the Signature

The verifier must verify the signature as defined in RFC 7515, Appendix F.

To use the modified object, the recipient reconstructs the JWS by re-inserting the payload representation into the modified object and uses the resulting JWS in the usual manner. Note that this method needs no support from JWS libraries, as applications can use this method by modifying the inputs and outputs of standard JWS libraries.

Sample JOSE Header

{

"alg": "RS512",

"kid": "90210ABAD",

"b64": false,

"http://openbanking.org.uk/iat": 1501497671,

"http://openbanking.org.uk/iss": "C=UK, ST=England, L=London, O=Acme Ltd.",

"crit": [ "b64", "http://openbanking.org.uk/iat", "http://openbanking.org.uk/iss"]

}

Filtering

An ASPSP must provide limited support of filtering on GET operations that return multiple records.

The filter parameters, are always specific to particular field(s) of the resource, and follow the rules/formats defined under the resource's data dictionary.

In case of DateTime type filter parameters, values must be specified in ISO8601 format. If the DateTime contains a timezone, the ASPSP must ignore the timezone component.

The filter values will be assumed to refer to the same timezone as the timezone in which the resource is maintained.

Pagination

An ASPSP MAY provide a paginated response for GET operations that return multiple records.

In such a situation, the ASPSP MUST:

- If a subsequent page of resource records exists, the ASPSP must provide a link to the next page of resources in the Links.Next field of the response. The absence of a next link would indicate that the current page is the last page of results.

- If a previous page of resource records exists, the ASPSP must provide a link to the previous page of resources in the Links.Prev field of the response. The absence of a prev link would indicate that the current page is the first page of results.

For a paginated responses, the ASPSP SHOULD ensure that the number of records on a page are within reasonable limits - a minimum of 25 records (except on the last page where there are no further records) and a maximum of 1000 records.

Additionally, the ASPSP MAY provide:

- A link to the first page of results in the Links.First field.

- A link to the last page of results in the Links.Last field.

- The total number of pages in the Meta.TotalPages field.

As with all other responses, the ASPSP MUST include a "self" link to the resource in the Links.Self field as described in the Links sections.

This standard does not specify how the pagination parameters are passed by the ASPSP and each ASPSP may employ their own mechanisms to paginate the response.

If the original request from the AISP included filter parameters, the paginated response must return only results that match the filter.

ASPSPs are not expected to implement pagination with transaction isolation. The underlying data-set may change between two subsequent requests. This may result in situations where the same transaction is returned on more than one page.

Archiving

Archiving of resources will be for ASPSPs to defined based on their internal Legal and Regulatory requirements.

In addition:

ASPSPs must only delete expired intent-ids 24 hours after creation

- ASPSPs may archive these expired intent-ids

Security & Access Control

Scopes & Grant Types

To access each of the APIs, the API must be called with an access token in the HTTP Authorization header.

The scopes required with these access tokens and the grant type used to get the access token are specified in the specific API documentation.

Consent Authorisation

OAuth 2.0 scopes are coarse grained and the set of available scopes are defined at the point of client registration. There is no standard method for specifying and enforcing fine grained scopes (e.g. a scope to enforce payments of a specified amount on a specified date).

An intent is used to define the fine-grained permissions that are granted by the PSU to the TPP.

The act of providing authorisation of an intent by a PSU to an ASPSP is called consent authorisation.

The Open Banking Read/Write APIs use a variety of intents such payments and account-requests.

A TPP requests an ASPSP to create intent by using a client credentials grant. The ASPSP creates the intent and responds with the intent-id. The TPP then redirects the PSU to the ASPSP to authorise consent for the intent, passing in an intent-id as a parameter.

This is done through an authorization grant flow and results in the issuance of an access token tied to the authorised intent.

An access token is bound to a single PSU and an intent.

Error Condition

If the PSU does not complete a successful consent authorisation (e.g. if the PSU is not authenticated successfully), the authorization code grant ends with a redirection to the TPP with an error response as described in RFC 6749 Section 4.1.2.1. The PSU is redirected to the TPP with an error parameter indicating the error that occurred.

Handling Expired Access Tokens

Access Token issued through Client Credentials Grant

When an access token issued through a Client Credentials Grant expires, the TPP must get a new access token by executing a client credential grant again.

Access Token issued through Authorization Code Grant

An ASPSP may issue a refresh token along with an access token at the end of an authorization code grant.

When an access token obtained through an authorization code grant expires, the TPP may attempt to get a new access and refresh token as defined in Section 6 of the OAuth 2.0 specification.

If the TPP fails to get an access token using a refresh token, the TPP must get the PSU to initiate a fresh authorisation code grant.

Changes to an Intent's Authorized State

An ASPSP may change the state of an authorized intent under certain situations to indicate that the intent is no longer authorized.

E.g., an account-request may be reset to a status of "AwaitingAuthorisation"

In such a situation, the PISP may request the intent to be re-authorized by initiating an authorization code grant with the intent-id of the offending intent specified in the request parameter.

An ASPSP may change the state of an authorized intent under certain situations to indicate that the intent is rejected. This is a terminal state and the TPP must not attempt to initiate an authorization code grant using the intent.

Data Model

Common Payload Structure

This section gives an overview of the top level structure for the API payloads for the Openbanking Read/Write APIs.

The data contained within the Data section is documented with each individual API endpoint.

Request Structure

The top level request structure for Open Banking Read/Write APIs:

{

"Data": {

...

},

"Risk": {

...

}

}

Data

The Data section contains the request data for the specific API request.

The structure of this element differs for each API endpoint.

Risk

The Risk section contains risk indicators for the specific API request as provided by the TPP.

The risk indicators contained in this element may be different for each API endpoint.

Response Structure

The top level response structure for Openbanking Read/Write APIs:

{

"Data": {

...

},

"Risk": {

...

},

"Links": {

...

},

"Meta": {

...

}

}

In line with the principle of RESTful APIs, the full resource must be replayed as part of the response.

Two additional top level sections are included in the response for:

Links

Meta

Links

The Links section is mandatory and will always contain absolute URIs to related resources,

The "Self" member is mandatory.

For example:

"Links": {

"Self": "https://api.alphabank.com/open-banking/v1.0/payments/58923"

}

Where an API provides a paginated response, the Links element must also contain the members First, Prev, Next and Last.

For example:

"Links": {

"Self": "http://example.com/articles?page[number]=3&page[size]=1",

"First": "http://example.com/articles?page[number]=1&page[size]=1",

"Prev": "http://example.com/articles?page[number]=2&page[size]=1",

"Next": "http://example.com/articles?page[number]=4&page[size]=1",

"Last": "http://example.com/articles?page[number]=13&page[size]=1"

}

Meta

The Meta section is mandatory, but may be empty. An optional member is "TotalPages" which is specified as an integer (int32) and shows how many pages of results (for pagination) are available.

For example:

"Meta": {

"TotalPages": 13

}

Usage Examples

The usage examples for the individual APIs are documented in their respective pages.

This section provides usage examples for some repeating patterns that are used by multiple resources.

Pagination Flows

The example below illustrates how an ASPSP may return a paginated response.

Request

GET /accounts/22289/transactions HTTP/1.1 Authorization: Bearer Az90SAOJklae x-fapi-financial-id: OB/2017/001 x-fapi-customer-last-logged-time: Sun, 10 Sep 2017 19:43:31 UTC x-fapi-customer-ip-address: 104.25.212.99 x-fapi-interaction-id: 93bac548-d2de-4546-b106-880a5018460d Accept: application/json

Paginated Resource Response

HTTP/1.1 200 OK

x-fapi-interaction-id: 93bac548-d2de-4546-b106-880a5018460d

Content-Type: application/json

{

"Data": {

...

},

"Links": {

"Self": "https://api.alphabank.com/open-banking/v1.0/accounts/22289/transactions/",

"Last": "https://api.alphabank.com/open-banking/v1.0/accounts/22289/transactions?pg=20",

"First": "https://api.alphabank.com/open-banking/v1.0/accounts/22289/transactions/",

"Next": "https://api.alphabank.com/open-banking/v1.0/accounts/22289/transactions?pg=2"

},

"Meta": {

"TotalPages": 20,

"FirstAvailableDateTime": "2017-05-03T00:00:00+00:00",

"LastAvailableDateTime": "2017-12-03T00:00:00+00:00"

}

}

The TPP may follow the links provided in the Links section of the payload to navigate to the first, last, next and previous pages:

Request Next Page of Results

GET /accounts/22289/transactions?pg=2 HTTP/1.1 Authorization: Bearer Az90SAOJklae x-fapi-financial-id: OB/2017/001 x-fapi-customer-last-logged-time: Sun, 10 Sep 2017 19:43:31 UTC x-fapi-customer-ip-address: 104.25.212.99 x-fapi-interaction-id: 93bac548-d2de-4546-b106-880a5018460d Accept: application/json

Paginated Resource Response

HTTP/1.1 200 OK

x-fapi-interaction-id: 93bac548-d2de-4546-b106-880a5018460d

Content-Type: application/json

{

"Data": {

...

},

"Links": {

"Self": "https://api.alphabank.com/open-banking/v1.0/accounts/22289/transactions?pg=2",

"Last": "https://api.alphabank.com/open-banking/v1.0/accounts/22289/transactions?pg=20",

"First": "https://api.alphabank.com/open-banking/v1.0/accounts/22289/transactions/",

"Next": "https://api.alphabank.com/open-banking/v1.0/accounts/22289/transactions?pg=3",

"Prev": "https://api.alphabank.com/open-banking/v1.0/accounts/22289/transactions?pg=1"

},

"Meta": {

"TotalPages": 20,

"FirstAvailableDateTime": "2017-05-03T00:00:00+00:00",

"LastAvailableDateTime": "2017-12-03T00:00:00+00:00"

}

}

Error Flows

This section provides some examples of error scenarios and the expected outputs.

Missing or Expired Access Token

This flow assumes that the following Steps have been completed successfully:

- Step 1: Request Account Information

- Step 2: Setup Account Request

- Step 3: Authorise Consent

The AISP attempts to provide an expired or missing access token to the ASPSP in an attempt to Request Data

Incomplete or Malformed Request Payload

This flow assumes that the following Steps have been completed successfully:

- Step 1: Request Account Information

- Step 2: Setup Account Request

- Step 3: Authorise Consent

The AISP provides a malformed request to the ASPSP in an attempt to setup an Account Request.

Missing or Invalid Access Token Scope

This flow assumes that the following Steps have been completed successfully:

- Step 1: Request Account Information

- Step 2: Setup Account Request

- Step 3: Authorise Consent

The AISP provides a (valid) access token which does not have a valid scope (or link to the correct Permissions) to Request Data

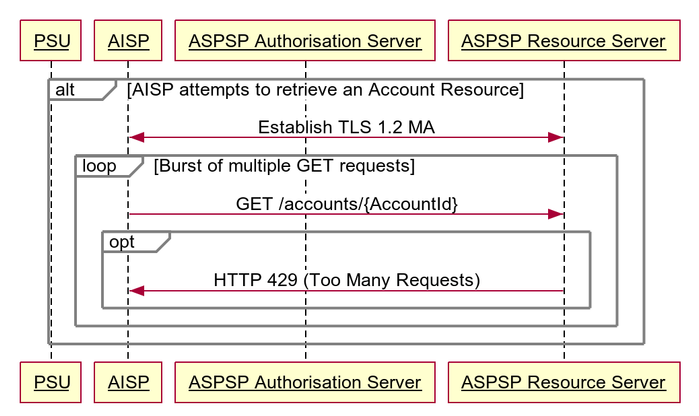

Sudden Burst of API Requests

This flow assumes that the following Steps have been completed successfully:

- Step 1: Request Account Information

- Step 2: Setup Account Request

- Step 3: Authorise Consent

The AISP provides a (valid) access token which is used to generate a burst of multiple requests to retrieve an Accounts resource.

The ASPSP may optionally choose to return a 429 Response

Failed Authorisation Consent

This flow assumes that the following Steps have been completed successfully:

- Step 1: Request Account Information

- Step 2: Setup Account Request

The Step 3: Authorise Consent Flow fails to succeed due to the PSU providing invalid credentials to the ASPSP, resulting in no Authorization Code being generated.

© Open Banking Limited 2019 | https://www.openbanking.org.uk/open-licence | https://www.openbanking.org.uk

.png?version=1&modificationDate=1519755880796&cacheVersion=1&api=v2&width=698&height=400)

.png?version=1&modificationDate=1519755881029&cacheVersion=1&api=v2&width=738&height=342)

.png?version=1&modificationDate=1519755881269&cacheVersion=1&api=v2&width=700&height=400)

.png?version=1&modificationDate=1519755875884&cacheVersion=1&api=v2&width=700&height=473)