Account and Transaction API Specification - v1.1.0

Version Control

| Version | Date | Author | Comments |

|---|---|---|---|

| 1.0.0 | 23 Jun 2017 | Open Banking Read/Write API Team | This is the Baseline version. No Changes from v1.0-rc4. |

| 1.1.0 | 31 Aug 2017 | Open Banking Read/Write API Team | Includes 9 fixes, 5 clarifications and 14 enhancements. Please see the release note for details. Changes from v1.1-rc2: More explicit wording around Non-Repudiation not to be implemented for v1.x |

Release Note

This release note explains what's new in The Account and Transaction API Specifications v1.1.0.

Fixes

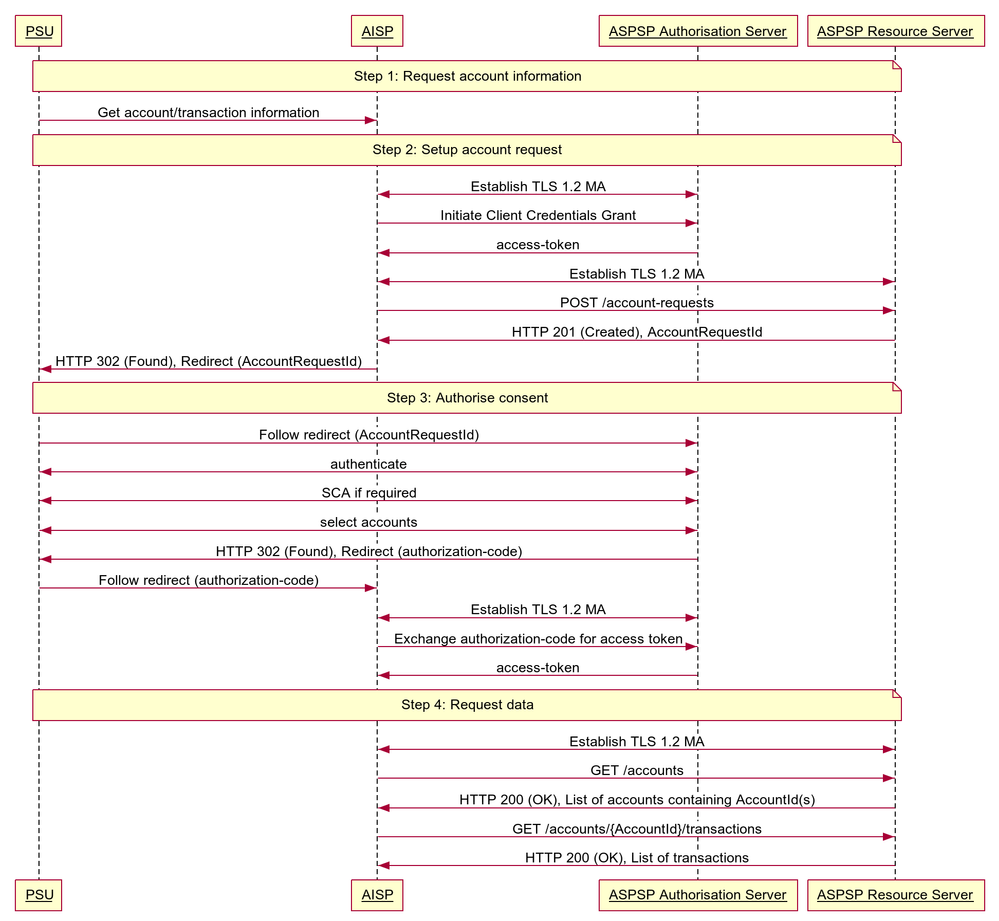

In Accounts Transactions sequence diagram, removed Step 4 Request data response to the PSU.

- Corrected the case for Links.First, Links.Last, Links.Next, Links.Prev, Links.Self and Meta.TotalPages (updated Basics/Pagination, Basics / Return & Error Codes / 400 (Bad Request) v/s 404 (Not Found), and Data Model / High Level Payload Structure / Response Structure).

- Removed special characters in the Frequency field for Data Model / Data Payload - Resources / Standing Orders / Data Dictionary.

- Corrected the Pattern for the ActiveOrHistoricCurrencyCode class from [A-Z]{3,3} to ^[A-Z]{3,3}$ to limit the field to 3 characters.

- Corrected the Pattern for the CountryCode class to be specified as ^[A-Z]{2,2}$ instead of [A-Z]{2,2} to limit the field to 2 characters.

- In Usage Examples, have corrected "AwaitingAuthentication" to "AwaitingAuthorisation"

- Updated Usage Example for /products endpoint to align with Data Dictionary.

- Updated Pagination Response JSON payload to correctly separate one of the JSON properties by inclusion of a comma.

- Corrected a mis-spelling from "UFT-8" to "UTF-8".

Clarifications

- Added details and updated examples on the various date formats used outside of the JSON payload (updated Examples, Basics / Date formats, and Basics / Non-repudiation / Process for signing a payload).

- Clarified that Timezone offsets of -00:00 are not permitted in ISO-8601 (updated Examples, and all default dates in Data Model / Data payload - resources).

- Clarified that all dates in HTTP headers are represented as RFC 7231 Full Dates. For example: Sun 3 Sep 2017 19:43:31 UTC

- Clarified that a status of 403 should not be used to indicate a time-out of the access token, and that a 403 indicates that re-authentication of the PSU will not help.

- Clarified that digital signatures must NOT be implemented for v1.x specification.

Enhancements

- Metadata fields in the /transactions response now include an earliest available transaction date AND a latest available transaction date (updated Examples, Data Model / High Level Payload Structure / Response Structure / Meta, and default values specified in the Data Payload sections).

- Added a new section to cater for reversals (Security & Access Control / Consent Authorization / Permissions / Reversing Entries).

- Added a new section to specify the default character set as UTF-8 (Basics / Character Encoding).

- All datetime fields returned by the API must have the Timezone specified (updated Examples and added a new section Basics / Date Format).

- Specified min and max page sizes for pagination (updated section on Basics / Pagination).

Sort Code and Account Number are now stored in the Account identification section together (in the Identification field), and a new SchemeName has been created for SortCodeAccountNumber (updated Examples, Data Model / Data Payload - Resources / Accounts / Data Dictionary, Data Model / Data Payload - Resources / Beneficiaries / Data Dictionary, Data Model / Data Payload - Resources / Standing Orders / Data Dictionary, and Data Model / Data Payload - Enumerations).

- Extended the Standing Order Frequency pattern to include weekends and clarified pattern description (updated Data Model / Data Payload - Resources / Standing Orders / Data Dictionary).

- Changed the BankTransactionCode to be the ISO 20022 code description, with all delimiters removed (updated Data Model / Data Payload - Resources / Transactions).

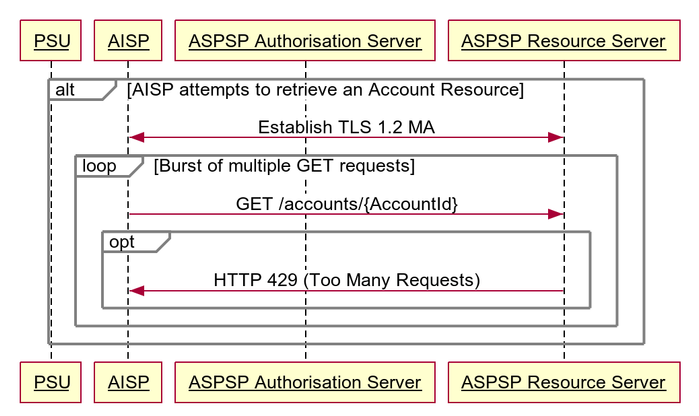

- Add a Retry-After header for the HTTP 429 Too Many Requests response (updated Basics / Return & Error Codes, Basics / Headers / Response Headers, and Alternate Error Flows showing 429 as an optional implementation).

Added 405 and 406 as status codes (updated section on Basics / Response Headers).

Added clarifications to the Pagination section to state that the self link must be included in the response (Updated section Basic / Pagination).

Added a section describing resource URL path structures.

Added regex pattern for all Amount based fields under the Data Model / Data Payload. Removed pattern definition TotalDigits: 18 FractionDigits: 5.

Swagger Specification updated to include the Swagger Specification version number in the base of the URL (i.e. linked to this Specification).

Overview

This specification describes the Account Information and Transaction API flows and payloads.

The API endpoints described here allow an AISP to:

- Register an intent to retrieve account information by creating an "account request". This registers the data "permissions", expiration and transaction history timeframe the customer (PSU) has consented to provide to the AISP; and

- Subsequently retrieve account and transaction data

Document Overview

This document consists of the following parts:

Overview: Provides an overview of the scope of the API and the key decisions and principles that contributed to the specification.

Basics: The section identifies the resources, operations that are permitted on those resources, and various special cases.

Security & Access Control: Specifies the means for AISPs and PSUs to authenticate themselves and provide consent.

Swagger Specifications: Provides links to the swagger specifications for the APIs.

Data Model: Describes the data model for the API payloads.

Usage Examples: Examples for normal flows, and alternate flows.

Design Principles

RESTful APIs

The API adheres to RESTful API concepts where possible and sensible to do so.

However, the priority is to have an API that is simple to understand and easy to use. In instances where following RESTful principles would be convoluted and complex, the principles have not been followed.

References:

- The highest level Data Description Language used is the JSON Schema : http://json-schema.org/

- Best Practice has also been taken from the Data Description Language for APIs; JSON API : http://jsonapi.org/

- The Interface Description Language used is the Swagger Specification version 2.0 (also known as Open API) : http://swagger.io/ and

Standards

The OBIE principles for developing the new API standards:

- OBIE will adopt existing standards where relevant/appropriate to minimise re-inventing the wheel.

- The initial scope of these Standards is limited to current OBIE scope - i.e., meeting CMA remedies. However, the intention is that the scope of the Standards will extend to either include or align to initiatives to cover a wider scope (i.e., PSD2).

- The Standards currently being reviewed include ISO20022, and FAPI.

- OBIE will favour developer/user experience over and above adoption of existing Standards, in order to create a more future proof Standard.

- OBIE will work with other relevant bodies to align with, contribute to and/or adopt other Standards work, especially relating to creation of Standards around APIs and JSON payloads

ISO 20022

The CMA Order requires the CMA9 Banks to be aligned with the Regulatory and Technical Standards (RTS) under PSD2.

A previous draft of the EBA RTS required that the interface "shall use ISO 20022 elements, components or approved message definitions". In keeping with that requirement, the API payloads are designed using the ISO 20022 message elements and components where available.

The principles we have applied to re-use of ISO message elements and components are:

- Where relevant - the API payloads have been flattened so that they are more developer friendly. This has been a request from the developer community, and the stakeholders involved in the design workshop

- Only elements that are required for the functioning of the API endpoint will be included in the API payload. API endpoints are defined for specific use-cases (not to be generically extensible for all use-cases). Hence - only elements that are required for the account and transaction information scope are included in the Account Information API payloads for v1.0 (as this is the agreed scope for our v1.0 specification).

- We will modify ISO 20022 elements where the existing standard does not cater for an API context (such as filtering, pagination etc.). An example is having latitude and longitude in decimal format - as this is how developers will work with latitude and longitude; or using simple types (e.g., a single date-time field) instead of a complex type (e.g., a choice field with a nesting of date and time).

Extensibility

Version 1.0 of the API only caters to read access to account and transaction information for BCAs and PCAs.

However - where possible the APIs have been designed to be extensible - so they can in the future cover additional account types (e.g., card accounts) and operations (e.g., write access).

Idempotency

The Account Information and Transaction APIs will not be idempotent for v1.0.

Non-Repudiation

Important

API requests and responses MUST NOT be digitally signed for implementation of the v1.x specification.

This section is for future reference only.

Digital signatures will facilitate non-repudiation for Open Banking APIs.

However, the solution for digital signatures (if required in a future release) has been agreed and the approach required to achieve this is described in Basics / Non-repudiation.

Unique Identifiers (Id Fields)

A REST resource should have a unique identifier (e.g. a primary key) that can be used to identify the resource. These unique identifiers are used to construct URLs to identify and address specific resources.

However, considering that:

- Some of the resources described in this specification do not have a primary key in the system of record.

- For v1.0 it is not neccessary to individually address resources,

a decision has been made that Id fields will be specified for all resources - but be optional for all resources, except for the account resource.

The account resource needs to be addressed individually and must have a mandatory, unique and non-mutable identifier.

Scope

The APIs specified in this document provide the ability for AISPs to access a PSU's account and transaction information for domestic PCA and BCA accounts.

Out of Scope

This v1.0 specification does not cater for:

- Write operations (the ability to create) standing orders, direct debits and beneficiaries.

- Accounts other than PCAs and BCAs.

- Progressive or changing consent - if the consent between the AISP and PSU changes, then the existing account-request object is deleted and a new account-request is created with the new consent/authorisation details.

- The ability for the AISP to pre-specify the list of accounts that have been agreed with the PSU for consent/authorisation. At the time of writing the specification - it is not clear from a Legal perspective how the changing of these details over time (e.g, customers adding or deleting accounts) affects the original agreed authorisation.

- The ability for the AISP to specify and "hints" for the types of accounts that have been agreed with the PSU for consent/authorisation (e.g., product or customer channel types). At the time of writing the specification - it is not clear from a Legal perspective how the changing of these details over time affects the original agreed authorisation.

- Multi-authentication flows have been designed - but the full implications of the multi-authentication flows have not been worked through - so these are are not in the v1.0 specification.

- Non-functional requirements and specification of caching and throttling.

Basics

Overview

The figure below provides a general outline of a account information requests and flow using the Account Info APIs.

Steps

Step 1: Request Account Information

- This flow begins with a PSU consenting to allow an AISP to access account information data.

Step 2: Setup Account Request

- The AISP connects to the ASPSP that services the PSU's account(s) and creates an account-request resource. This informs the ASPSP that one of its PSUs is granting access to account and transaction information to an AISP. The ASPSP responds with an identifier for the resource (the AccountRequestId - which is the intent identifier).

- This step is carried out by making a POST request to /account-requests endpoint

- The setup payload will include these fields - which describe the data that the PSU has consented with the AISP:

- Permissions - a list of data clusters that have been consented for access

- Expiration Date - an optional expiration for when the AISP will no longer have access to the PSU's data

- Transaction Validity Period - the From/To date range which specifies a transaction history period which can be accessed by the AISP

- An AISP may be a broker for data to other 4th parties, and so it is valid for a customer to have multiple account-requests for the same accounts, with different consent/authorisation parameters agreed.

Step 3: Authorise Consent

- The AISP redirects the PSU to the ASPSP. The redirect includes the AccountRequestId generated in the previous step. This allows the ASPSP to correlate the account-request that was setup. The ASPSP authenticates the PSU. The ASPSP updates the state of the account-request resource internally to indicate that the account request has been authorised.

- The principle we have agreed is that consent is managed between the PSU and the AISP - so the account-request details cannot be changed (with the ASPSP) in this step. The PSU will only be able to authorise or reject the account-request details in its entirety.

- During authorisation - the PSU selects accounts that are authorised for the AISP request (in the ASPSP's banking interface)

- The PSU is redirected back to the AISP.

Step 4: Request Data

- This is carried out by making a GET request the relevant resource.

- The unique AccountId(s) that are valid for the account-request will be returned with a call to GET /accounts. This will always be the first call once an AISP has a valid access token.

Sequence Diagram

Actors

| Actor | Abbreviation | Type | Specializes | Description |

|---|---|---|---|---|

| Payment Service User | PSU | Person | N/A | A natural or legal person making use of a payment service as a payee, payer or both (PSD2 Article 4(10)) |

| Payment Service Provider | PSP | Legal Entity | N/A | A legal entity (and some natural persons) that provide payment services as defined by PSD2 Article 4(11) |

| Account Servicing Payment Service Provider | ASPSP | Legal Entity | PSP | An ASPSP is a PSP that provides and maintains a payment account for a payment services user (PSD 2 Article 4(15). The CMA 9 are all ASPSPs. |

| Third Party Providers / Trusted Third Parties | TPP | Legal Entity | PSP | A party other than an ASPSP that provides payment related services. The term is not actually defined in PSD2, but is generally deemed to include all payment service providers that are 3rd parties (the ASPSP and the PSU to whom the account belongs being the first two parties) |

| Payment Initiation Service Provider | PISP | Legal Entity | TPP | A TPP that provides Payment Initiation Services. PSD2 does not offer a formal definition. Article 4(18) quite circularly defines a PISP as a PSP that provides Payment Initiation Services. |

Account Information Service Provider | AISP | Legal Entity | TPP | A TPP that provides Account Information Services. Again, PSD2 defines AISPs in Article 4(19) circularly as a PSP that provides account information services |

Character Encoding

The API requests and responses must use a UTF-8 character encoding. This is the default character encoding for JSON (RFC 7158 - Section 8.1).

However, an ASPSP's downstream system may not accept some UTF-8 characters, such as emoji characters (e.g. "Happy Birthday 🎂🎂!" may not be an acceptable Payment Reference). If the ASPSP rejects the message with a UTF-8 character that cannot be processed, the ASPSP should respond with an HTTP 400 (Bad Request) status code.

Date Formats

All dates in the JSON payloads are represented in ISO 8601 date-time format. All date-time fields in responses must include the timezone. An example is below:

2017-04-05T10:43:07+00:00

All dates in the HTTP headers are represented as RFC 7231 Full Dates. An example is below:

Sun, 10 Sep 2017 19:43:31 UTC

JWT claims are expressed as a JSON number representing the number of seconds from 1970-01-01T0:0:0Z as measured in UTC until the date/time.

Resource URI Path Structure

The resources defined by these APIs can be addressed through a path structure consisting of the following parts:

- An optional ASPSP specific path prefix

- The constant string "open-banking"

- The version of the APIs expressed as /v[major-version].[minor-version]/

- The resource name

Examples:

/superbank/open-banking/v1.1/payments

/open-banking/v1.0/payments

/apis/open-banking/v1.1/payments

Headers

Request Headers

The following headers SHOULD be inserted by the TPP in each API call:

| Header Value | Notes | POST | GET | DELETE |

|---|---|---|---|---|

| x-fapi-financial-id | The unique id of the ASPSP to which the request is issued. The unique id will be issued by OB. | Mandatory | Mandatory | Mandatory |

| x-fapi-customer-last-logged-time | The time when the PSU last logged in with the TPP. | Optional | Optional | Optional |

| x-fapi-customer-ip-address | The PSU's IP address if the PSU is currently logged in with the TPP. | Optional | Optional | Optional |

| x-fapi-interaction-id | An RFC4122 UID used as a correlation id. If provided, the ASPSP must "play back" this value in the x-fapi-interaction-id response header. | Optional | Optional | Optional |

| Authorization | Standard HTTP Header; Allows Credentials to be provided to the Authorisation / Resource Server depending on the type of resource being requested. For OAuth 2.0 / OIDC, this comprises of either the Basic / Bearer Authentication Schemes. | Mandatory | Mandatory | Mandatory |

| Content-Type | Standard HTTP Header; Represents the format of the payload being provided in the request. This must be set to application/json. | Mandatory | Do not use | Do not use |

| Accept | Standard HTTP Header; Determine the Content-Type that is required from the Server. If set, it must have the value application/json. If set to any other value, ASPSP must respond with a 406 Not Acceptable. | Optional | Optional | Optional |

| x-jws-signature | Header containing a detached JWS signature of the body of the payload. Mandatory for requests that contain a payload. A policy decision is under consideration on whether API requests and responses will be digitally signed to provide a simpler means of non-repudiation. This header will only be applicable if the policy decision is to implement non-repudiation through digital signatures. | Not for v1.x | Not for v1.x | Not for v1.x |

(Reference: Section 6.3 - Financial API — Part 1: Read Only API Security Profile (Implementer’s Draft).)

Whether the PSU is present or not-present is identified via the x-fapi-customer-ip-address header. If the PSU IP address is supplied, it is inferred that the PSU is present during the interaction.

The implications to this are:

- ASPSPs will need to rely on AISPs assertion.

- As agreed at TDA (18/05) It will be up to the ASPSPs to interpret the 4-times customer not present rule - to be within the “spirit” of the RTS requirement.

- This is dependent on GDPR considerations on the AISP passing a PSU's IP address to an ASPSP.

Response Headers

| Header Value | Notes | Mandatory ? |

|---|---|---|

| Content-Type | Standard HTTP Header; Represents the format of the payload returned in the response. The ASPSP must return Content-type: application/json as a content header in response to requests that return a HTTP body (all post and get requests) | Conditionally Mandatory |

| x-jws-signature | Header containing a detached JWS signature of the body of the payload. Mandatory for requests that contain a payload. A policy decision is under consideration on whether API requests and responses will be digitally signed to provide a simpler means of non-repudiation. This header will only be applicable if the policy decision is to implement non-repudiation through digital signatures. | Not for v1.x |

| x-fapi-interaction-id | An RFC4122 UID used as a correlation id. This must be the same value provided in the x-fapi-interaction-id request header. Mandatory if provided in the request. | Conditionally Mandatory |

| Retry-After | Header indicating the time (in seconds) that the TPP should wait before retrying an operation. The ASPSP should include this header along with responses with the HTTP status code of 429 (Too many requests). | Optional |

Return & Error Codes

The following are the HTTP response codes for the different HTTP methods - across all Account Info API endpoints.

Situation | HTTP Status | Notes | Returned by POST | Returned by GET | Returned by DELETE |

|---|---|---|---|---|---|

| Query completed successfully | 200 OK | No | Yes | No | |

| Normal execution. The request has succeeded. | 201 Created | The operation results in the creation of a new resource. | Yes | No | No |

| Delete operation completed successfully | 204 No Content | No | No | Yes | |

Account Request has malformed, missing or non-compliant JSON body or URL parameters | 400 Bad Request | The requested operation will not be carried out. | Yes | No | No |

Authorization header missing or invalid token | 401 Unauthorized | The operation was refused access. Re-authenticating the PSU may result in an appropriate token that can be used. | Yes | Yes | Yes |

Token has incorrect scope or a security policy was violated. | 403 Forbidden | The operation was refused access. Re-authenticating the PSU is unlikely to remediate the situation. | Yes | Yes | Yes |

| The TPP tried to access the resource with a method that is not supported. | 405 Method Not Allowed | Yes | Yes | Yes | |

| The request contained an accept header that requested a content-type other than application/json and a character set other than UTF-8 | 406 Not Acceptable | Yes | Yes | Yes | |

| The operation was refused as too many requests have been made within a certain timeframe. | 429 Too Many Requests | Throttling is a NFR. The ASPSP should include a Retry-After header in the response indicating how long the TPP must wait before retrying the operation. | Yes | Yes | Yes |

| Something went wrong on the API gateway or micro-service | 500 Internal Server Error | The operation failed. | Yes | Yes | Yes |

An ASPSP MAY return other standard HTTP status codes (e.g. from gateways and other edge devices) as described in RFC 7231 - Section 6.

400 (Bad Request) v/s 404 (Not Found)

When a TPP tries to request a resource URL with an resource Id that does not exist, the ASPSP must respond with a 400 (Bad Request) rather than a 404 (Not Found).

E.g., if a TPP tries to GET /accounts/22289 where 22289 is not a valid AccountId, the ASPSP must respond with a 400.

When a TPP tries to request a resource URL that results in no business data being returned (e.g. a request to retrieve standing order on an account that does not have standing orders) the ASPSP must respond with a 200 (OK) and set the array to be empty.

If the TPP tries to access a URL for a resource that is not defined by these specifications (e.g. GET /card-accounts), the ASPSP may choose to respond with a 404 (Not Found).

If an ASPSP has not implemented an optional API, it must respond with a 404 (Not Found) for requests to that URL.

The table below illustrates some examples of expected behaviour:

| Situation | Request | Response |

|---|---|---|

| TPP attempts to retrieve an account with an AccountId that does not exist | GET /accounts/1001 | 400 (Bad Request) |

| TPP attempts to retrieve a resource that is not defined | GET /credit-cards | 404 (Not Found) |

TPP attempts to retrieve a resource that is in the specification, but not implemented by the ASPSP. E.g., an ASPSP has chosen not to implement the bulk direct-debit endpoint | GET /direct-debits | 404 (Not Found) |

| TPP attempts to retrieve standing orders for an AccountId that does not exists | GET /accounts/1001/standing-orders | 400 (Bad Request) |

| TPP attempts to retrieve standing orders for an AccountId that exists, but does not have any standing orders | GET /accounts/1000/standing-orders | 200 OK {

"Data": {

"StandingOrder": []

},

"Links": {

"Self": "/accounts/1000/standing-orders/"

},

"Meta": {

"TotalPages": 1

}

} |

403 (Forbidden)

When a TPP tries to access a resource that it does not have permission to access, the ASPSP must return a 403 (Forbidden).

The situation could arise when:

- The TPP uses an access token that does not have the approporiate scope to access the requested resource.

- The TPP does not have a consent authorisation for the AccountId

E.g., an attempt to access GET /accounts/2001 or /accounts/2001/transactions when the PSU has not selected AccountId 2001 for authorisation. - The TPP does not have a consent authorisation with the right Persmissions to access the requested resource.

E.g., an attempt to access GET /standing-orders when the ReadStandingOrdersBasic permission was not included in the consent authorisation. - The TPP attempted to access a resource with an Id that it does not have access to.

E.g., an attempt to access GET /account-requests/1001 where an account-request resource with Id 1001 belongs to another TPP.

When the TPP uses an access token that is no longer valid, the situation could potentially be remedied by asking the PSU to re-authenticate. This should be indicated by a 401 (Unauthorized) status code.

429 (Too Many Requests)

When a TPP tries to access a resource too frequently the ASPSP may return a 429 (Too Many Requests). This is a Non Functional Requirement and is down to individual ASPSPs to decide throttling limits.

This situation could arise when:

- The TPP has not implemented caching, it requests transactions for a PSU account, and constantly re-requests the same transactions

- Similarly for any of the PSU information endpoints

Pre-Conditions

The following pre-conditions must be satisfied in order to use these APIs:

Pre-conditions for TPPs

- The TPP must have completed onboarding on the Open Banking Directory

- The TPP must have registered one or more software statements with the Open Banking Directory. The software statement must have "accounts" as one of the required scopes.

- The TPP must have valid network and signing certificates issued by Open Banking.

- The TPP must have completed registration with each of the ASPSPs that it wants to transact with and have been issued with a client-id.

Pre-conditions for ASPSPs

- The ASPSP must have completed onboarding on the Open Banking Directory

- The ASPSP must have valid network and signing certificates issued by Open Banking

Idempotency

The API for creating an account-request resource is not idempotent. Once the API has been called, the state of the underlying resource changes.

If a time-out error occurs - then we would expect an AISP to create a new account-request resource - rather than try with the same resource.

Non-repudiation

Important

API requests and responses MUST NOT be digitally signed for implementation of the v1.x specification.

This section is for future reference only.

The solution for digital signatures (if required in a future release) has been agreed and the approach required to achieve this is described in Basics / Non-repudiation.

Overview

The APIs require TLS 1.2 Mutual Authentication and this can be used as a means of non-repudiation. However, it would be difficult to maintain digital records and evidence of non-repudiation if the API only relied on TLS 1.2.

A solution for non-repudiation that does not rely on TLS, would be achieved by providing a JWS with detached content (as defined in RFC 7515 - Appendix F) in the HTTP header of each API request.

The HTTP body would form an un-encoded payload as defined in RFC 7797.

The JWS would be signed using an algorithm that supports asymmetric keys.

A request would be signed by a TPP's private key and a response would be signed by the ASPSP's private key.

OB Directory will provide and host the necessary certificates containing the corresponding public keys so that hte signature can be verified.

Specification

The TPP must sign the HTTP body of each API request that has an HTTP body. (e.g. GET requests do not have an HTTP body and are not signed.)

The ASPSP must sign the HTTP body of each API response that it produces which has an HTTP body.

The ASPSP should verify the signature of API requests that it receives before carrying out the request. If the signature fails validation, the ASPSP must respond with a 400 (Bad Request).

The ASPSP must reject any API requests that should be signed but do not contain a signature in the HTTP header with a 400 (Bad Request) error.

The TPP should verify the signature of API responses that it receives.

Process for signing a payload

Step 1: Identify the private key and corresponding signing certificate to be used for signing

The signer must use a private key that has a corresponding digital certificate (that contains the corresponding public key) issued by OB.

The signing certificate must be valid at the time of creating the JWS.

Step 2: Form the JOSE Header

The JOSE header for the signature must contain the following fields

Claim | Description |

|---|---|

alg | The algorithm that will be used for signing the JWS. The list of valid algorithms is here https://tools.ietf.org/html/rfc7518#section-3.1. The algorithms that will be supported by OB will be specified in the future. |

kid | This must match the certificate id of the certificate selected in step 1. |

| b64 | This must have the boolean value false. This indicates that the message payload is not base64 url encoded. |

| http://openbanking.org.uk/iat | This must be a JSON number representing the number of seconds from 1970-01-01T0:0:0Z as measured in UTC until the date/time. This is a private header parameter name. (See RFC 7515 - Private Header Parameter Names) |

| http://openbanking.org.uk/iss | This must be a string containing the id of the TPP. This must match the dn of the signing certificate. This is a private header parameter name. (See RFC 7515 - Private Header Parameter Names) |

| crit | This must be a string array consisting of the values "b64", "http://openbanking.org.uk/iat", "http://openbanking.org.uk/iss" This indicates that the JWS signature validator must understand and process the three additional claims. |

Step 3: Compute the JWS

The signer must compute the signature as a detached JWS as defined in RFC 7515.

payload = base64Encode (JOSEHeader) + "." + base64Encode( json) detachedJWS = base64Encode( JOSEHeader) + ".." + base64Encode ( encrypt (privateKey, base64Encode(json)))

Step 4: Add the JWS as a HTTP header

The signer must include an HTTP header called x-jws-signature with its value set to the signature computed in Step 3.

x-jws-signature: V2hhdCBoYXRoIGdvZCB3cm91Z2h0ID8=..QnkgR2VvcmdlLCBzaGUncyBnb3QgaXQhIEJ5IEdlb3JnZSBzaGUncyBnb3QgaXQhIE5vdyBvbmNlIGFnYWluLCB3aGVyZSBkb2VzIGl0IHJhaW4/

Process for verifying a signature

Step 1: Extract the components from the JWS

The verifier must extract and decode the JOSE header and signature from the JWS provided in the x-jws-signature http header

JWSParts[] = detachedJWS.tokenize("..");

JOSEHeader = base64Decode (JWSParts[0]);

Signature = JWSParts[1];

ExpectedSignedPayload = JWSParts[0] + "." + base64Encode( httpBody)

Step 2: Validate the JOSE header and certificate

The verifier must validate the JOSE header to ensure that it is a valid json object with only the claims specified in Process for Signing a Payload - Step 2.

The verifier must ensure that the specified alg is one of the algorithms specified by OB.

The verifier must ensure that the specified kid is valid and a signing certificate with the specified key id can be retrieved from the OB directory.

The verifier must ensure that the certificate is valid.

The verifier must ensure that the b64 claim is set to false.

The verifier must ensure that the http://openbanking.org.uk/iat claim has a date-time value set in the past.

The veriier must ensure that the http://openbanking.org.uk/iss claim matches the dn of the certificate.

The verifier must ensure that the crit claim does not contain additional critical elements.

Step 3: Verify the signature

The verifier must verify the signature by decrypting it and ensuring that it matches the ExpectedSignedPayload.

DecryptedPayload = base64Decode ( decrypt ( publicKey, Signature));

Sample JOSE Header

{

"alg": "",

"kid": "90210ABAD",

"b64": false,

"http://openbanking.org.uk/iat": 1501497671,

"http://openbanking.org.uk/iss": "C=UK, ST=England, L=London, O=Acme Ltd.",

"crit": [ "b64", "http://openbanking.org.uk/iat", "http://openbanking.org.uk/iss"]

]

Filtering

Limited support for filtering is provided on the transactions resource.

Transactions can be filtered based on their Booking Date using the fromBookingDateTime and toBookingDateTime parameters

The dates MUST be specified in ISO8601 format. The date MUST NOT include a timezone.

The filter values will be assumed to refer to the same timezone as the timezone in which the booking date for the account is maintained.

The ASPSP must treat the following as valid input:

- non-working days (e.g. a sunday or a bank holiday) or any other days on which no transactions are recorded

- dates that fall outside the range for which transaction information is provided through APIs

- dates that fall outside the range for which a consent authorisation is available.

In the above situations, the ASPSP must return data for the remaining valid period specified by the filter.

// All transactions from 1st Jan, 2015 GET /transactions?fromBookingDateTime=2015-01-01T00:00:00 // All transactions in 2016 GET /transactions?fromBookingDateTime=2016-01-01T00:00:00&toBookingDateTime=2016-12-31T23:59:59 // All transactions in a specific account upto 31-Mar-2017 GET /accounts/1/transactions?toBookingDateTime=2017-03-31T23:59:59

Pagination

An ASPSP MAY provide a paginated response for GET operations that return multiple records.

In such a situation, the ASPSP MUST:

- If a subsequent page of resource records exists, the ASPSP must provide a link to the next page of resources in the Links.Next field of the response. The absence of a next link would indicate that the current page is the last page of results.

- If a previous page of resource records exists, the ASPSP must provide a link to the previous page of resources in the Links.Prev field of the response. The absence of a prev link would indicate that the current page is the first page of results.

For a paginated responses, the ASPSP SHOULD ensure that the number of records on a page are within reasonable limits - a minimum of 25 records (except on the last page where there are no further records) and a maximum of 1000 records.

Additionally, the ASPSP MAY provide:

- A link to the first page of results in the Links.First field.

- A link to the last page of results in the Links.Last field.

- The total number of pages in the Meta.TotalPages field.

As with all other responses, the ASPSP MUST include a "self" link to the resource in the Links.Self field as described in the Links sections.

This standard does not specify how the pagination parameters are passed by the ASPSP and each ASPSP may employ their own mechanisms to paginate the response.

If the original request from the AISP included filter parameters, the paginated response must return only results that match the filter.

ASPSPs are not expected to implement pagination with transaction isolation. The underlying data-set may change between two subsequent requests. This may result in situations where the same transaction is returned on more than one page.

Regulatory Considerations

Non-normative guidance

This section provides non-normative guidance on how the specifications can be used to comply with certain requirements of PSD2 and the RTS. This is not an exhaustive list. Detailed analysis will be provided separately - with full traceability matrix of requirements.

Although this specification refers to the use of SCA, the use of SCA is not mandated until the RTS comes into effect.

The RTS is not finalised at the point of publishing this version of the specification - this may lead to some changes as new drafts of the RTS are released.

RTS - Article 10

- Subject to paragraph 2 of this Article and to compliance with the requirements laid down in paragraphs 1, 2 and 3 of Article 2, payment service providers are exempted from the application of strong customer authentication where a payment service user is limited to accessing either or both of the following items online without disclosure of sensitive payment data:

(a) the balance of one or more designated payment accounts;

(b) the payment transactions executed in the last 90 days through one or more designated payment accounts.- For the purpose of paragraph 1, payment service providers are not exempted from the application of strong customer authentication where either of the following condition is met:

(a) the payment service user is accessing online the information specified in points (a) and (b) of paragraph 1 for the first time;

(b) the last time the payment service user accessed online the information specified in point (b) of paragraph 1 and strong customer authentication was applied more than 90 days ago.

The ASPSP can determine if the conditions in paragraph 1 are met by examining the Account Request resource. In such a situation the Account Request will have:

- The only requested permission is ReadBalances OR

- All of the following are true:

- The requested permissions are limited to the following: ReadBalance, ReadTransactionsBasic, ReadTransactionsCredits, ReadTransactionsDebits

- The TransactionFromDateTime and ExpirationDateTime are both specified.

- The ExpirationDateTime is the current date or a future date.

- and the difference between TransactionFromDateTime and ExpirationDateTime is less than or equal to 90 days

The ASPSP must implement the necessary checks to ensure that the PSU is not accessing the data for the first time (as specified in Para 2(a)) - this is an implementation issue for the ASPSP.

If the ASPSP choses to re-authenticate the PSU every 90 days, the ASPSP should limit the validity of the refresh tokens that they issue to 90 days.

RTS - Article 31(5)

Account information service providers shall be able to access information from designated payment accounts and associated payment transactions held by account servicing payment service providers for the purposes of performing the account information service in either of the following circumstances:

(a) whenever the payment service user is actively requesting such information;

(b) where the payment service user is not actively requesting such information, no more than four times in a 24 hour period, unless a higher frequency is agreed between the account information service provider and the account servicing payment service provider, with the payment service user’s consent.

Although it is difficult to determine what constitutes a PSU "actively requesting information", the ASPSP may utilise the FAPI headers (x-fapi-customer-last-logged-time and x-fapi-customer-ip-address) to make a determination of whether the PSU is "actively requesting such information".

Endpoints

This section looks at the list of available API endpoints to access Account Information and Transaction data. For detail on the request and response objects - refer to the Data Model section of the specification.

The ASPSP must implement the API end-points in the table below that are marked as mandatory.

The ASPSP may optionally implement the API end-points that are marked as non-mandatory.

If an ASPSP has not implemented an optional API, it must respond with a 404 (Not Found) for requests to that URL.

Endpoint design considerations:

- Having resources that are finer grained (e.g., beneficiaries, direct-debits, standing-orders) means that we can, in the future, manage these resources (with unique identifiers)

- While balances is not a typical resource - we believe having a /accounts/{AccountId}/balances endpoint is simpler to understand than a URI to expand the /accounts resource

- Some ASPSPs were uncomfortable implementing the bulk APIs (e.g., /accounts , /transactions , /beneficiaries etc.) for v1.0 - so the bulk APIs have been specified as optional (these are endpoints 12 to 17). However - the bulk endpoint for /accounts is mandatory to discover what accounts have been authorised for the account-request.

| Resource | HTTP Operation | Endpoint | Mandatory ? | Scope | Idempotent | Parameters | Request Object | Response Object | |

|---|---|---|---|---|---|---|---|---|---|

| 1 | account-requests | POST | POST /account-requests | Mandatory | accounts | No | Pagination | OBReadRequest1 | OBReadResponse1 |

| 2 | account-requests | GET | GET /account-requests/{AccountRequestId} | Optional | accounts | Pagination | OBReadResponse1 | ||

| 3 | account-requests | DELETE | DELETE /account-requests/{AccountRequestId} | Mandatory | accounts | Yes | Pagination | ||

| 4 | accounts | GET | GET /accounts | Mandatory | accounts | Pagination | OBReadAccount1 | ||

| 5 | accounts | GET | GET /accounts/{AccountId} | Mandatory | accounts | Pagination | OBReadAccount1 | ||

| 6 | balances | GET | GET /accounts/{AccountId}/balances | Mandatory | accounts | Pagination | OBReadBalance1 | ||

| 7 | beneficiaries | GET | GET /accounts/{AccountId}/beneficiaries | Mandatory | accounts | Pagination | OBReadBeneficiary1 | ||

| 8 | direct-debits | GET | GET /accounts/{AccountId}/direct-debits | Mandatory | accounts | Pagination | OBReadDirectDebit1 | ||

| 9 | products | GET | GET /accounts/{AccountId}/product | Mandatory | accounts | Pagination | OBReadProduct1 | ||

| 10 | standing-orders | GET | GET /accounts/{AccountId}/standing-orders | Mandatory | accounts | Pagination | OBReadStandingOrder1 | ||

| 11 | transactions | GET | GET /accounts/{AccountId}/transactions | Mandatory | accounts | Pagination Filtering | OBReadTransaction1 | ||

| 12 | balances | GET | GET /balances | Optional | accounts | Pagination | OBReadBalance1 | ||

| 13 | beneficiaries | GET | GET /beneficiaries | Optional | accounts | Pagination | OBReadBeneficiary1 | ||

| 14 | direct-debits | GET | GET /direct-debits | Optional | accounts | Pagination | OBReadDirectDebit1 | ||

| 15 | products | GET | GET /products | Optional | accounts | Pagination | OBReadProduct1 | ||

| 16 | standing-orders | GET | GET /standing-orders | Optional | accounts | Pagination | OBReadStandingOrder1 | ||

| 17 | transactions | GET | GET /transactions | Optional | accounts | Pagination Filtering | OBReadTransaction |

We have specified what are "mandatory" endpoints for the functioning of the Account Info APIs.

However, if ASPSPs do not provide direct debit, standing order or beneficiary details via existing online channels - the endpoints will be not be mandatory.

POST /account-requests

POST /account-requests

The API allows the AISP to ask an ASPSP to create a new account-request resource.

- This API effectively allows the AISP to send a copy of the consent to the ASPSP to authorise access to account and transaction information.

- For v1.0 - we have made a decision to remove functionality for an AISP to pre-select a set of accounts (i.e., the SelectedAccounts block). This is because the behaviour of the pre-selected accounts, after authorisation, is not clear form a Legal perspective at the time of writing the spec.

- The ASPSP creates the account-request resource and responds with a unique AccountRequestId to refer to the resource.

- Prior to calling the API, the AISP must have an access token issued by the ASPSP using a client credentials grant.

Account Request Status

The account-request resource that is created successfully must have one of the following Status code-list enumerations:

| Status | Status Description | |

|---|---|---|

| 1 | Rejected | The account request has been rejected. |

| 2 | AwaitingAuthorisation | The account request is awaiting authorisation. |

GET /account-requests/{AccountRequestId}

GET /account-requests/{AccountRequestId}

An AISP can optionally retrieve a account-request resource that they have created to check its status.

Prior to calling the API, the AISP must have an access token issued by the ASPSP using a client credentials grant.

Account Request Status

Once the PSU authorises the account-request resource - the Status of the account-request resource will be updated with "Authorised".

The available Status code-list enumerations for the account-request resource are:

| Status | Status Description | |

|---|---|---|

| 1 | Rejected | The account request has been rejected. |

| 2 | AwaitingAuthorisation | The account request is awaiting authorisation. |

| 3 | Authorised | The account request has been successfully authorised. |

| 4 | Revoked | The account request has been revoked via the ASPSP interface. |

DELETE /account-requests/{AccountRequestId}

DELETE /account-requests/{AccountRequestId}

If the PSU revokes consent to data access with the AISP - the AISP should delete the account-request resource.

- This is done by making a call to DELETE the account-request resource.

- Prior to calling the API, the AISP must have an access token issued by the ASPSP using a client credentials grant.

GET Authorised Accounts

GET /accounts

The first step for an AISP after an account-request is authorised - is to call the GET /accounts endpoint.

This will give the full list of accounts (the AccountId(s)) that the PSU has authorised the AISP to access. The AccountId(s) returned can then be used to retrieve other resources for an account. The selection of authorised accounts for v1.0 happens only at the ASPSP's interface.

The AISP will use an access token associated with the PSU issued through an authorization code grant.

GET Resources for a Specific Account

GET /accounts/{AccountId}

GET /accounts/{AccountId}/balances

GET /accounts/{AccountId}/beneficiaries

GET /accounts/{AccountId}/direct-debits

GET /accounts/{AccountId}/standing-orders

GET /accounts/{AccountId}/transactions

GET /accounts/{AccountId}/product

An AISP can retrieve the account information resources for the AccountId (which is retrieved in the call to GET /accounts).

The AISP will use an access token associated with the PSU issued through an authorization code grant.

GET Resources in Bulk

GET /accounts GET /balances GET /beneficiaries GET /direct-debits GET /standing-orders GET /transactions GET /products

If an ASPSP has implemented the bulk retrieval endpoints - an AISP can optionally retrieve the account information resources in bulk.

This will retrieve the resources for all authorised accounts linked to the account-request.

The AISP will use an access token associated with the PSU issued through an authorization code grant.

Security & Access Control

API Scopes

The access tokens required for accessing the Account Info APIs must have at least the following scope:

accounts

Grants Types

AISPs must use a client credentials grant to obtain a token to access the account-requests resource.

AISPs must use a authorization code grant to obtain a token to access all other resources.

Consent Authorisation

OAuth 2.0 scopes are coarse grained and the set of available scopes are defined at the point of client registration. There is no standard method for specifying and enforcing fine grained scopes (e.g. a scope to specify that account information should only be provided for certain time periods).

A consent authorisation is used to define the fine-grained scope that is granted by the PSU to the AISP.

The AISP must create an account-request resource through a POST operation. This resource indicates the consent that the AISP claims it has been given by the PSU to retrieve account and transaction information. At this stage, the consent is not yet authorised as the ASPSP has not yet verified this claim with the PSU.

The ASPSP responds with an AccountRequestId. This is the intent-id that is used when initiating the authorization code grant (as described in the Trust Framework).

As part of the authorization code grant:

- The ASPSP authenticates the PSU.

- The ASPSP plays back the consent (registered by the AISP) back to the PSU - to get consent authorisation. The PSU may accept or reject the consent in its entirity (but not selectively).

- The ASPSP presents the PSU a list of accounts to which the consent will apply.

Once these steps are complete, the consent is considered to have been authorised by the PSU.

Consent Elements

The Account Request resource consists of the following fields, that together form the elements of the consent provided by the PSU to the AISP:

- Permissions: The set of data clusters that the PSU has consented to allow the AISP to access

- ExpirationDateTime: The date-time up to which the consent is valid.

- TransactionFromDateTime: The earliest booking date of transactions that the PSU has consented to provide access to the AISP.

- TransactionToDateTime: The last booking date of transactions that the PSU has consented to provide access to the AISP.

Permissions

Permissions codes will be used to limit the data that is returned in response to a resource request.

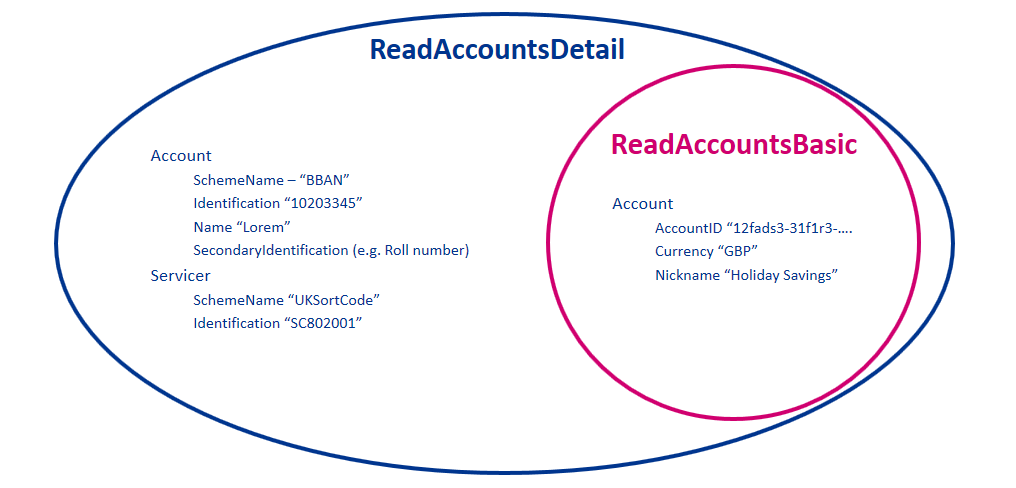

When a permission is granted for a "Detail" permission code (e.g., ReadAccountsDetail), it implies that access is also granted to the corresponding "Basic" permission code (e.g., ReadAccountsBasic)

The following combinations of permissions are disallowed and the ASPSP must not allow such account-requests to be created:

- Account requests with an empty Permissions array

- Account requests with a Permissions array that contains ReadTransactionBasic but does not contain at least one of ReadTransactionCredits and ReadTransactionDebits.

- Account requests with a Permissions array that contains ReadTransactionDetail but does not contain at least one of ReadTransactionCredits and ReadTransactionDebits.

- Account requests with a Permissions array that contains ReadTransactionCredits but does not contain at least one of ReadTransactionBasic and ReadTransactionDetails.

- Account requests with a Permissions array that contains ReadTransactionDebits but does not contain at least one of ReadTransactionBasic and ReadTransactionDetails.

| Permissions | Endpoints | Business Logic | Data Cluster Description |

|---|---|---|---|

| ReadAccountsBasic | /accounts /accounts/{AccountId} | Ability to read basic account information | |

| ReadAccountsDetail | /accounts /accounts/{AccountId} | Access to additional elements in the payload (the additional data elements are listed in the table below) | Ability to read account identification details |

| ReadBalances | /balances /accounts/{AccountId}/balances | Ability to read all balance information | |

| ReadBeneficiariesBasic | /beneficiaries /accounts/{AccountId}/beneficiaries | Ability to read basic beneficiary details | |

| ReadBeneficiariesDetail | /beneficiaries /accounts/{AccountId}/beneficiaries | Access to additional elements in the payload | Ability to read account identification details for the beneficiary |

| ReadDirectDebits | /direct-debits | Ability to read all direct debit information | |

| ReadStandingOrdersBasic | /standing-orders /accounts/{AccountId}/standing-orders | Ability to read standing order information | |

| ReadStandingOrdersDetail | /standing-orders /accounts/{AccountId}/standing-orders | Access to additional elements in the payload | Ability to read account identification details for beneficiary of the standing order |

| ReadTransactionsBasic | /transactions /accounts/{AccountId}/transactions | Permissions must also include at least one of:

| Ability to read basic transaction information |

| ReadTransactionsDetail | /transactions /accounts/{AccountId}/transactions | Access to additional elements in the payload Permissions must also include at least one of

| Ability to read transaction data elements which may hold silent party details |

| ReadTransactionsCredits | /transactions /accounts/{AccountId}/transactions | Access to credit transactions. Permissions must also include one of:

| Ability to read only credit transactions |

| ReadTransactionsDebits | /transactions /accounts/{AccountId}/transactions | Access to debit transactions. Permissions must also include one of:

| Ability to read only debit transactions |

| ReadProducts | /products /accounts/{AccountId}/product | Ability to read all product information relating to the account |

The additional elements that are granted for "Detail" permissions are listed in this table.

All other fields (other than these fields listed) are available with the "Basic" Permission access.

| Permission - Detail Codes | Data Element Name | Occurrence | XPath |

|---|---|---|---|

| ReadAccountsDetail | Account | 0..1 | OBReadAccount1/Data/Account/Account |

| ReadAccountsDetail | Servicer | 0..1 | OBReadAccount1/Data/Account/Servicer |

| ReadBeneficiariesDetail | Servicer | 0..1 | OBReadBeneficiary1/Data/Beneficiary/Servicer |

| ReadBeneficiariesDetail | CreditorAccount | 0..1 | OBReadBeneficiary1/Data/Beneficiary/CreditorAccount |

| ReadStandingOrderDetail | Servicer | 0..1 | OBReadStandingOrder1/Data/StandingOrder/Servicer |

| ReadStandingOrderDetail | CreditorAccount | 0..1 | OBReadStandingOrder1/Data/StandingOrder/CreditorAccount |

| ReadTransactionDetail | TransactionInformation | 0..1 | OBReadTransaction1/Data/Transaction/TransactionInformation |

| ReadTransactionDetail | Balance | 0..1 | OBReadTransaction1/Data/Transaction/Balance |

| ReadTransactionDetail | MerchantDetails | 0..1 | OBReadTransaction1/Data/Transaction/MerchantDetails |

Example behaviour of the Permissions for the ReadAccountsBasic and ReadAccountDetail codes is as follows:

Reversing Entries

It is expected that transactions will be returned in the payload irrespective of whether they are reversing entries as long as the PSU has provided consent for that type of transaction.

If the PSU has provided permission for ReadTransactionsCredits, the ASPSP must include all credits including debit reversals.

If the PSU has provided permission for ReadTransactionDebits, the ASPSP must include all debits including credit reversals.

Expiration Date Time

The ExpirationDateTime is an optional field which specifies the expiration for AISP access to the PSU's data.

The field is optional - as the consent for AISP access to a PSU's data can be indefinite. The ExpirationDateTime is different to the RTS requirement for a PSU to re-authorise after 90 days - which is clarified in the "RTS and SCA Exemptions" section. The same account-request resource will be re-authenticated - with the same ExpirationDateTime as the original request.

The ExpirationDateTime applies to all Permissions (data clusters) being consented.

Transaction To/From Date Time

The TransactionToDateTime and the TransactionFromDateTime specify the period for consented transaction history. The AISP will be restricted to accessing transactions within this period when accessing the transactions resource.

Both the fields are optional and one can be specified without the other.

Account Request Status

The Account Request resource can have one of the following status codes after authorisation has taken place:

| Status | Description | |

|---|---|---|

| 1 | Authorised | The account request has been successfully authorised. |

| 2 | Rejected | The account request has been rejected. |

| 3 | Revoked | The account request has been revoked via the ASPSP interface. |

Error Condition

If the PSU does not complete a successful consent authorisation (e.g. if the PSU is not authenticated successfully), the authorization code grant ends with a redirection to the TPP with an error response as described in RFC 6749 Section 4.1.2.1. The PSU is redirected to the TPP with a error parameter indicating the error that occoured.

Consent Revocation

A PSU can revoke consent for accessing account information at any point in time.

The PSU can revoke authorisation directly with the ASPSP. The mechanisms for this are in the competitive space and are up to each ASPSP to implement in the ASPSP's banking interface. ASPSPs are under no obligation to notify AISPs regarding the revocation of authorisation in v1.0.

The PSU can request the AISP to revoke consent that it has authorised. If consent is revoked with the AISP:

- The AISP must cease to access the APIs at that point (otherwise it may be in breach of GDPR).

- The AISP should call the DELETE operation on the account-request resource to indicate to the ASPSP that the PSU has revoked consent.

Changes to Selected Account(s)

The PSU can select the accounts to which the consent should be applied at the point of consent authorisation.

Subsequent changes to the set of accounts to which the consent authorisation applies can be carried out directly with the ASPSP. The method for doing this lies in the competitive space and is not part of this specification.

Additionally, the set of selected accounts may also change due to external factors. This include (but are not limited to):

- The account being closed.

- The PSU's mandate to operate the account is revoked.

- The account is barred or frozen.

In such a situation, only the affected account is removed from the list of selected accounts. The ASPSP must not revoke authorisation to other accounts.

Handling Expired Access Tokens

Access Token issued through Client Credentials Grant

When an access token issued through a Client Credentials Grant expires, the TPP must get a new access token by executing a client credential grant again.

Access Token issued through Authorization Code Grant

An ASPSP may issue a refresh token along with an access token at the end of an authorization code grant.

When an access token obtained through an authorization code grant expires, the TPP may attempt to get a new access and refresh token as defined in Section 6 of the OAuth 2.0 specification.

If the TPP fails to get an access token using a refresh token, the TPP would have to get the PSU to initiate a fresh authorisation code grant using an existing intent-id.

An ASPSP may choose to simplify their implementation by ensuring that the access token and consent authorisation have the same period of validity - in such a situation, the access token will not expire within the lifetime of the consent authorisation and subsequently the ability to re-authenticate is not required.

Risk Scoring Information

Information for risk scoring and assessment will come via:

- FAPI HTTP headers. These are defined in Section 6.3 of the FAPI specification and in the Headers section above.

- Additional fields identified by the industry as business logic security concerns - which will be passed in the Risk section of the payload in the JSON object.

No fields for business logic security concerns have been identified for the Account Info APIs for v1.0.

Swagger Specification

The Swagger Specification (v1.1.0) for Account Information APIs can be downloaded from the following links:

Data Model

High Level Payload Structure

This section gives an overview of the top level structure for the API payloads for the Account Info APIs.

Request Structure

The top level request structure for Account Info APIs:

{

"Data": {

...

},

"Risk": {

...

}

}

The top level structure for the Account Info API POST requests will be:

Data

Risk

The Data section contains the request details.

A Risk section for the request structure has been separated out - so that this can evolve in isolation from request section of the payload.

Response Structure

The top level response structure for Account Info APIs:

{

"Data": {

...

},

"Risk": {

...

},

"Links": {

...

],

"Meta": {

...

}

}

In line with the principle on RESTful API practices - we are replaying the resource as part of the response.

Two additional top level sections are included for:

Links

Meta

Links

The Links section is mandatory and will always contain URIs to related resources,

The "Self" member is mandatory, the other members "First", "Prev", "Next", "Last" are optional.

For example:

"Links": {

"Self": "http://example.com/articles?page[number]=3&page[size]=1",

"First": "http://example.com/articles?page[number]=1&page[size]=1",

"Prev": "http://example.com/articles?page[number]=2&page[size]=1",

"Next": "http://example.com/articles?page[number]=4&page[size]=1",

"Last": "http://example.com/articles?page[number]=13&page[size]=1"

}

Meta

The Meta section is mandatory, but can be empty.

An optional member is "TotalPages" which is specified as an integer (int32) and shows how many pages of results (for pagination) are available.

For example:

"Meta": {

"TotalPages": 1,

"FirstAvailableDateTime": "2017-05-03T00:00:00+00:00",

"LastAvailableDateTime": "2017-12-03T00:00:00+00:00"

}

Identifying Available Transaction Period

The transactions for a particular range of dates may be excluded from the response because:

- The ASPSP does not provide historical transactions during that date range.

- The PSU has not consented to transactions for that date range.

The absence of transactions in the payload does not indicate that there were no transactions during that period. To ensure that the data is interpreted correctly, the ASPSP MAY provide the date of the first available transaction and last available transaction as part of the response in the Meta section in the FirstAvailableDateTime and LastAvailableDateTime fields.

Data Payload - Consent Object

This data dictionary section gives the detail on the payload content for Account Information flow to request access to account information.

Account Requests - Request

The OBReadRequest1 object will be used for the call to:

- POST /account-requests

UML Diagram

Notes:

- The fields in the OBReadRequest1 object are described in the Consent Elements section above

- No fields have been identified for the Risk section for v1.0

Data Dictionary

| Name | Occurrence | XPath | EnhancedDefinition | Class | Codes |

|---|---|---|---|---|---|

| OBReadRequest1 | OBReadRequest1 | OBReadRequest1 | |||

| Data | 1..1 | OBReadRequest1/Data | OBReadData1 | ||

| Permissions | 1..n | OBReadRequest1/Data/Permissions | Specifies the Open Banking account request types. This is a list of the data clusters being consented by the PSU, and requested for authorisation with the ASPSP. | OBExternalPermissions1Code | ReadAccountsBasic ReadAccountsDetail ReadBalances ReadBeneficiariesBasic ReadBeneficiariesDetail ReadDirectDebits ReadProducts ReadStandingOrdersBasic ReadStandingOrdersDetail ReadTransactionsBasic ReadTransactionsCredits ReadTransactionsDebits ReadTransactionsDetail |

| ExpirationDateTime | 0..1 | OBReadRequest1/Data/ExpirationDateTime | Specified date and time the permissions will expire. If this is not populated, the permissions will be open ended. | ISODateTime | |

| TransactionFromDateTime | 0..1 | OBReadRequest1/Data/TransactionFromDateTime | Specified start date and time for the transaction query period. If this is not populated, the start date will be open ended, and data will be returned from the earliest available transaction. | ISODateTime | |

| TransactionToDateTime | 0..1 | OBReadRequest1/Data/TransactionToDateTime | Specified end date and time for the transaction query period. If this is not populated, the end date will be open ended, and data will be returned to the latest available transaction. | ISODateTime | |

| Risk | 1..1 | OBReadRequest1/Risk | The Risk section is sent by the initiating party to the ASPSP. It is used to specify additional details for risk scoring for Account Info. | OBRisk2 |

Account Requests - Response

The OBReadResponse1 object will be used for the:

- Response to POST /account-requests

- Call to GET /account-requests/{AccountRequestId}

UML Diagram

Notes:

- The OBReadResponse1 object contains the same information as the OBReadRequest1 - but with additional fields:

- AccountRequestId - to uniquely identify the account-request resource

- Status

- CreationDateTime

- No fields have been identified for the Risk section for v1.0

Data Dictionary

| Name | Occurrence | XPath | EnhancedDefinition | Class | Codes |

|---|---|---|---|---|---|

| OBReadResponse1 | OBReadResponse1 | OBReadResponse1 | |||

| Data | 1..1 | OBReadResponse1/Data | OBReadDataResponse1 | ||

| AccountRequestId | 1..1 | OBReadResponse1/Data/AccountRequestId | Unique identification as assigned to identify the account request resource. | Max128Text | |

| Status | 0..1 | OBReadResponse1/Data/Status | Specifies the status of the account request resource. | OBExternalRequestStatus1Code | Authorised Revoked |

| CreationDateTime | 1..1 | OBReadResponse1/Data/CreationDateTime | Date and time at which the resource was created. | ISODateTime | |

| Permissions | 1..n | OBReadResponse1/Data/Permissions | Specifies the Open Banking account request types. This is a list of the data clusters being consented by the PSU, and requested for authorisation with the ASPSP. | OBExternalPermissions1Code | ReadAccountsBasic ReadAccountsDetail ReadBalances ReadBeneficiariesBasic ReadBeneficiariesDetail ReadDirectDebits ReadProducts ReadStandingOrdersBasic ReadStandingOrdersDetail ReadTransactionsBasic ReadTransactionsCredits ReadTransactionsDebits ReadTransactionsDetail |

| ExpirationDateTime | 0..1 | OBReadResponse1/Data/ExpirationDateTime | Specified date and time the permissions will expire. If this is not populated, the permissions will be open ended. | ISODateTime | |

| TransactionFromDateTime | 0..1 | OBReadResponse1/Data/TransactionFromDateTime | Specified start date and time for the transaction query period. If this is not populated, the start date will be open ended, and data will be returned from the earliest available transaction. | ISODateTime | |

| TransactionToDateTime | 0..1 | OBReadResponse1/Data/TransactionToDateTime | Specified end date and time for the transaction query period. If this is not populated, the end date will be open ended, and data will be returned to the latest available transaction. | ISODateTime | |

| Risk | 1..1 | OBReadResponse1/Risk | The Risk section is sent by the initiating party to the ASPSP. It is used to specify additional details for risk scoring for Account Info. | OBRisk2 |

Data Payload - Resources

This data dictionary section gives the detail on the payload content for the account information resource endpoints.

How the resources relate from a logical perspective is documented in the Logical Data Model: Account Info - Logical Model.

UML diagram notes:

- All amount fields across the API endpoints use the ISO 20022 ActiveOrHistoricCurrencyAndAmount class. This is an XML attribute (with an embedded Currency field). Due to the limitations of the XML tool - the Currency field does not show in the UML diagram - however, is reflected in the Data Dictionary.

Accounts

The OBReadAccount1 object will be used for the call to:

- GET /accounts/{AccountId}

- GET /accounts

Resource Definition

The resource that represents the account to which credit and debit entries are made.

Each account resource will have a unique and immutable AccountId.

UML Diagram

Notes:

- The Account and Servicer blocks replicate what is used consistently throughout the Account Information APIs.

- This structure has been designed to:

- Reflect the DebtorAccount and DebtorAgent (and similarly for CreditorAccount and CreditorAgent) structures in the PISP use case

- Having a SchemeName for the Account and Servicer blocks means we can be flexible to accommodate multiple types of accounts (SortCodeAccountNumber or IBAN)

- Where "SortCodeAccountNumber" is specified as the SchemeName in the Account identification section, the Identification field must be populated with the 6 digit Sort Code and 8 digit Account Number (a 14 digit field); and the Servicer section must not be populated

- Where the "IBAN" is specified as the SchemeName in the Account identification section, the Identification field must be populated with the full IBAN; and the Servicer section should be populated with the "BICFI" as the SchemeName

- The SecondaryIdentification element can be used for the roll number for building societies

Data Dictionary

| Name | Occurrence | XPath | EnhancedDefinition | Class | Codes | Pattern |

|---|---|---|---|---|---|---|

| OBReadAccount1 | OBReadAccount1 | OBReadAccount1 | ||||

| Data | 1..1 | OBReadAccount1/Data | OBReadDataAccount1 | |||

| Account | 0..n | OBReadAccount1/Data/Account | Unambiguous identification of the account to which credit and debit entries are made. | OBAccount1 | ||

| AccountId | 1..1 | OBReadAccount1/Data/Account/AccountId | A unique and immutable identifier used to identify the account resource. This identifier has no meaning to the account owner. | Max40Text | ||

| Currency | 1..1 | OBReadAccount1/Data/Account/Currency | Identification of the currency in which the account is held. Usage: Currency should only be used in case one and the same account number covers several currencies and the initiating party needs to identify which currency needs to be used for settlement on the account. | ActiveOrHistoricCurrencyCode | ^[A-Z]{3,3}$ | |

| Nickname | 0..1 | OBReadAccount1/Data/Account/Nickname | The nickname of the account, assigned by the account owner in order to provide an additional means of identification of the account. | Max70Text | ||

| Account | 0..1 | OBReadAccount1/Data/Account/Account | Provides the details to identify an account. | OBCashAccount1 | ||

| SchemeName | 1..1 | OBReadAccount1/Data/Account/Account/SchemeName | Name of the identification scheme, in a coded form as published in an external list. | OBExternalAccountIdentification2Code | IBAN SortCodeAccountNumber | |

| Identification | 1..1 | OBReadAccount1/Data/Account/Account/Identification | Identification assigned by an institution to identify an account. This identification is known by the account owner. | Max34Text | ||

| Name | 0..1 | OBReadAccount1/Data/Account/Account/Name | Name of the account, as assigned by the account servicing institution, in agreement with the account owner in order to provide an additional means of identification of the account. Usage: The account name is different from the account owner name. The account name is used in certain user communities to provide a means of identifying the account, in addition to the account owner's identity and the account number. | Max70Text | ||

| SecondaryIdentification | 0..1 | OBReadAccount1/Data/Account/Account/SecondaryIdentification | This is secondary identification of the account, as assigned by the account servicing institution. This can be used by building societies to additionally identify accounts with a roll number (in addition to a sort code and account number combination). | Max34Text | ||

| Servicer | 0..1 | OBReadAccount1/Data/Account/Servicer | Party that manages the account on behalf of the account owner, that is manages the registration and booking of entries on the account, calculates balances on the account and provides information about the account. | OBBranchAndFinancialInstitutionIdentification2 | ||

| SchemeName | 1..1 | OBReadAccount1/Data/Account/Servicer/SchemeName | Name of the identification scheme, in a coded form as published in an external list. | OBExternalFinancialInstitutionIdentification2Code | BICFI | |

| Identification | 1..1 | OBReadAccount1/Data/Account/Servicer/Identification | Unique and unambiguous identification of the servicing institution. | Max35Text |

Balances

The OBReadBalance1 object will be used for the call to:

- GET /accounts/{AccountId}/balances

- GET /balances

Resource Definition

Representation of the net increases and decreases in an account (AccountId) at a specific point in time.

An account (AccountId) can have multiple balance types (these follow the standard ISO 20022 balance type enumerations). If an ASPSP includes a credit line in an available balance - then the balance representation will have a section for the credit line amount and type.

UML Diagram

Notes:

- Multiple balances can be returned (each with a different value for Type) for an account. This is for ASPSPs that show multiple balances in their online channels.

- The CreditLine section can be repeated - as multiple credit lines may be included in an available balance.

- A DateTime element has been used instead of a complex choice element of Date and DateTime. Where time elements do not exist in ASPSP systems - the time portion of the DateTime element will be defaulted to 00:00:00+00:00

Data Dictionary

| Name | Occurrence | XPath | EnhancedDefinition | Class | Codes | Pattern |

|---|---|---|---|---|---|---|

| OBReadBalance1 | OBReadBalance1 | OBReadBalance1 | ||||

| Data | 1..1 | OBReadBalance1/Data | OBReadDataBalance1 | |||

| Balance | 1..n | OBReadBalance1/Data/Balance | Set of elements used to define the balance details. | OBCashBalance1 | ||

| AccountId | 1..1 | OBReadBalance1/Data/Balance/AccountId | A unique and immutable identifier used to identify the account resource. This identifier has no meaning to the account owner. | Max40Text | ||

| Amount | 1..1 | OBReadBalance1/Data/Balance/Amount | Amount of money of the cash balance. | ActiveOrHistoricCurrencyAndAmount | ^\d{1,13}\.\d{1,5}$ | |

| Currency | 1..1 | OBReadBalance1/Data/Balance/Amount/Currency | A code allocated to a currency by a Maintenance Agency under an international identification scheme, as described in the latest edition of the international standard ISO 4217 "Codes for the representation of currencies and funds". | ActiveOrHistoricCurrencyCode | ^[A-Z]{3,3}$ | |

| CreditDebitIndicator | 1..1 | OBReadBalance1/Data/Balance/CreditDebitIndicator | Indicates whether the balance is a credit or a debit balance. Usage: A zero balance is considered to be a credit balance. | OBCreditDebitCode | Credit Debit | |

| Type | 1..1 | OBReadBalance1/Data/Balance/Type | Balance type, in a coded form. | OBBalanceType1Code | ClosingAvailable ClosingBooked Expected ForwardAvailable Information InterimAvailable InterimBooked OpeningAvailable OpeningBooked PreviouslyClosedBooked | |

| DateTime | 1..1 | OBReadBalance1/Data/Balance/DateTime | Indicates the date (and time) of the balance. | ISODateTime | ||

| CreditLine | 0..n | OBReadBalance1/Data/Balance/CreditLine | Set of elements used to provide details on the credit line. | OBCreditLine1 | ||

| Included | 1..1 | OBReadBalance1/Data/Balance/CreditLine/Included | Indicates whether or not the credit line is included in the balance of the account. Usage: If not present, credit line is not included in the balance amount of the account. | xs:boolean | ||

| Amount | 0..1 | OBReadBalance1/Data/Balance/CreditLine/Amount | Amount of money of the credit line. | ActiveOrHistoricCurrencyAndAmount | ^\d{1,13}\.\d{1,5}$ | |

| Currency | 1..1 | OBReadBalance1/Data/Balance/CreditLine/Amount/Currency | A code allocated to a currency by a Maintenance Agency under an international identification scheme, as described in the latest edition of the international standard ISO 4217 "Codes for the representation of currencies and funds". | ActiveOrHistoricCurrencyCode | ^[A-Z]{3,3}$ | |

| Type | 0..1 | OBReadBalance1/Data/Balance/CreditLine/Type | Limit type, in a coded form. | OBExternalLimitType1Code | Pre-Agreed Emergency Temporary |