...

| 2.0.0 | 24 Jul 2017 | Open Banking Open Data API Team | This is the baseline version. |

| 2.1.0 | 21 Aug 2017 | Open Banking Open Data API Team | This release incorporates all known issues with 2.0.0 up to 18 Aug 2017. Please see the release notes for details. |

| 2.1.1 | 12 Oct 2017 | Open Banking Open Data API Team | For CCC, this release is identical to v2.1.0 API. Please see the 2.1.0 release notes for details. The MIG is from v2.2 (as recommended by PMG) |

...

Message Implementation Guide

...

Purpose

The message implementation guide (MIG) is designed to assist the implementers of the messaging specification by providing worked examples as to how the message fields should be completed in different scenarios.

The intention is that this will better ensure consistency. This guide should be read alongside the data dictionary which provides fuller information about the rules, constraints and guidelines that should be adhered to when populating the fields.

The format that is used in this document for field value assignment is:-

[] enclose a set of field values. Where there are multiple records for a particular field, I depict this as [<record 1 value1>,< record 1 value2>…<recordn valuen>], whilst where I’m showing that there is 1 field value in 1 record, and another field value in a 2nd record, I depict this as [<record1 value1>],[<record 2 value 1>],[<record 3 value 3>], seperates individual field values within a field value set.

“ surrounds a text or date field value.

We are choosing different accounts based on how fully they test each section of the design.

Implementation Notes

Before implementing the message standard, it is useful browsing the current market leading price comparison websites (e.g. https://www.moneysupermarket.com/business-finance/business-credit-cards-explained/, http://www.knowyourmoney.co.uk/business-credit-cards-guide/) to understand how implementation of our standard by the CMA9 banks would help to more easily facilitate provision of information used on those sites.

Currently, price comparison websites have to obtain their CCC product data either via bank proprietary APIs, via information collected by dedicated data capture agencies or via "screen scraping" (i.e. capturing product web page information and writing scripts to extract relevant data). This work is complex and prone to error, so having a standard API would make the data capture side much easier and allow more third party providers to provide applications that could target particular consumer markets.

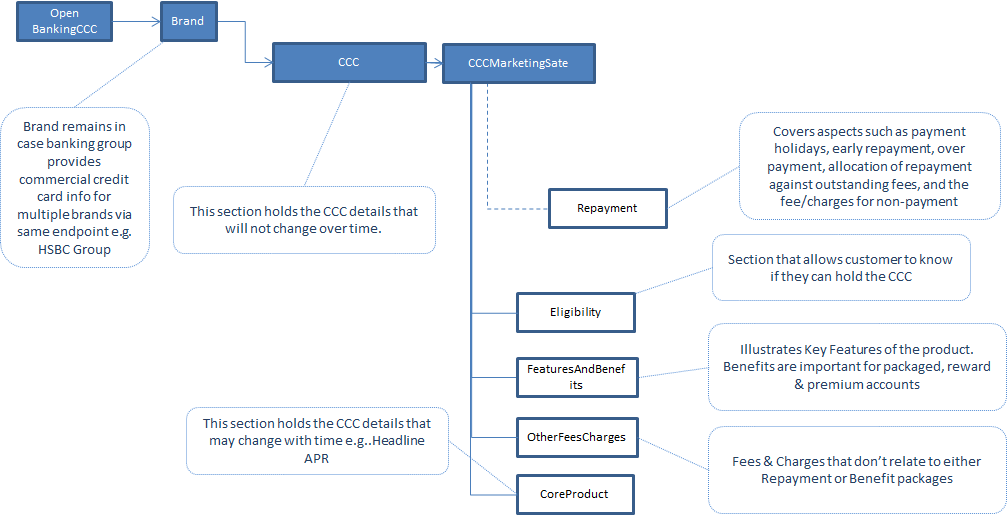

| Expand |

|---|

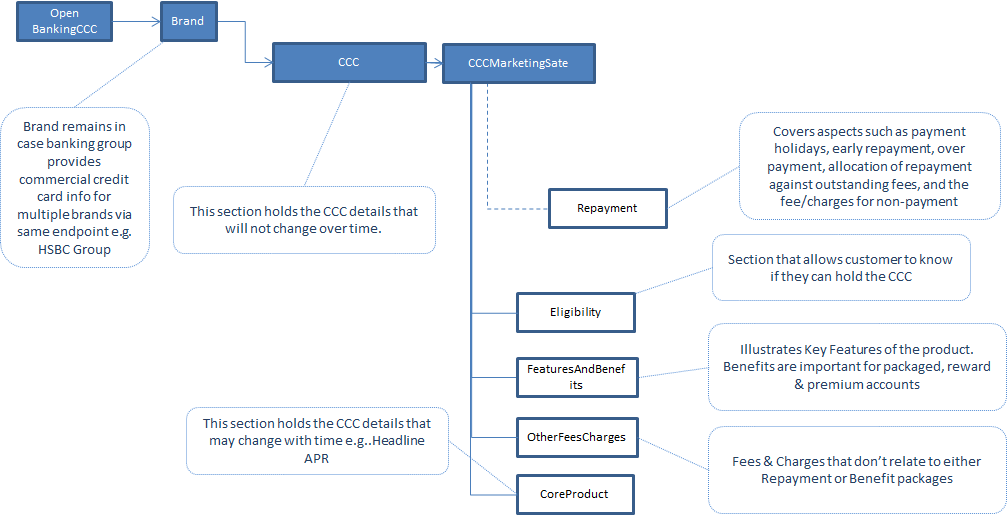

| title | CCC v2.2.0 Top Level Design |

|---|

|

Image Added Image Added

|

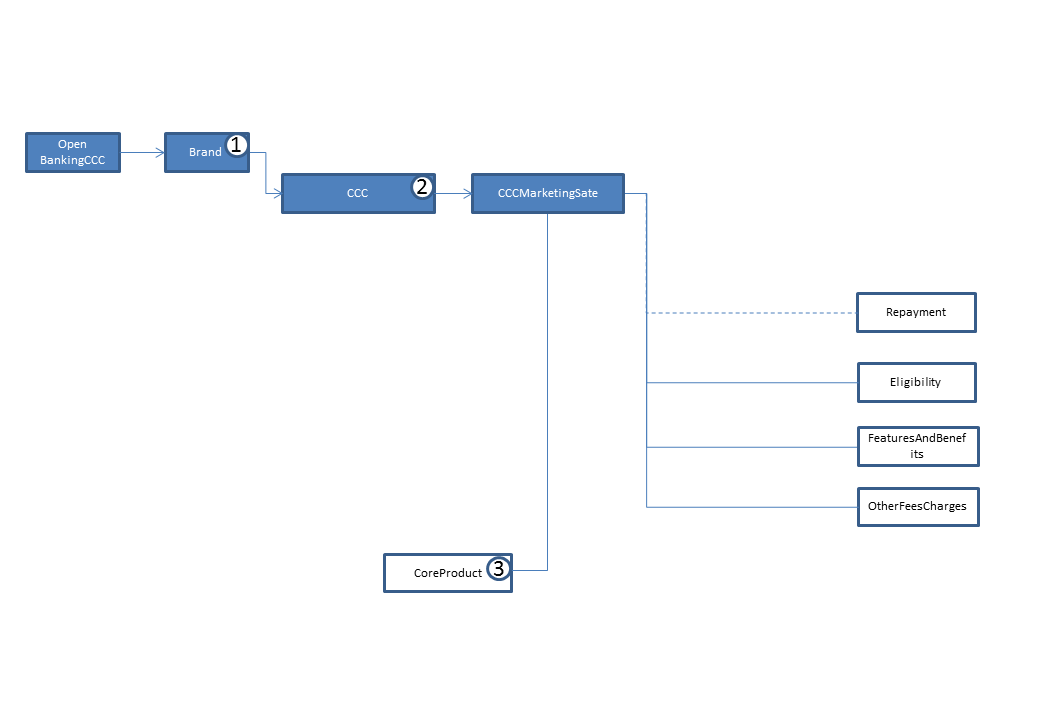

| Expand |

|---|

| title | How I can supply fixed and variable core product details? |

|---|

|

Image Added Image Added

| Section Number | Field Name | Cardinality | Value(s) |

|---|

| 1 | BrandName | 1..1 | “HSBC” | | 2 | Name | 1..1 | ” HSBC Business Credit Card” | | 2 | Identification | 1..1 | ” Business Credit Card - Commercial Card” | | 2 | Segment | 1..* | “General” | | 3 | ProductURL | 1..1 | “http://www.business.hsbc.uk/en-gb/finance-and-borrowing/business-card/business-credit-card?DCSext.nav=foot-mat” | | 3 | TcsAndCsURL | 1..1 | “http://www.business.hsbc.uk/~/media/library/business-uk/pdfs/commercial-card-agreement-terms.pdf?la=en-GB” | | 3 | MinCreditLimit | 0..1 | 500.00 | | 3 | MaxCreditLimit | | | | 3 | MaxPurchaseFeeFreeLengthDays | 0..1 | 56 | | 3 | SalesAccessChannels | 1..* | [“Branch”,”Online”] | | 3 | ServicingAccessChannels | 1..* | [“Branch”,”Online”,”Post”,”Phone”,”MobileApps”] | | 3 | CardScheme | 1..* | “Visa” | | 3 | OtherCardScheme | | | | 3 | ContactlessIndicator | 1..1 | [True] | | 3 | Period Fee | 0..1 | 32.00 | | 3 | PeriodicFeePeriod | 0..1 | “Monthly” | | 3 | APR | | 22.00 | | 3 | Notes |

| |

Example: HSBC Business Credit Card |

| Expand |

|---|

| title | How do I represent an introductory and balance transfer offer? |

|---|

|

(1) Marketing State | Section Number | Field | CardinalityCa | Value(s) |

|---|

| 1 | Identification | 1..1 | [ “P1”][“P2”],[“R1”] | | 1 | MarketingState | 1..1 | [“Promotional”][“Promotional”][“Regular”] | | 1 | PredecessorID | 0..1 | [][“P1”][“P2”] | | 1 | FirstMarketedDate | 0..1 | [“1/1/1990”][“1/1/1990”] [“1/1/1990”] | | 1 | LastMarketedDate | 0..1 | [“31/12/9999”][“31/12/9999”] [“31/12/9999”] | | 1 | StateTenureLength | 0..1 | [6][37][] | | 1 | StateTenurePeriod | 0..1 | [“Month”][][“Month”][] | | 1 | Notes | 0..* | [“0% on Balance Transfers and Purchases’][“0% on Balance Transfers”][”Regular Rates Apply”] |

Example: After 43 months, the rate on balance transfers will go from 0 to 15.9% After 6 months, the rate on purchases will go from 0% to 15.9% Notes:

The way to think about this is that is to consider what is being offered to the Account Holder when they open the account during particular periods of time:- - For the 1st 6 months, the Account Holder can obtain a promotional 0% on both their balance transfers and purchases.

- For the next (43-6)=37 months, the Account Holder can obtain a promotional 0% on their balance transfers only

- After 43 months if over, the Account Holder will be charged regular rates on both balance transfers and purchases.

We use the StateTenureLength and StateTenurePeriod to indicate the period of time during which the Account Holder experiences a particular offering. We use the FirstMarketedState and LastMarketedState to indicate the period of time during which a complete set of offerings is advertised. |

| Expand |

|---|

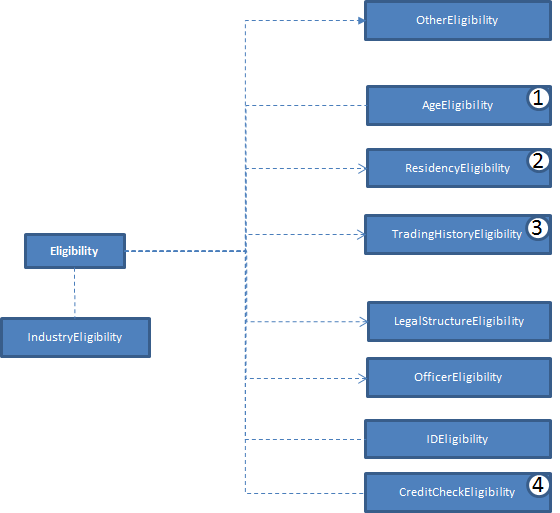

| title | How do I specify Minimum Payment required against an account? |

|---|

|

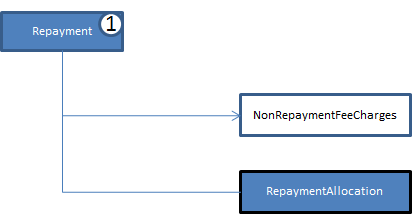

Image Added Image Added

| Section Number | Field Name | Cardinality | Value(s) |

|---|

| 1 | MinBalanceRepaymentRate | 1..1 | 1.50 | | 1 | MinBalanceRepaymentAmount | 0..1 | 5.00 | | 1 | Notes | 0..* | “Minimum Payment: The sum of:the interest for the period from the last statement; any fees and charges; 1.5% of the full amount you owe us as shown on your monthly statement rounded to the nearest pound above minimum £5 or your statement balance if it is lower.” |

Example: HSBC Business Credit Card Minimum Payment: The sum of:the interest for the period from the last statement; any fees and charges; 1.5% of the full amount you owe us as shown on your monthly statement rounded to the nearest pound above minimum £5 or your statement balance if it is lower.

Notes: 1. It is an industry standard that interest and any fees and charges have to be paid off, and that the minimum payment will either be the outstanding balance or the maximum of a specified rate or minimum payment amount, but this can be specified in the notes, as in the example above. |

| Expand |

|---|

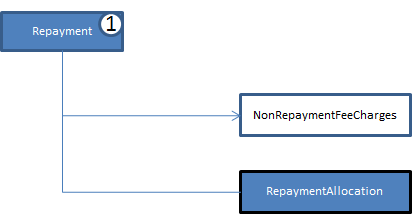

| title | How do I represent repayment charges? |

|---|

|

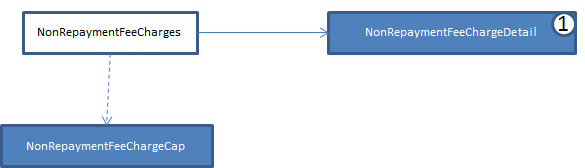

Image Added Image Added

| Section Number | Field Name | Cardinality | Value(s) |

|---|

| 1 | FeeType | 1..1 | [“LatePayment”][“ReturnPayment”] | | 1 | OtherFeeType |

|

| | 1 | NegotiableIndicator |

|

| | 1 | FeeAmount | 0..1 | [12.00][5.00] | | 1 | FeeRate |

|

| | 1 | FeeRateType |

|

| | 1 | OtherFeeRateType |

|

| | 1 | ApplicationFrequency | 1..1 | [“Monthly”][“Monthly”] | | 1 | OtherApplicationFrequency |

|

| | 1 | CalculationFrequency | 1..1 | [“PerItem”][“PerItem”] | | 1 | OtherCalculationFrequency | | | | 1 | Notes | | |

Example: HSBC Business Credit Card Late Payment: £12 Returned Payment: £5 |

| Expand |

|---|

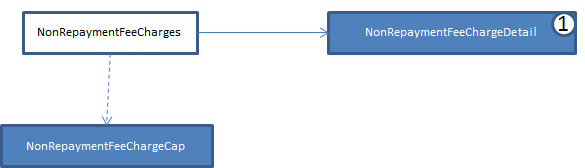

| title | What about Key “Other Fees And Charges”? |

|---|

|

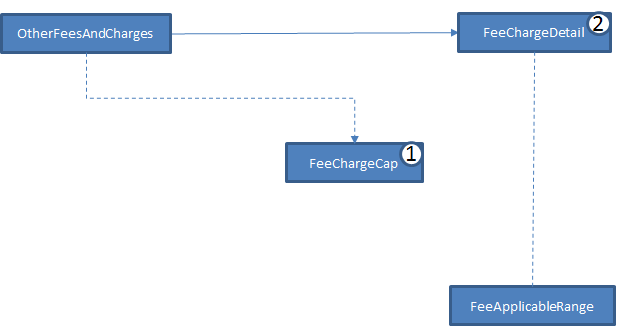

Image Added Image Added

| Section Number | Field Name | Cardinality | Value(s) |

|---|

| 1 | FeeType | 1..* | “Handling” | | 1 | OtherFeeType |

|

| | 1 | MinMaxType | 1..1 | “Minimum” | | 1 | FeeCapOccurrence |

|

| | 1 | FeeCapAmount | 0..1 | 3.00 | | 1 | CappingPeriod | 0..1 | “PerItem” | | 1 | Notes |

|

| | 2 | FeeCategory | 1..1 | [“Purchase”][“CashAdvance”][‘Handling’][“FX”] | | 2 | FeeType | 1..1 | [“Purchase”][“CashAdvance”][‘Servicing’][“ForeignCash”] | | 2 | OtherFeeType |

|

| | 2 | NegotiableIndicator |

|

| | 2 | IncludedInAnnualChargeIndicator |

|

| | 2 | FeeAmount | | | | 2 | FeeRate | 0..1 | [15.9][15.9][1][2.99] | | 2 | FeeRateType | | | | 2 | OtherFeeRateType | | | | 2 | ApplicationFrequency | 1..1 | [“Monthly”] [“Monthly”] [“Monthly”] | | 2 | OtherApplicationFrequency | | | | 2 | CalculationFrequency | 1..1 | [“Daily”] [“Daily”] [“Daily”] | | 2 | OtherCalculationFrequency | | | | 2 | Notes |

| |

Example: HSBC Business Credit Card Purchases: 15.9% variable Cash Advances: 15.9% variable, handling fee 1% (minimum £3) Non-Sterling Transaction Fee: 2.99% |

| Expand |

|---|

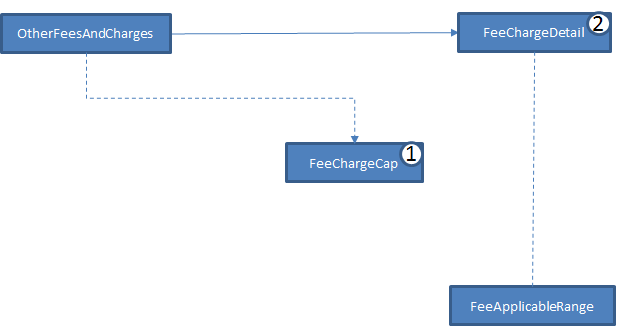

| title | What if I wish to restrict who can apply for the account? |

|---|

|

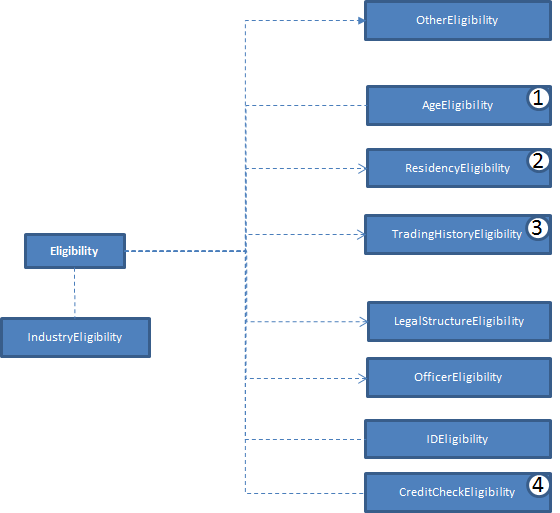

Image Added Image Added

| Section Number | Field Name | Cardinality | Value(s) |

|---|

| 1 | MinimumAge | 0..1 | 18 | | 1 | MaximumAge |

|

| | 1 | Notes |

| | | 2 | ResidencyType | 0..1 | "Trading" | | 2 | OtherResidencyType | | | | 2 | ResidencyIncluded | 1..* | “GB” | | 2 | Notes |

| | | 3 | TradingType | 0..1 | [“PreviousBankruptcyAllowed”][“PreviousCCJs”] | | 3 | OtherTradingType | | | | 3 | MinMaxType | | | | 3 | Indicator | 0..1 | [False][False] | | 3 | Textual | | | | 3 | Period | | | | 3 | Notes | | | | 4 | ScoringType | | | | 4 | Notes | 0..* | “You must agree to a credit check as part of the application and this will determine whether or not you're accepted and the credit limit that we can offer.” |

Example: Santander Business Credit Card You can apply for a credit card if:- - You're a UK resident

- Aged 18 years or over

- Have a good credit record and have not been declared bankrupt, had a CCJ or an IVA within the last 6 years.

- You must agree to a credit check as part of the application and this will determine whether or not you're accepted and the credit limit that we can offer.

|

| Expand |

|---|

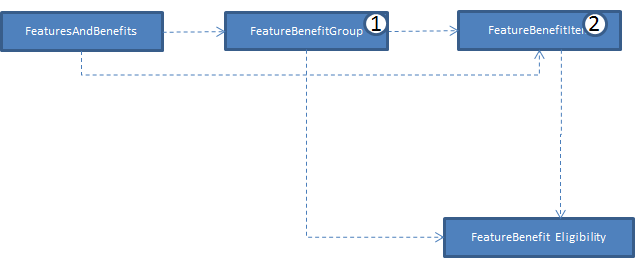

| title | What about benefits packages? |

|---|

|

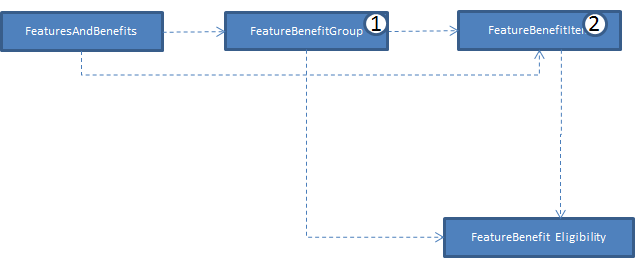

Image Added Image Added

| Section Number | Field Name | Cardinality | Value(s) |

|---|

| 1 | Name | 1..1 | “BusinessRewards” | | 1 | Type |

|

| | 1 | OtherType |

|

| | 1 | BenefitGroupNominalValue |

|

| | 1 | Fee |

|

| | 1 | ApplicationFrequency |

|

| | 1 | OtherApplicationFrequency |

|

| | 1 | CalculationFrequency |

|

| | 1 | OtherCalculationFrequency |

|

| | 1 | Notes |

|

| | 2 | Identification | 0..1 | [1],[2],[3],[4],[5] | | 2 | Type | 1..1 | [“CreditReports”][“PreferentialRates”][“PreferentialRates”][“PreferentialRates”][“PreferentialRates”] | | 2 | OtherType |

|

| | 2 | Amount |

|

| | 2 | Indicator |

|

| | 2 | Textual | 0..1 | [“Free Experian Credit Report for 3 months”][“Up to 66% off AA Business Breakdown cover”][5% rebate on car rental charges at Avis”][“15% off your ecommerce website with cloudBuy”][“EventTickets from Barclays Entertainment”] | | 2 | Notes |

| |

Example: Business Rewards with Barclays Business Credit Card Essentials - Free Experian credit report for 3 months

- Up to 66% off AA Business Breakdown cover

- 5% rebate on car rental charges at Avis

Marketing - 15% off your ecommerce website with cloudBuy

Entertainment - Event tickets from Barclays Entertainment

|