FCA Service Metrics API Specification - v1.0.0

Version Control

Version | Date | Author | Comments |

|---|---|---|---|

| 1.0.0-rc1 | Open Banking API Team | This is the Baseline version, as approved by TDA on 29 Mar 2018 | |

| 1.0.0 | Open Banking API Team |

Release Note

Background

The FCA published a Policy Statement (PS) https://www.fca.org.uk/publication/policy/ps17-26.pdf in December 2017 detailing rules requiring providers of personal current accounts (PCAs) and business current accounts (BCAs) to make information about current account services available to customers.

These rules are aimed at promoting effective competition by:

- enabling customers and intermediaries to make meaningful comparisons between providers of PCAs and BCAs based on quality of service

- incentivising providers to improve service and performance

The FCA’s Policy Statement affects the majority of current and potential participants in the PCA and BCA markets as well as those interested in this market, including:

- firms that accept deposits (banks and building societies) that provide payment accounts as defined by the Payment Accounts Regulations (typically PCAs) or BCAs that have the features of a payment account

- organisations which offer comparison services

The Policy Statement also requires firms that are subject to the CMA’s Retail Banking Market Investigation Order, or who use an Application Programming Interface (API) for the purposes of PSD2, to make service information available also through an API.

This specification provides a single API standard that firms may use in order to meet those requirements.

Key Components of the specification

The specification covers the following key service metrics:

- How and when a customer can contact their bank to ask about the following things:

- checking the balance and transactions

- sending money within the UK, including setting up a standing order

- sending money outside the UK

- paying in a cheque

- cancelling a cheque

- cash withdrawal in a foreign currency outside the UK

- a lack of funds: including unarranged overdrafts, payments we allow despite lack of funds and payments we refuse due to lack of funds

- a direct debit, or allowing someone to collect one or more payments from your account using your debit card number

- third party access to an account, for example under a power of attorney

- problems using internet banking or mobile banking

- reporting a suspected fraudulent incident or transaction

- progress following an account suspension or card cancellation, e.g. following a fraud incident

- account opening: including eligibility for an arranged overdraft, what is required to open an account and an indication of what arranged overdraft may be available

- How and when a customer can use their bank account to do the following things:

- checking the balance and transactions

- sending money within the UK, including setting up a standing order

- sending money outside the UK

- paying in a cheque

- cancelling a cheque

- cash withdrawal in a foreign currency outside the UK

- Information about operational and security incidents

- Information about complaints data

- Information about opening a current account with a bank

- Information about how quickly a bank opens a [personal/business] current account?

- Information about how quickly a bank gives a customer a debit card?

- Information about how quickly a bank gives a customer internet banking?

- Information about how quickly a bank makes available an overdraft ?

- Information about how quickly a bank replaces debit cards which have been lost, stolen or stopped?

FCA Service Metrics Specification

Overview

This specification includes all relevant artefacts for the Open Data FCA Service Metrics API Specification.

There will be two separate endpoints: One for Personal Current Account and other for Business Current Account Service Metrics.

Each endpoint can contain multiple brands owned by a particular banking group. Each brand can have separate Service Metrics.

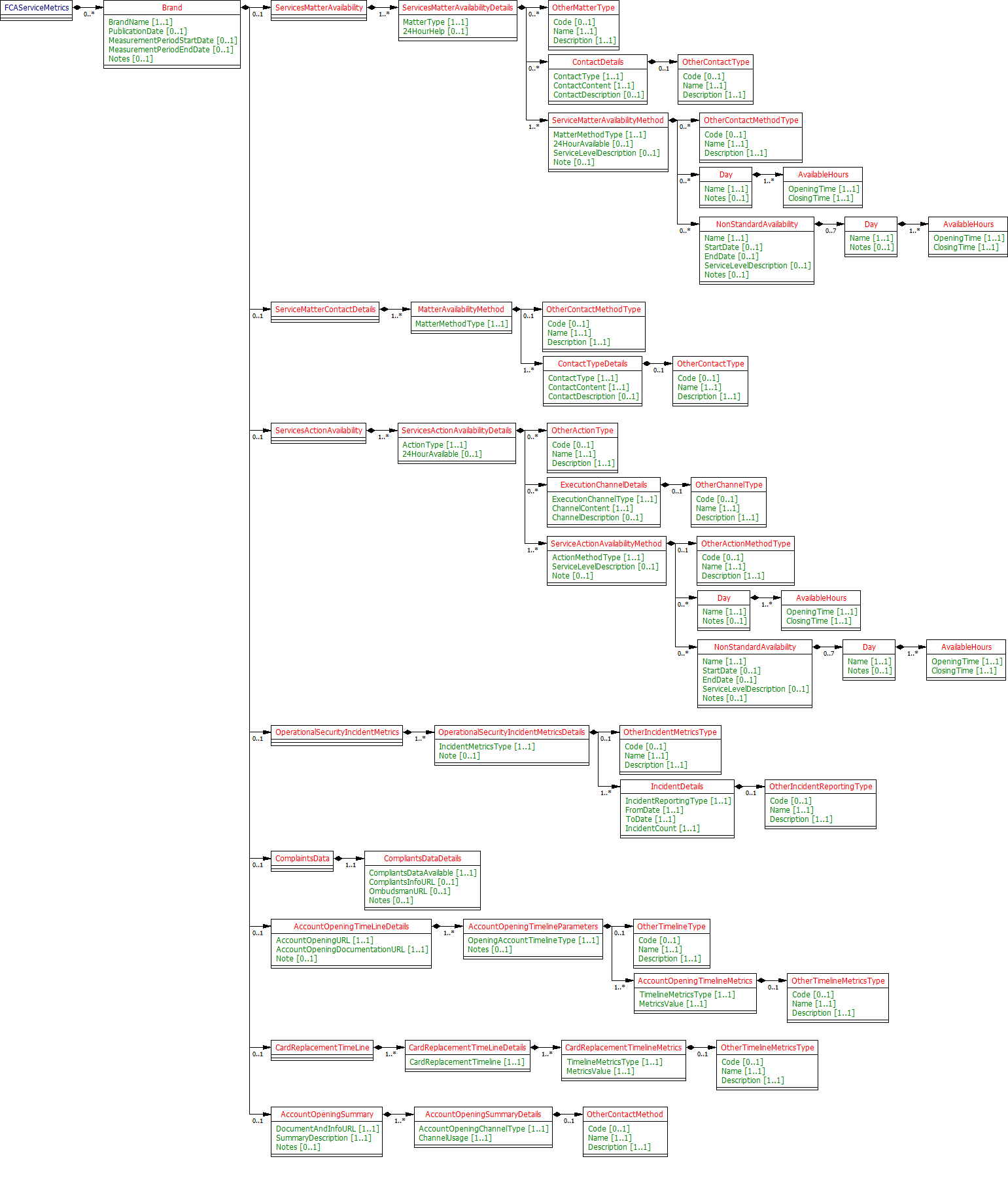

The Service Metrics is made up of the following section:-

- Brand description

- ServicesMatterAvailability: How and when a party can contact banks to ask about the available services.

- ServicesActionAvailability: How and when , a party can use their bank account to execute the services supported by the bank

- OperationalAndSecurityIncidentMetrics: Metrics information about any major operational or security incident which prevents banks customers from using their payment services.

- ComplaintsData: This section is used for publishing complaints related info

- AccountOpeningTimeLineDetails: This section covers info related to time line of opening an account along with other supported features.

- CardReplacementTimeLine: This section covers info related to time line of replacing a bank card.

- AccountOpeningSummary: This section cover info related to documentation along with instruments to facilitate the account opening.

Specification

The following section includes UML Class Diagram along with simple examples data. The UML diagram provides the hierarchical structure of the message in a graphical form, which is easier to digest. The examples are made up data and its OBIE view of the implementation of this specification.

Brand Description

Brand name of the bank for which to publish the service metrics data.

PublicationDate: Date on which this service metrics data was made available.

Notes: Any info which bank would like to publish to support this metrics.

A banking group will publish the metrics data for each associated Brand on the same end point.

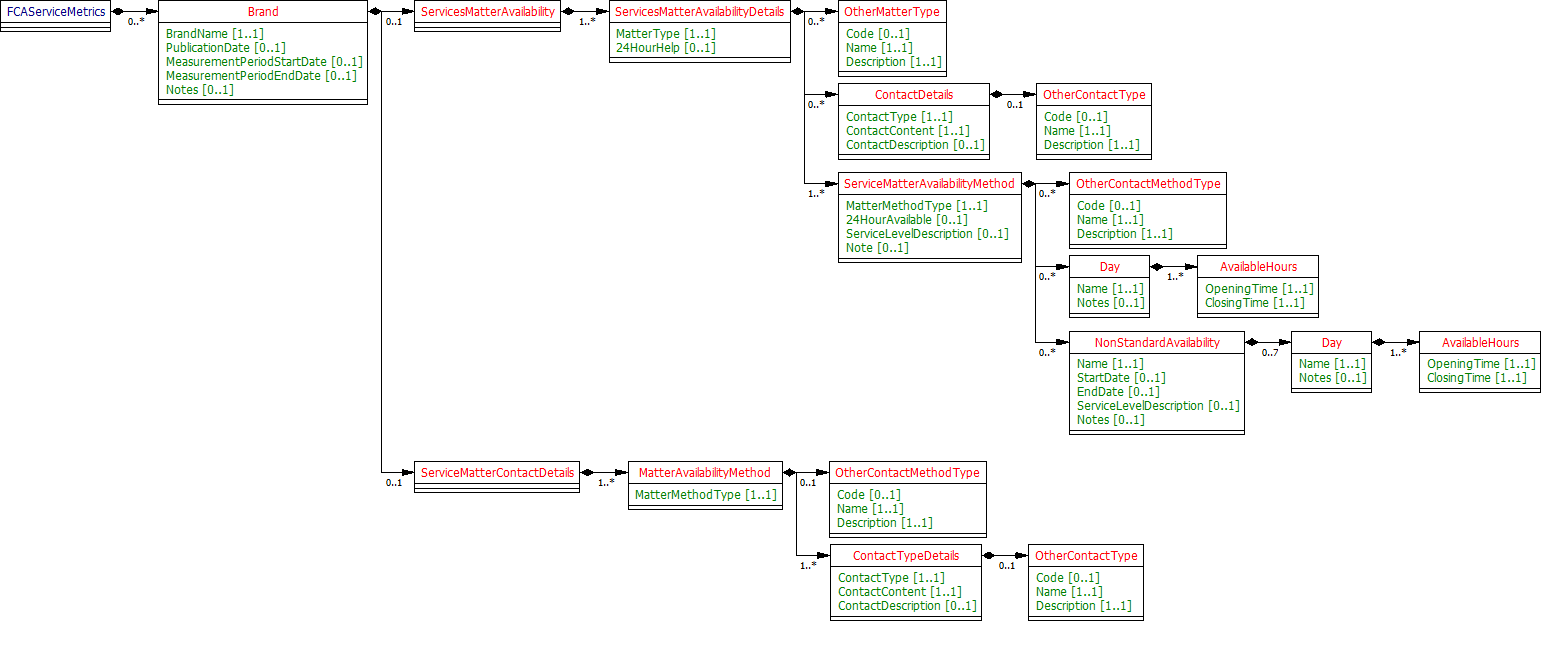

ServicesMatterAvailability

How and when a party can contact banks to ask about the available services.

Matters: Services for which an account holder can discuss with a member of staff of the firm who has been trained to discuss the relevant action or matter. Ref 7.5.2(2)

A firm should only indicate that help is available (i.e. an action or matter may be discussed) where the banking customer or prospective banking customer is able to discuss the action or matter with a member of staff who has been appropriately trained to respond to such queries. This might mean, for example, a customer call center responding to telephone queries or live WebChat for internet banking, operated by appropriately trained staff. Automated responses, an FAQ list which filters out queries, or a messaging or mailbox system would not be sufficient; the discussion must involve real-time interaction.

7.5.2 (1) refers to ’24 hours a day’. The firms should report 24/7 availability if they are available across at least one channel (or across a combination of channels) for the full 24 hours? (e.g. if hypothetically a firm is available by telephone from 8.00 am to 8.00 pm and available through the night via internet banking, does that count as available 24/7?)

UML Diagram

Implementation Example1

The example below is to illustrate, how the banks are expected to publish the data. The examples do not have comprehensive list of services (Matters and Actions), which are needed to be published by banks. For complete list of actions, matters and other related topic, please refer to Policy Statement Document (PS17/26): Information about current account services) along with Code List attached with this page.

Brand: Happy Days Building society

How and when you can contact us to ask about the following things?

| 24Hours Help? | Telephone | Internet Banking | Mobile Banking | OBIE Comments | |

|---|---|---|---|---|---|

| Contact Details | Gen Enq Tel: 0044-XXXXXX0909 Bal enq Tel: 0044- XXXXXX0910 WebChat: www.thebank.co.uk/contact-us | Gen Enq Tel: 0044-XXXXXX0909 Bal enq Tel: 0044- XXXXXX0910 WebChat: www.thebank.co.uk/contact-us | Gen Enq Tel: 0044-XXXXXX0909 Bal enq Tel: 0044- XXXXXX0910 WebChat: www.thebank.co.uk/contact-us | Same contact details for all the methods. But using the generic design, contact details can be provided for individual services | |

| Checking the balance and transactions | No | Mon-Fri 08:00 - 16:00 Sat: 10:00 - 13:00 | Mon-Fri 08:00 - 16:00 Sat: 10:00 - 13:00 Sun: 11:00 - 13:00 | Not Possible | |

| sending money within the UK, including setting up a standing order | No | Mon-Fri 08:00 - 16:00 Sat: 10:00 - 13:00 | Mon-Sun 00:00 - 24:00 NonStandard-Availability:

| Mon-Fri 06:00 - 24:00 Sat-Sun: 10:00 - 24:00 | One channel is available 24x7x364 |

| sending money outside the UK | Yes | Mon-Sun 00:00 - 24:00 | Mon-Sun 00:00 - 24:00 | Mon-Sun 00:00 - 24:00 | |

| reporting a suspected fraudulent incident or transaction | Yes | Mon-Fri 08:00 - 16:00 Sat: 10:00 - 16:00 Sun: 11:00 - 16:00 | Mon-Sun 16:00 - 24:00 | Mon-Fri 00:00 - 08:00 Sat-Sun: 00:00 - 11:00 | Cumulative, all the channels cover 24x7x365 |

Implementation Example 2

This example shows use case where some services can have different contact number/methods

Brand: Happy Days Building society

How and when you can contact us to ask about the following things?

| 24Hours Help? | Telephone | Internet Banking | Mobile Banking | OBIE Comments | ||

|---|---|---|---|---|---|---|

| Checking the balance and transactions | No | Mon-Fri 08:00 - 16:00 Sat: 10:00 - 13:00 | Mon-Fri 08:00 - 16:00 Sat: 10:00 - 13:00 Sun: 11:00 - 13:00 | Not Possible | Gen Enq Tel: 0044-XXXXXX0909 Bal enq Tel: 0044- XXXXXX0910 WebChat: www.thebank.co.uk/contact-us | |

| sending money within the UK, including setting up a standing order | No | Mon-Fri 08:00 - 16:00 Sat: 10:00 - 13:00 | Mon-Sun 00:00 - 24:00 NonStandard-Availability:

| Mon-Fri 06:00 - 24:00 Sat-Sun: 10:00 - 24:00 | Gen Enq Tel: 0044-XXXXXX0909 Initiate Trns Tel: 0044- XXXXXX0912 WebChat: www.thebank.co.uk/contact-us | One channel is available 24 x 7 x364 |

| sending money outside the UK | Yes | Mon-Sun 00:00 - 24:00 | Mon-Sun 00:00 - 24:00 | Mon-Sun 00:00 - 24:00 | Gen Enq Tel: 0044-XXXXXX0909 International Payment Tel: 0044- XXXXXX0911 WebChat: www.thebank.co.uk/contact-us | |

| reporting a suspected fraudulent incident or transaction | Yes | Mon-Fri 08:00 - 16:00 Sat: 10:00 - 16:00 Sun: 11:00 - 16:00 | Mon-Sun 16:00 - 24:00 | Mon-Fri 00:00 - 08:00 Sat-Sun: 00:00 - 11:00 | Gen Enq Tel: 0044-XXXXXX0909 Fraud Tel: 0044- XXXXXX0999 WebChat: www.thebank.co.uk/contact-us | Cumulative, all the channels cover 24 x 7 x 365 |

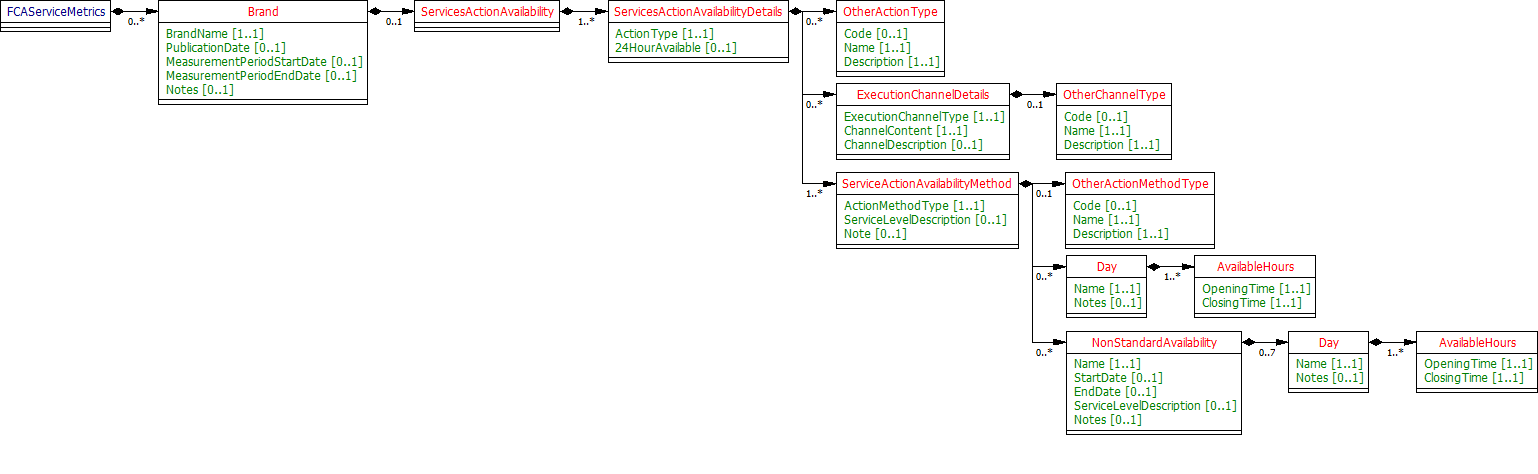

ServicesActionAvailability

How and when you can use your bank account to do action for services.

UML Diagram

Implementation example

Brand: Happy Days Building society

How and when you can use your bank account to do the following things?

| 24Hours Available? | Telephone Banking | Internet Banking | Mobile Banking | OBIE Comments | |

|---|---|---|---|---|---|

| checking the balance | No | Mon-Fri 08:00 - 16:00 Sat: 10:00 - 13:00 | Mon-Fri 08:00 - 16:00 Sat: 10:00 - 13:00 Sun: 11:00 - 13:00 | Mon-Fri 06:00 - 24:00 Sat-Sun: 10:00 - 24:00 | |

| setting up a standing order | No | Mon-Fri 08:00 - 16:00 Sat: 10:00 - 13:00 | Mon-Sun 00:00 - 24:00 NonStandard-Availability:

| Mon-Fri 06:00 - 24:00 Sat-Sun: 10:00 - 24:00 | One channel is available 24 x 7 x363 |

| sending money outside the UK | Yes | Mon-Sun 00:00 - 24:00 | Mon-Sun 00:00 - 24:00 | Mon-Sun 00:00 - 24:00 | |

| cancelling a cheque | Yes | Mon-Fri 08:00 - 16:00 Sat-Sun: 10:00 - 16:00 | Mon-Fri 16:00 - 24:00 Sat-Sun: 16:00 - 23:00 | Mon-Fri 00:00 - 08:00 Sat-Sun: 23:00 - 11:00 | Cumulative all the channels, the banks can be contacted 24 * 7 Or account holder can do action 24 * 7 |

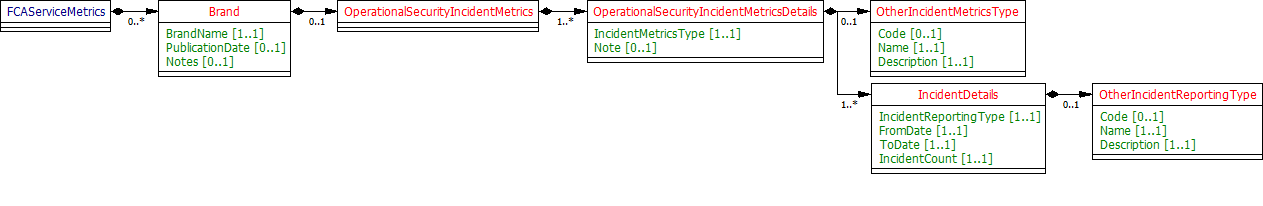

OperationalAndSecurityIncidentMetrics

Metrics information about any major operational or security incident which prevents banks customers from using their payment services.

UML Diagram

Implementation example

Example is just for illustrating, how banks can interpret the specs and publish the required data.

Yearly data is rolling yearly data. It will have cumulative last 4 quarters data. History is not required to be maintained. Note: all other incident types are documented in the code list

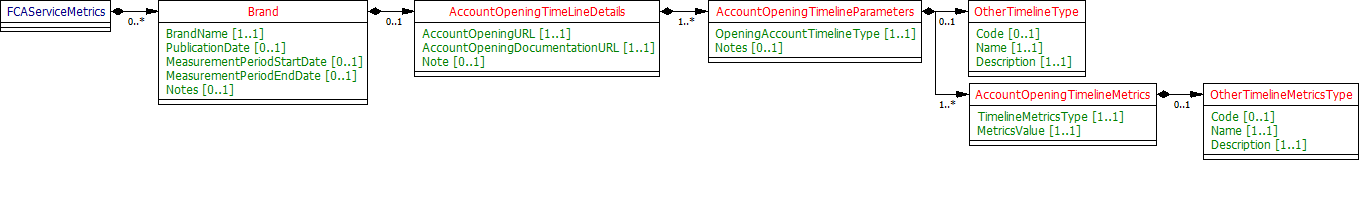

AccountOpeningTimeLineDetails

This section covers info related to time line of opening an account along with other supported features such as "how quickly do a customers get internet banking?"

UML Diagram

Implementation Example

Note: all other service metrics are documented in the code list

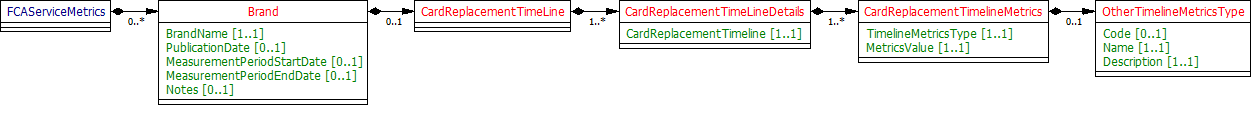

CardReplacementTimeLine

This section covers info related to time line of replacing a bank card.

UML Diagram

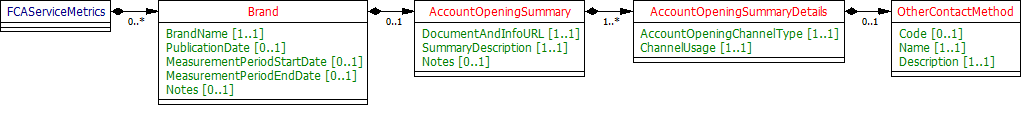

AccountOpeningSummary

This section covers info related to account opening documentation requirements and also facilities details like "You can open an account: without visiting a branch". SummaryDescription field will have free text info like "To open [this account OR any of our accounts], a new customer will need to provide us with the [following documents and information OR the documents and information set out [link to webpage on which the list is published]]. We may request additional information or documents in individual cases.

OR

We do not publish a list of the documents and information which all new customers will need to give us in order to open [this OR an] account."

UML Diagram

Implementation Example

Example is for illustration purpose only. Full list of actions and other info can be found in the Code List and Data Dictionary document(attached on this page).

Data Model

Code List

Provides the list of enumeration which have been used in the Design and specification.

Data Dictionary

Provides detailed descriptions for each field in the message specification along with the associated code lists, constraints and other technical details such as cardinality, any pattern constraints, min, max length etc.

Swagger

The API specification written using the Swagger API specification format.

© Open Banking Limited 2019 | https://www.openbanking.org.uk/open-licence | https://www.openbanking.org.uk