Version Control

| 2.0.0 | 29 Jun 2017 | Open Banking Open Data API Team | This is the baseline version. |

| 2.1.0 | 21 Aug 2017 | Open Banking Open Data API Team | This release incorporates all known issues with 2.0.0 up to 18 Aug 2017. Please see the release notes for details. |

| 2.1.1 | 18 Oct 2017 | Open Banking Open Data API Team | This release includes the enhancement for LBG overdraft charges CR : IncrementalBorrowingAmount added to OverdraftFeeChargeDetail section in PCA specification to allow LBG to accurately represent their new overdraft pricing. |

Overview

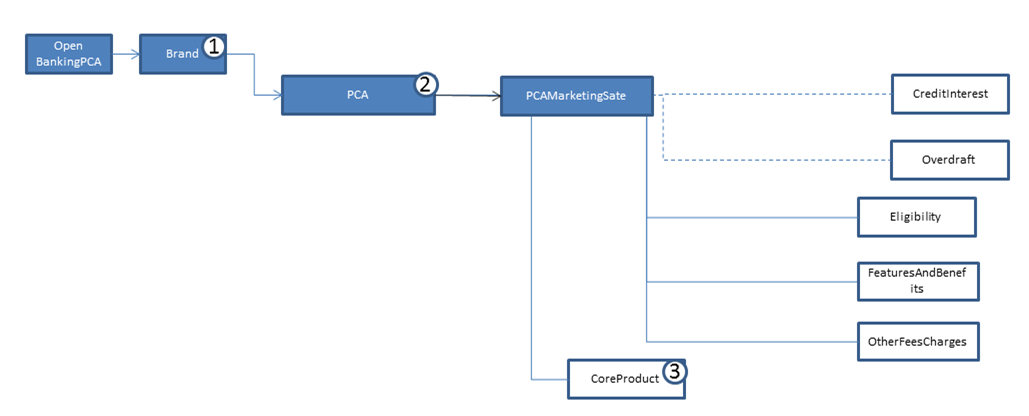

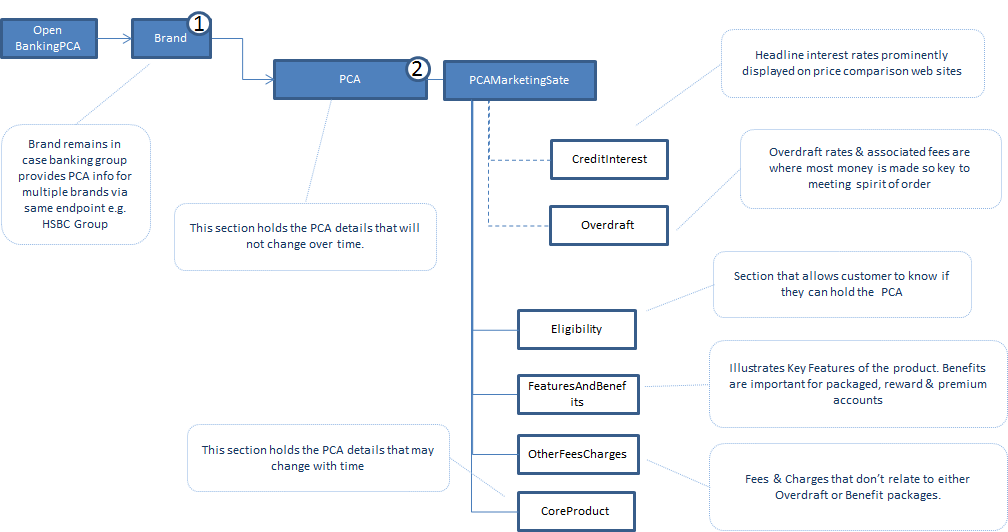

This specification includes all relevant artefacts for the Open Data Personal Current Account (PCA) API Specification.

Currently, price comparison websites have to obtain their PCA product data either via bank proprietary APIs, via information collected by dedicated data capture agencies or via "screen scraping" (i.e. capturing product web page information and writing scripts to extract relevant data). This work is complex and prone to error, so having a standard API would make the data capture side much easier and allow more third party providers to provide applications that could target particular consumer markets.

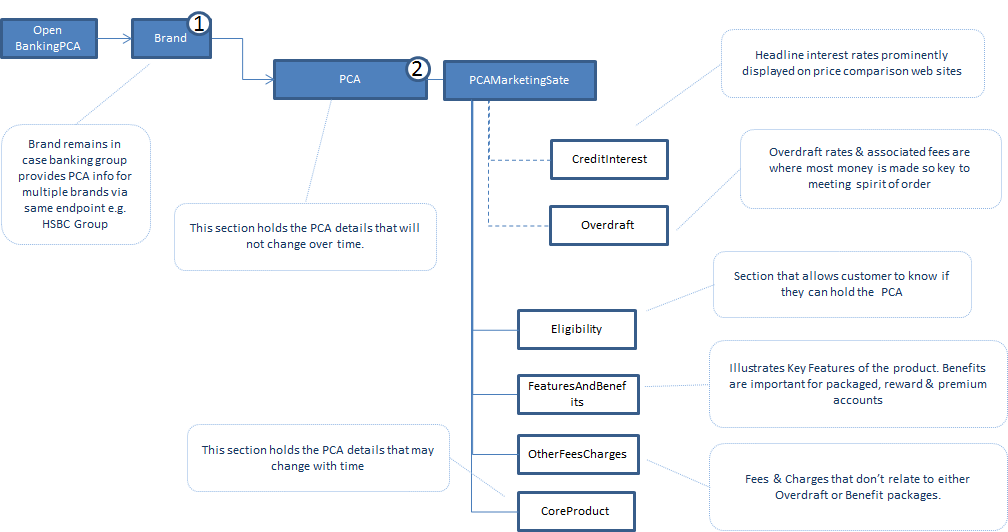

This endpoint can contain multiple brands owned by a particular banking group. Each brand can own multiple PCA products.

PCA

This section covers PCA attributes that will change only under rare circumstances (see Core Product section below for additional attributes that will be updated regularly). In this section the following information can be provided:-

- Product Name i.e. the name marketed to the consumers.

- Identification is the unique id created by the financial institution to internally define the product

- Segment - allows specification of the type of product e.g. basic, regular, premium

MarketingState

Within our design, we have a concept of a "marketing state" for the product. This concept is required because for any "On Sale" PCA product:-

- The PCA may provide a different offering to the account holder the longer that they hold a particular PCA

- The bank can change any of the PCA attributes over time.

We'll illustrate this with a complex example.

CMA9Bank has a PCA product that was first advertised on 1/1/2017 and has the following features currently:-

- If the accountholder takes the product, they are offered a promotional interest rate of 5% for 1st 9 months, then 2% for next 12 months and then it reverts back to the standard variable rate (currently 0%).

The original marketing states can be shown as follows:-

Identification | PredecessorID | MarketingState | FirstMarketedDate | LastMarketedDate | StateTenureLength | StateTenurePeriod | Notes |

|---|

| CP1 |

| Promotional | 1/1/2017 | 31/12/9999 | 9 | Month | When an accountholder opens the PCA, they will receive an initial promotional offer lasting 9 months. Attached to this state will be the original initial promotional interest rate information. |

| CP2 | CP1 | Promotional | 1/1/2017 | 31/12/9999 | 12 | Month | 9 months after the account has been opened, the customer will receive a 2nd promotional offer lasting 12 months |

| CR1 | CP2 | Regular | 1/1/2017 | 31/12/9999 | | | After the 2nd promotional period has expired, the accountholder will be moved to the regular interest rate. |

On 17th July, CMA9Bank are going to change the offer, so that only 3% is paid in the 1st 9 months. The marketing states on 16th July will look like this:-

Identification | PredecessorID | MarketingState | FirstMarketedDate | LastMarketedDate | StateTenureLength | StateTenurePeriod | Notes |

|---|

| CP1 |

| Promotional | 1/1/2017 | 16/7/2017 | 9 | Month | When an accountholder opens the PCA, they will receive an initial promotional offer lasting 9 months. Attached to this state will be the original initial promotional interest rate information. |

| CP2 | CP1 | Promotional | 1/1/2017 | 31/12/9999 | 12 | Month | 9 months after the account has been opened, the customer will receive a 2nd promotional offer lasting 12 months |

| CR1 | CP2 | Regular | 1/1/2017 | 31/12/9999 | | | After the 2nd promotional period has expired, the accountholder will be moved to the regular interest rate. |

| CP3 |

| Promotional | 17/7/2017 | 31/12/9999 | 9 | Month | When an accountholder opens the PCA, they will receive an initial promotional offer lasting 9 months. Attached to this, will be the revised initial promotional offer interest rate information. |

And on the 17th July, the marketing states will look like this:-

Identification | PredecessorID | MarketingState | FirstMarketedDate | LastMarketedDate | StateTenureLength | StateTenurePeriod | Notes |

|---|

| CP2 | CP3 | Promotional | 1/1/2017 | 31/12/9999 | 12 | Month | 9 months after the account has been opened, the customer will receive a 2nd promotional offer lasting 12 months |

| CR1 | CP2 | Regular | 1/1/2017 | 31/12/9999 | | | After the 2nd promotional period has expired, the accountholder will be moved to the regular interest rate. |

| CP3 | | Promotional | 17/7/2017 | 31/12/9999 | 9 | Month | When an accountholder opens the PCA, they will receive an initial promotional offer lasting 9 months. Attached to this, will be the revised initial promotional offer interest rate information. |

Notes:

- PredecessorID is used to sequence the creditinterest states offered to the customer when they take out the PCA, it does not record change history.

- FirstMarketedDate and LastMarketedDate cover the period when the particular marketing state was advertised to the customer.

- CMA9 Banks only have to provide information for current (and known future, if they wish) marketing states. There is no open data requirement to provide an audit history of all marketing states that ever applied to the PCA. When the future marketing state becomes the current marketing state, the original marketing state information no longer needs to be published.

- When CP1 Marketing state is replaced by CP3 Marketing state, the PredecessorID in CP2 will also need to be updated to point to CP3, as shown.

- The Identification column is simply for internal bank use. The ID column is required so that we can sequence states, and also so that any applications that need to link an accountholder's PCA with the particular state that their account is in, can do this. e.g. For closed data, there is a requirement to compare an accountholders existing account details with those on the open market. If the accountholder has just opened the account, in the example above, they'd be in the 1st promotional state, if they have opened the account 10 months ago, they'd be in the 2nd promotional state. If they'd opened the account more than 21 months ago, they'd be in the regular state. By using a combination of the product id and the marketing state id, we can precisely link a particular accountholder's account with the current interest rate that is being applied to that account.

Core Product

This sections includes information that can change relatively often. Information to be provided includes:-

- Product URL allows a link to the financial institution's website where more detail about the product can be found

- URL to the product's terms & conditions

- Sales Access Channels cover all of the channels by which a customer can be sold a BCA

- Servicing Access Channels cover all of the channels by which a customer can receive service for their BCA. Note: This covers servicing of all aspects of the BCA. Some aspects may not be serviceable via certain channels

- MonthlyMaximumCharge (MMC) is a measure of the maximum amount that a consumer may be charged per month, when they exceed their agreed credit limit. There is currently strict definition of which charges fall in to this category, with grey areas such as "EmergencyBorrowing" potentially being in scope. The CMA9 have to calculate an MMC for each PCA product by August 2017, and provide the details as to how they calculated these.

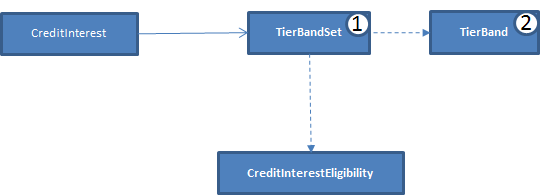

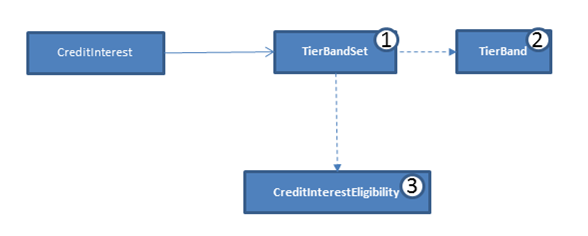

Credit Interest

In this section, information about the interest rates that are payable to the consumer are listed. Interest rates are typically standard variable rates, with rates potentially changing many times during the course of the products. In addition to the 'Regular' standard variable rates, some PCA products also provide for more attractive 'Promotion' interest rates which are fixed for a relatively short duration.

Another feature of interest rates is that certain PCA products will pay more attractive rates, as the amount deposited and maintained in the account increases.

This section has been designed to allow the implementer to provide whole or tiered interest rates.

Currently, most PCA price comparison websites focus on the promotional or regular interest rate (where there is no promotion) as their main mechanism for providing a comparison of PCA products.

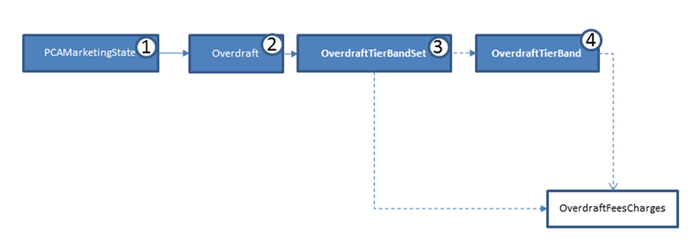

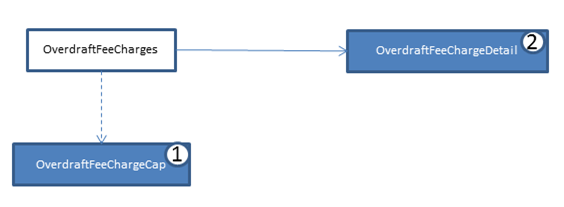

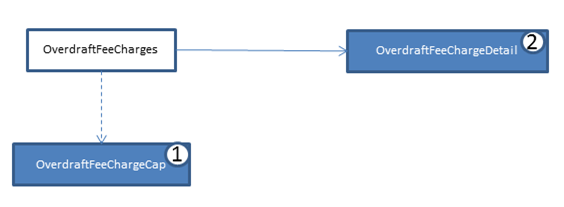

Overdraft/Borrowing

The Maximum Monthly Charge (MMC) focuses on fees & charges due to unauthorised borrowing. Price comparison websites are currently more focussed on details of arranged overdraft rates and accompanying fees & charges. There are also grey areas e.g. emergency borrowing which is a short term provision for situations where a customer has exceeded their arranged overdraft or authorised credit limit but only by a small amount and only for a short period.

As such, this section has been named 'Overdraft/Borrowing' so as to cover situations of authorised borrowing e.g. an Arranged Overdraft and unauthorised borrowing e.g. customer exceeding a credit limit by more than a buffer amount and with no arranged overdraft or emergency borrowing facility in place. An Authorised Indicator flag allows the implementer to indicate whether the borrowing is authorised or not.

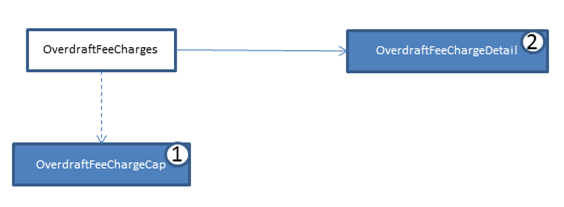

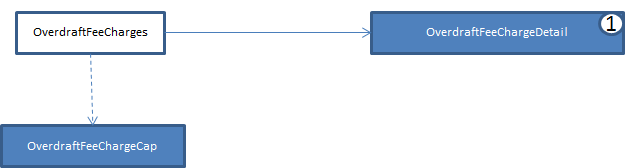

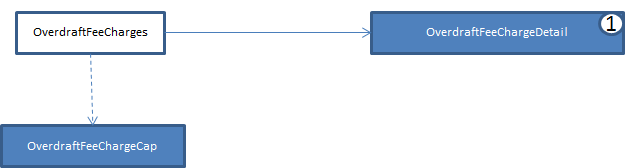

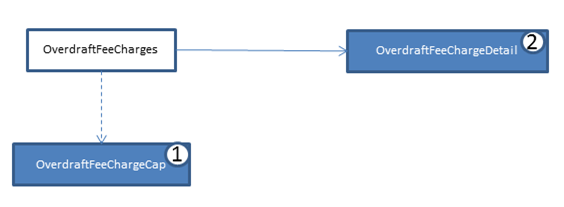

Details as to any capping (i.e. maximum amount that can be charged to a customer for a particular period) for any fee/charge can also be specified.

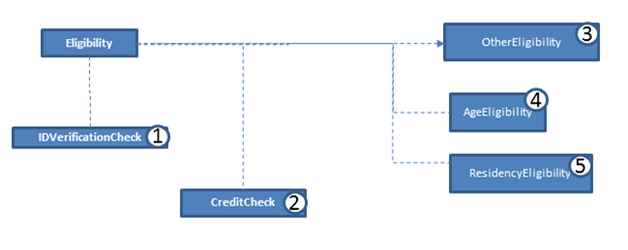

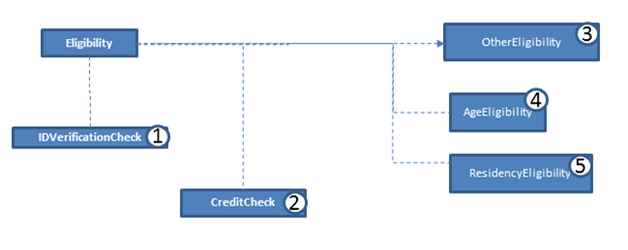

Eligibility

In this section, criteria such as residency and age restrictions that are necessary for opening an account are provided. Note eligibility criteria for features & benefits are treated in that section.

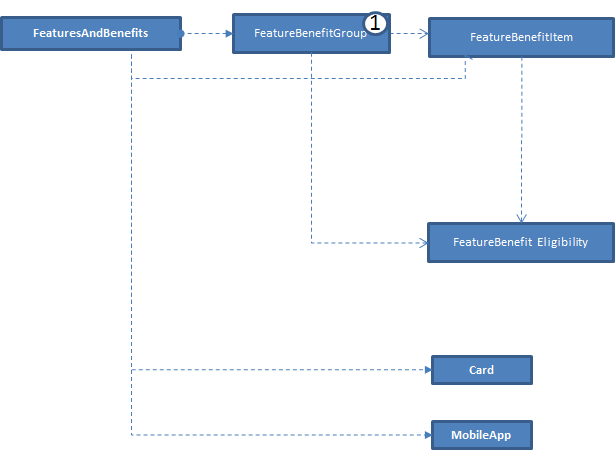

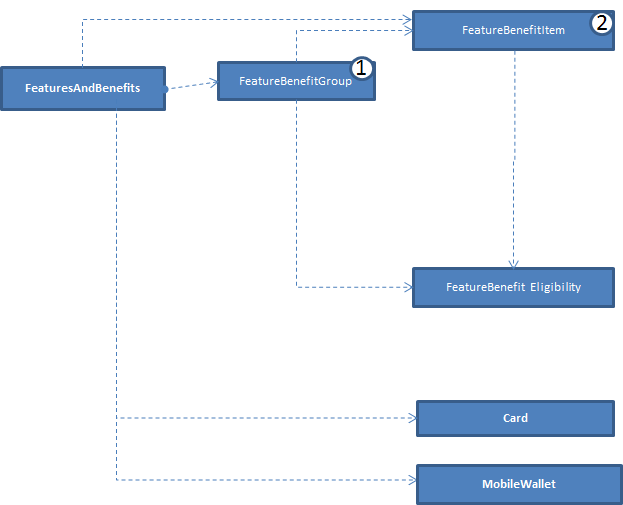

Features & Benefits

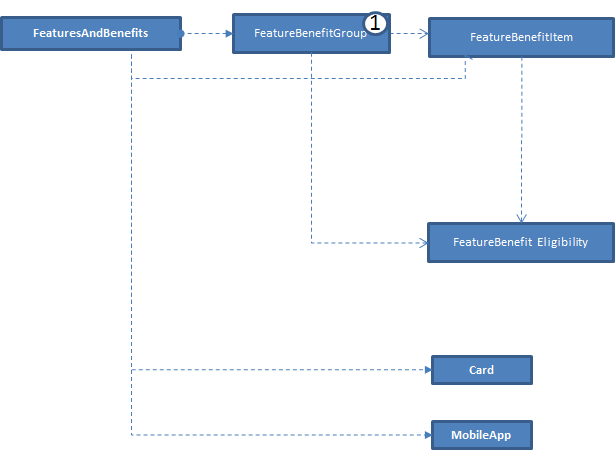

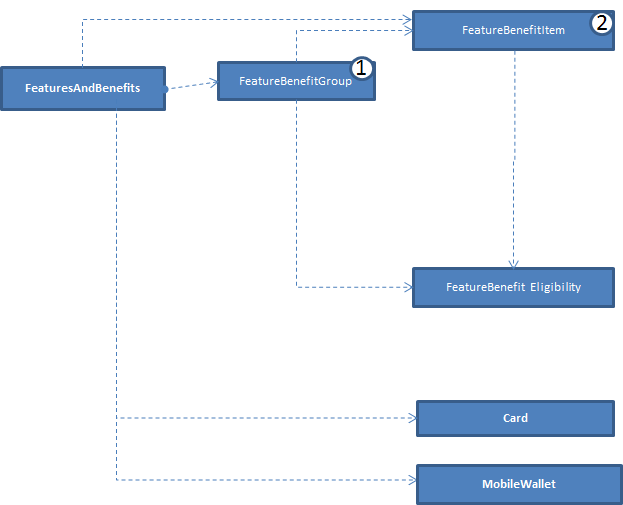

In this section, information about any inherent product features or value-added benefits (whether they're charged or not) can be captured. Benefits can also be grouped together e.g. if a package of benefits is supplied. For any benefits group, benefit details may be individually added or notes simply added to the benefits group.

For a benefits group or for individual benefits, any eligibility criteria required to obtain that benefit can be specified as notes.

Other Fees & Charges

Fees & Charges that a customer has to pay can be specified for Borrowing and in the Features & Benefits section. The long tail of additional fees & charges that are not associated to either of those 2 areas can be specified in this section.

Details as to any capping (i.e. maximum amount that can be charged to a customer for a particular period) for any fee/charge can also be specified in this section.

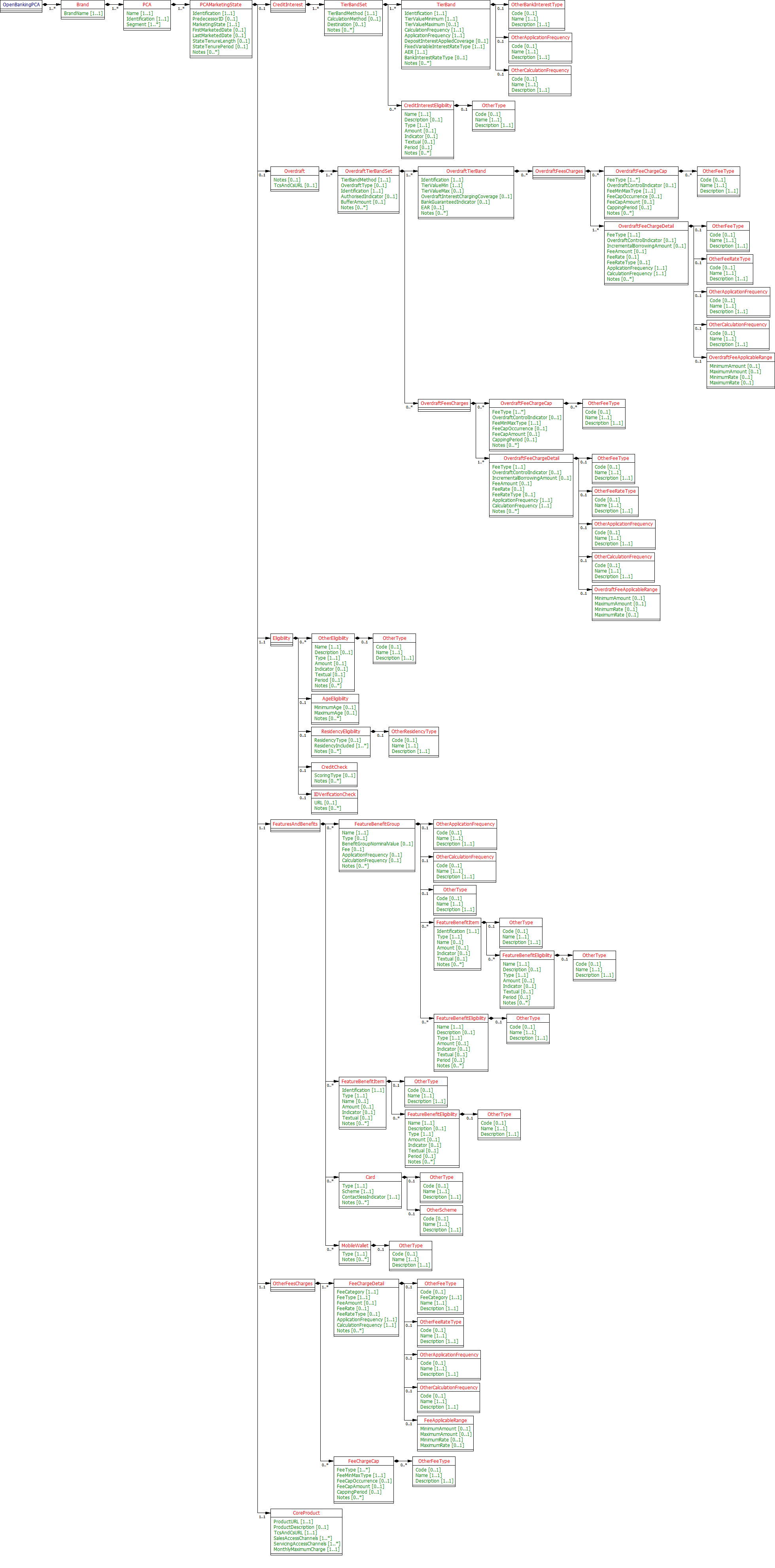

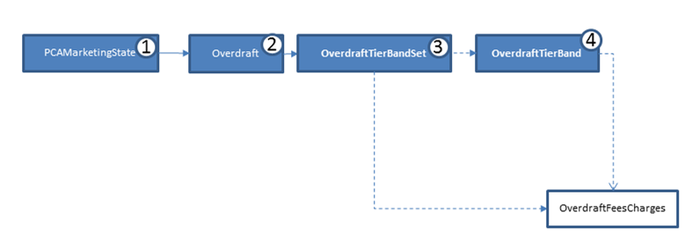

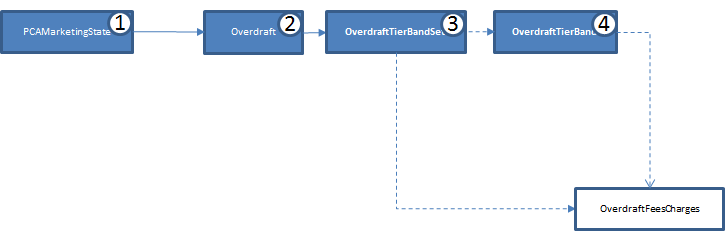

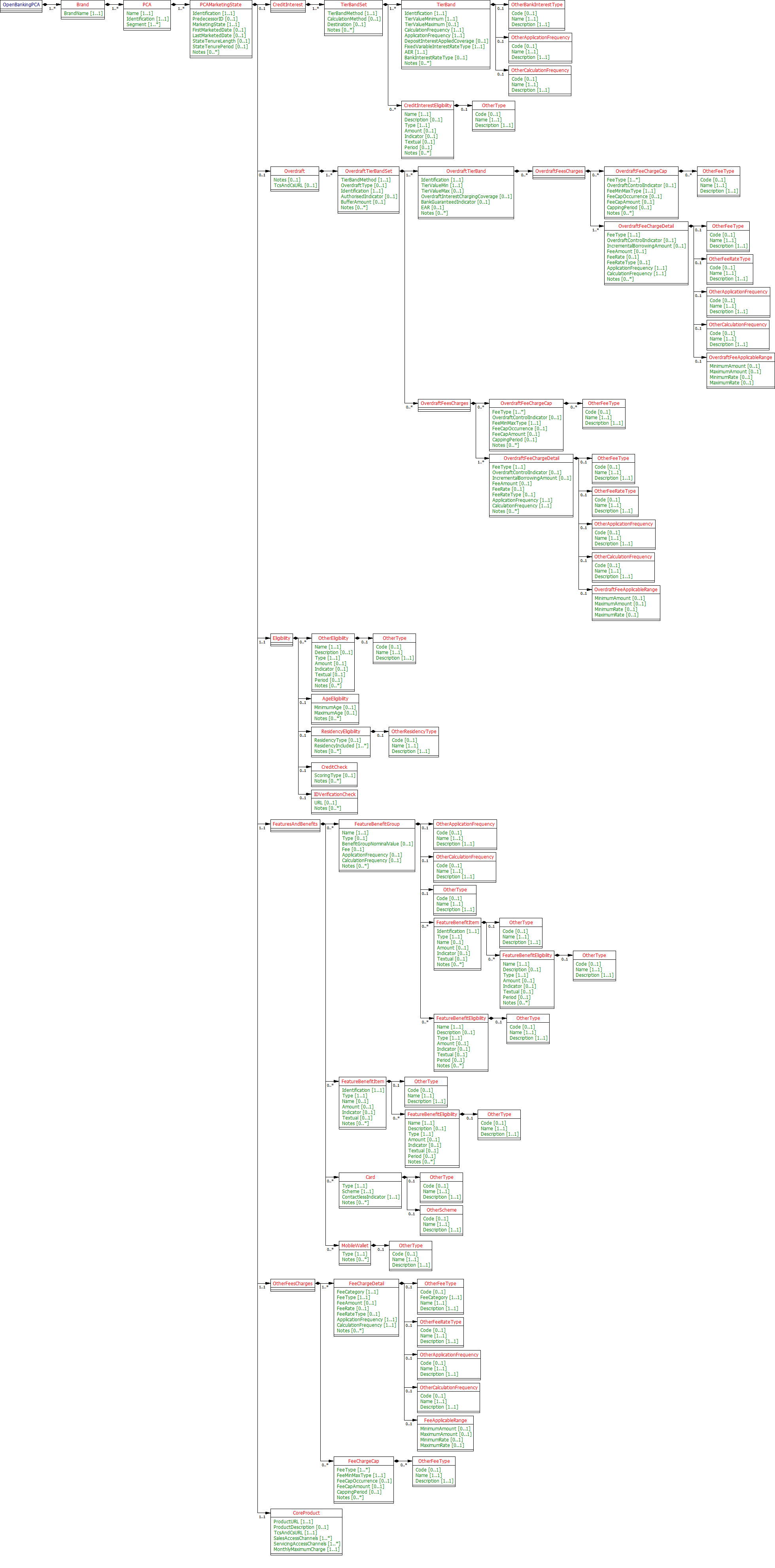

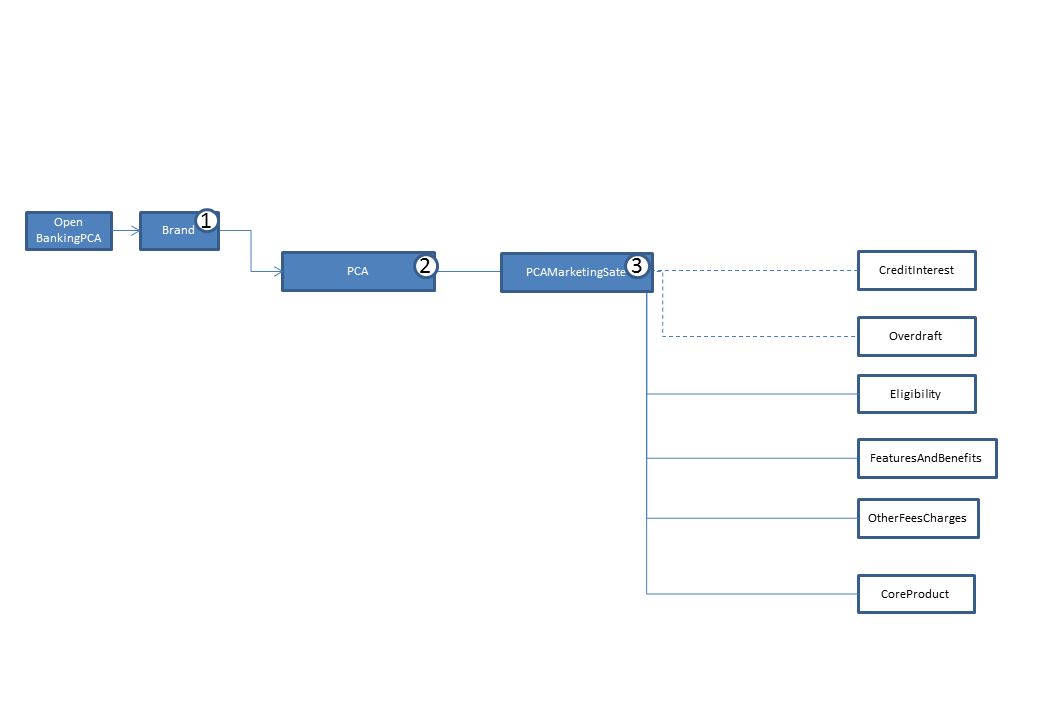

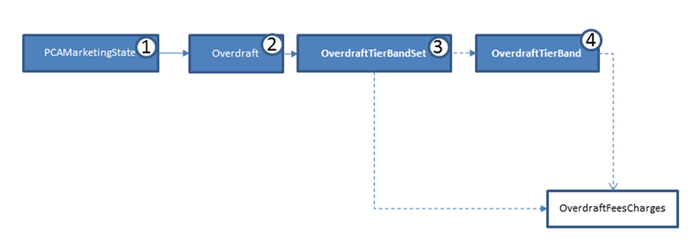

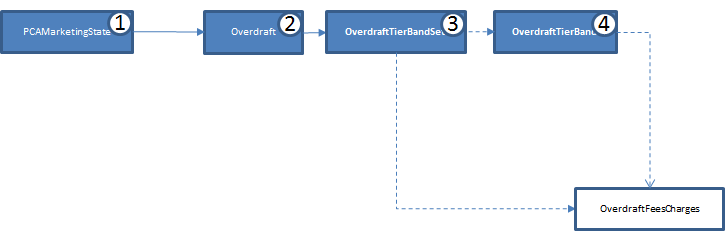

Specification

The following UML Class Diagram provides the hierarchical structure of the message in a graphical form, which is easier to digest.

- Data Dictionary - provides detailed descriptions for each field in the message specification along with the associated code lists, constraints and other technical details such as cardinality, any pattern constraints, min, max length etc.

- Swagger - the API specification written using the Swagger API specification format.

Compliance Report

Message Implementation Guide

Purpose

The message implementation guide (MIG) is designed to assist the implementer of the messaging specification by providing worked examples as to how the message fields should be completed in different scenarios.

The intention is that this will better ensure consistency. This guide should be read alongside the data dictionary which provides fuller information about the rules, constraints and guidelines that should be adhered to when populating the fields.

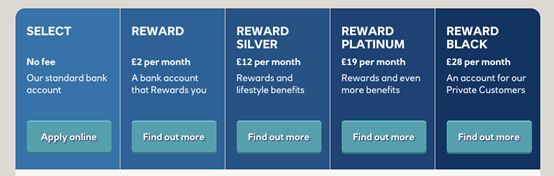

PCA is particularly challenging due to the different types of account that are covered:-

- Youth/Young Adult, Student, Graduate

- Basic, Standard, Premium – Note: Premium is a marketing term for a PCA that a bank feels is of higher value than the Standard offering. They are not legally distinguishable form a Standard PCA.

- Reward, Packaged.

Different accounts have been chosen, based on how fully they test each section of the design.

OtherFeesAndCharges isn’t covered by the use cases due to these currently being bank proprietary fees/charges and not standardised currently. Key standardised Fees and Charges covering overdraft and benefits are covered in the relevant examples stated above, however.

The format that we use in this document for field value assignment is:-

[] enclose a set of field values.

Where there are multiple records for a particular field, we depict this as [<record 1 value1>,< record 1 value2>…<recordn valuen>], whilst where we are showing that there is 1 field value in 1 record, and another field value in a 2nd record, I depict this as [<record1 value1>],[<record 2 value 1>],[<record 3 value 3>]

, seperates individual field values within a field value set.

“ surrounds a text or date field value.

Implementation Notes

Before implementing the message standard, it is very useful browsing price comparison websites (e.g. https://www.moneysupermarket.com/current-accounts/, https://www.comparethemarket.com/current-accounts/) to understand how implementation of our standard by the CMA9 banks would help to more easily facilitate provision of information used on those sites.

Currently, price comparison websites have to obtain their PCA product data either via bank proprietary APIs, via information collected by dedicated data capture agencies or via "screen scraping" (i.e. capturing product web page information and writing scripts to extract relevant data). This work is complex and prone to error, so having a standard API would make the data capture side much easier and allow more third party providers to provide applications that could target particular consumer markets.

PCA v2.0 Top Level Design

| Section Number | Field Name | Cardinality | Values |

|---|

| 1 | BrandName | 1..1 | "Nationwide" |

| 2 | Name | 1..1 | "FlexAccount" |

| 2 | Identification | 1..1 | "FLEXACCOUNT" |

| 2 | Segment | 1..* | "General" |

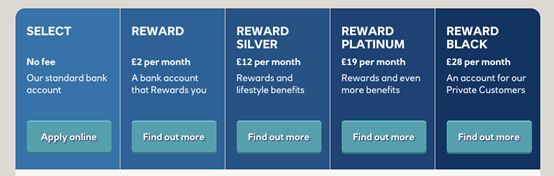

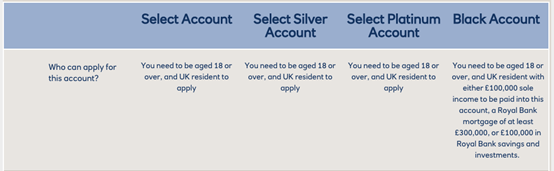

How do I handle accounts marketed differently dependent on residency?

Example: Royal Bank of Scotland current accounts

Scotland:-

England & Wales:-

In the examples, RBS market what may well be almost the same product using distinctly different names in Scotland than in England & Wales.

We recommend that the banks implement separate products and choose the appropriate ResidencyEligibility fields in the Eligibility section. Our reasoning is that the product brand name will be important to the end customer, and certain aspects of the product may vary with time.

How I can publish “Switching” or “Account Opening” incentives?

Example: Nationwide Flexaccount

- 3 months interest-free overdraft

- No overdraft interest for the first 3 months on arranged overdrafts.

- To be eligible for the 3 month interest-free overdraft on our FlexAccount, all we ask is that you use our Current Account Switch Team

Switching or Account Opening incentives are treated as a “Promotional” state. The other sections are filled in appropriately.

In the Switching example above, the Overdraft section would be filled out and the EAR set to 0% for the “Promotional” state, and the standard EAR for the “Regular Rate”.

Within the FeatureBenefit section, the FeatureBenefitGroup/Type will be set to “AccountOpeningOrSwitchingIncentive” and the FeatureBenefitEligibility/Type will be set to “Switchers Only”.

| Section Number | Field Name | Cardinality | Value(s) |

|---|

| 1 | BrandName | 1..1 | "Nationwide" |

| 2 | Name | 1..1 | "FlexAccount" |

| 2 | Identification | 1..1 | "FLEXACCOUNT" |

| 2 | Segment | 1..* | "General" |

| 3 | Identification | 1..1 | [“S1”][“R1”] |

| 3 | PredecessorID | 0..1 | [][“S1”] |

| 3 | MarketingState (Enumeration: OB_MarketingState1Code) | 1..1 | [“Promotional”][“Regular”] |

| 3 | FirstMarketedDate | 0..1 | [“1/1/1900”],[“1/1/1900”] |

| 3 | LastMarketedDate | 0..1 | [“31/12/9999”],[“31/12/9999”] |

| 3 | StateTenureLength | 0..1 | [3][] |

| 3 | StateTenurePeriod (Enumeration: OB_Period1Code) | 0..1 | [“Month”][] |

| 3 | Notes | 0..* | [“To be eligible for the 3 month interest-free overdraft on our FlexAccount, all we ask is that you use our Current Account Switch Team”][] |

How I can supply fixed and variable core product details?

How do I represent an introductory offer?

(1) PCAMarketingState

Example:

Nationwide FlexDirect has an introductory 12 month offer of 5% interest & no overdraft fees reverting to the standard variable rate of 1% on balances of up to £2500.

Notes:

- It’s preferable to provide default values for dates in order to make it easier to query which marketing states are operative on a particular date.

- Marketing state is only intended to cover the current and near term future changes in promotional and regular offers, which need to be presented to the customer when marketed. It is not intended to provide a change history going back in time.

| Section Number | Field Name | Cardinality | Value(s) |

|---|

| 1 | Identification | 1..1 | [ “P1”][“R1”] |

| 1 | MarketingState (Enumeration: OB_MarketingState1Code) | 1..1 | [“Promotional”][”Regular”] |

| 1 | PredecessorID | 0..1 | [],[“P1”] |

| 1 | FirstMarketedDate | 0..1 | [“1/1/1990”][“1/1/1990”] |

| 1 | LastMarketedDate | 0..1 | [“31/12/9999”][“31/12/9999”] |

| 1 | StateTenureLength | 0..1 | [“12”][] |

| 1 | StateTenurePeriod (Enumeration: OB_Period1Code) | 0..1 | [“Month”][] |

| 1 | Notes | 0..* | [“5% on balances up to £2500 (eligibility criteria apply) during promotional period, and then reverts to standard variable rate.”][“Standard variable rate on balances up to £2500”] |

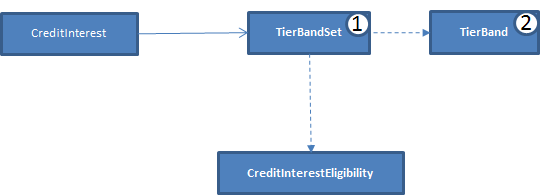

How can I show tiered credit interest rates?

Example:

Bank of Scotland Classic Vantage account (Prior to 11th June 2017)

- 3.00% AER (2.96% Gross) variable on balances £3,000-£5,000

- 2.00% AER (1.98% Gross) variable on balances £1,000-£2,999.99

- 1.50% AER (1.49% Gross) variable on balances £1 - £999.99

| Section Number | Field Name | Cardinality | Value(s) |

|---|

| 1 | CalculationMethod (Enumeration: OB_InterestCalculationMethod1Code) | 0..1 | “Compound” |

| 1 | Destination(Enumeration: OB_InterestDestination1Code) |

|

|

| 1 | TierBandMethod (Enumeration: OB_TierBandType1Code) | 1..1 | “Tiered” |

| 1 | Notes | 0..* | “From the 11th June 2017, we will be changing how we pay credit interest on our Bank of Scotland current accounts with Vantage. We are replacing the current tiered rates with a single interest rate of 2% AER (1.98% gross) (variable) on credit balances between £1 and £5,000. Depending on the balance of your account this may be an increase or decrease to the rate you currently receive.” |

| 2 | Identification | 1..1 | [1],[2] |

| 2 | TierValueMinimum | 1..1 | [1.00],[1000.00],[3000] |

| 2 | TierValueMaximum | 0..1 | [999.99],[2999.99],[5000] |

| 2 | CalculationFrequency (Enumeration: OB_Frequency1Code) | 1..1 | [Monthly],[Monthly], [Monthly] |

| 2 | OtherCalculationFrequency |

|

|

| 2 | ApplicationFrequency(Enumeration: OB_Frequency1Code) | 1..1 | [Monthly],[Monthly],[Monthly] |

| 2 | OtherApplicationFrequency |

|

|

| 2 | DepositInterestAppliedCoverage [Enumeration: OB_TierBandType1Code | 0..1 | [“Tiered”][“Tiered”][“Tiered”} |

| 2 | FixedVariableInterestRateType(Enumeration: OB_InterestFixedVariableType1Code) | 1..1 | [“Variable”],[“Variable”],[“Variable”] |

| 2 | AER | 1..1 | [1.5],[2.00],[3.00] |

| 2 | BankInterestRateType (Enumeration: OB_InterestType1Code) |

|

|

| 2 | BankInterestRate | | |

| 2 | OtherBankInterestType | | |

| 2 | Notes |

|

|

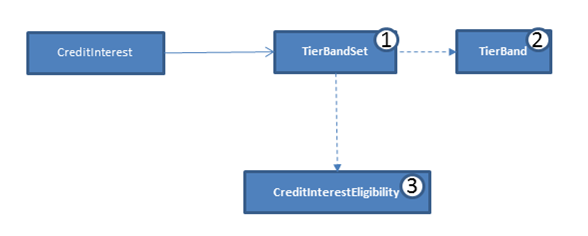

How can I show whole credit interest rates and relevant eligibility?

Example:

Bank of Scotland Classic Vantage account (After 11th June2017)

2% AER (1.98% Gross) variable on balances £1 - £5000

Section Number | Field | Cardinality

| Value(s) |

|---|

| 1 | CalculationMethod (Enumeration: OB_InterestCalculationMethod1Code) | 0..1 | “Compound” |

| 1 | Destination(Enumeration: OB_InterestDestination1Code) |

|

|

| 1 | TierBandMethod (Enumeration: OB_TierBandType1Code) | 1..1 | “Whole” |

| 1 | Notes | 0..* | “No interest on balances over £5,000” |

| 2 | Identification | 1..1 | 1 |

| 2 | TierValueMinimum | 1..1 | 1.00 |

| 2 | TierValueMaximum | 0..1 | 5000.00 |

| 2 | CalculationFrequency (Enumeration: OB_Frequency1Code) | 1..1 | “Monthly” |

| 2 | OtherCalculationFrequency |

|

|

| 2 | ApplicationFrequency(Enumeration: OB_Frequency1Code) | 1..1 | "Monthly" |

| 2 | OtherApplicationFrequency |

|

|

| 2 | DepositInterestAppliedCoverage [Enumeration: OB_TierBandType1Code | 0..1 | “Whole” |

| 2 | FixedVariableInterestRateType(Enumeration: OB_InterestFixedVariableType1Code) | 1..1 | “Variable” |

| 2 | AER | 1..1 | 2.00 |

| 2 | BankInterestRateType (Enumeration: OB_InterestType1Code) | 0..1 | "Gross" |

| 2 | OtherBankInterestType |

|

|

| 2 | BankInterestRate | 0..1 | 1.98 |

| 2 | Notes |

|

|

| 3 | Name | 1..1 | "Credit Interest Eligibility Criteria" |

| 3 | Description |

|

|

| 3 | Type (Enumeration: OB_PCAEligibilityType1Code | 1..1 | [“MinimumDeposit”][“MininumOperatingBalance”][“DirectDebits”] |

| 3 | OtherType (OtherCodeType) |

|

|

| 3 | Amount | 0..1 | [1000][0][2] |

| 3 | Indicator |

|

|

| 3 | Textual |

|

|

| 3 | Period(Enumeration: OB_Frequency1Code) | 0..1 | [“Monthly”][“Monthly”][“Monthly”] |

| 3 | Notes | 0..1 | [“Pay at least £1,000 into your account each calendar month”],[“Stay in credit (above £0) during the monthly billing period”][“Pay in at least two different Direct Debits from your account each calendar month“] |

How can I represent graduate overdraft limits?

Example: Barclays Higher Education Account

If you’ve graduated within the last 3 years, you can apply for an overdraft of up to £3,000 (subject to status). This is a breakdown of the fee-free amounts available based on how long ago you graduated. The maximum overdraft you can apply for with this account is £3,000.

- 1st year after graduation: Up to £3,000

- 2nd year after graduation: Up to £2,000

- 3rd year after graduation: Up to £1,000

Section Number | Field | Cardinality

| Value(s) |

|---|

| 1 | Identification | 1..1 | [“R1”][“R2”][“R3”] |

| 1 | MarketingState (Enumeration: OB_MarketingState1Code) | 1..1 | [“Regular”][”Regular”],[“Regular”] |

| 1 | PredecessorID | 0..1 | [][“R1”][“R2”] |

| 1 | FirstMarketedDate | 0..1 | [“1/1/1990”][“1/1/1990”] |

| 1 | LastMarketedDate | 0..1 | [“31/12/9999”][“31/12/9999”] |

| 1 | StateTenureLength | 0..1 | [1][1][1] |

| 1 | StateTenurePeriod (Enumeration: OB_Period1Code) | 0..1 | [“Year”][“Year”][“Year”] |

| 1 | Notes |

|

|

| 2 | Notes |

|

|

| 2 | T&CsURL |

|

|

| 3 | TierBandMethod (Enumeration:OB_TierBandType1Code) | 1..1 | “Whole” |

| 3 | OverdraftType (Enumeration: OB_OverdraftType1Code) |

|

|

| 3 | Identification | 1..1 | "G1" |

| 3 | AuthorisedIndicator | 0..1 | [True] |

| 3 | BufferAmount |

|

|

| 3 | Notes | 0..1 | [“If you’ve graduated within the last 3 years, you can apply for an overdraft of up to £3,000 (subject to status). This is a breakdown of the fee-free amounts available based on how long ago you graduated. The maximum overdraft you can apply for with this account is £3,000.“] |

| 4 | Identification | 1..1 | [“G1”],[“G2”],[“G3”] |

| 4 | TierValueMin | 1..1 | [0][0][0] |

| 4 | TierValueMax | 0..1 | [3000][2000][1000] |

| 4 | OverdraftInterestChargingCoverage (Enumeration: OB_TierBandType1Code) |

|

|

| 4 | BankGuaranteedIndicator | 0..1 | [True][True][True] |

| 4 | EAR | 0..1 | [0],[0],[0] |

| 4 | Notes | 0..1 | [“Up to £3000”][“Up to £2000”][“Up to £1000”] |

How can I represent overdrafts charged as tiered amount rates?

Example: Barclays Bank Account

- Up to £15 buffer: Buffer

- Up to £1000: 75p per day

- Up to £2000: £1.50 per day

- Over £2000: £3.00 per day

Guidance Notes:

- The buffer should be provided in the OverdraftTierBandSet/BufferAmount field and also included as an initial tier in the OverdraftTierBand section

- The appropriate daily fees can be supplied in the OverdraftFeesCharges section: The daily fee will be stated in OverdraftFeeChargeDetail/FeeAmount field, and OverdraftFeeChargeDetail/CalculationFrequency should be set to “Daily”.

Section Number | Field | Cardinality | Value(s) |

|---|

| 1 | Identification | 1..1 | “R1” |

| 1 | MarketingState (Enumeration: OB_MarketingState1Code) | 1..1 | “Regular” |

| 1 | PredecessorID |

|

|

| 1 | FirstMarketedDate | 0..1 | “1/1/1990” |

| 1 | LastMarketedDate | 0..1 | “31/12/9999” |

| 1 | StateTenureLength |

|

|

| 1 | StateTenurePeriod (Enumeration: OB_Period1Code) |

|

|

| 1 | Notes |

|

|

| 2 | Notes |

|

|

| 2 | T&CsURL |

|

|

| 3 | TierBandMethod (Enumeration:OB_TierBandType1Code) | 1..1 | “Tiered” |

| 3 | OverdraftType (Enumeration: OB_OverdraftType1Code) |

|

|

| 3 | Identification | 1..1 | T1 |

| 3 | AuthorisedIndicator | 0..1 | [True] |

| 3 | BufferAmount | 0..1 | 15.00 |

| 3 | Notes |

|

|

| 4 | Identification | 1..1 | [“B1”][“T1”][“T2”][“T3”] |

| 4 | TierValueMin | 1..1 | [0][15.01][1000.01][2000.01] |

| 4 | TierValueMax | 0..1 | [15.00][1000][2000][25000] |

| 4 | OverdraftInterestChargingCoverage (Enumeration: OB_TierBandType1Code) |

|

|

| 4 | BankGuaranteedIndicator |

|

|

| 4 | EAR |

|

|

| 4 | Notes | 0..1 | “Up to £15: Buffer Amount” |

How can I represent overdrafts charged as whole amount rates?

Example: Nationwide FlexAccount

Fees for arranged overdrafts, 18.9% EAR variable.

Representative example: If you use an arranged overdraft of £1,200 the interest rate we will charge you is 18.9% EAR (variable).

Section Number | Field | Cardinality | Value(s) |

|---|

| 1 | Identification | 1..1 | “R1” |

| 1 | MarketingState (Enumeration: OB_MarketingState1Code) | 1..1 | “Regular” |

| 1 | PredecessorID |

|

|

| 1 | FirstMarketedDate | 0..1 | “1/1/1990” |

| 1 | LastMarketedDate | 0..1 | “31/12/9999” |

| 1 | StateTenureLength |

|

|

| 1 | StateTenurePeriod (Enumeration: OB_Period1Code) |

|

|

| 1 | Notes |

|

|

| 2 | Notes |

|

|

| 2 | T&CsURL |

|

|

| 3 | TierBandMethod (Enumeration:OB_TierBandType1Code) | 1..1 | “Whole” |

| 3 | OverdraftType (Enumeration: OB_OverdraftType1Code) |

|

|

| 3 | Identification | 1..1 | "W1" |

| 3 | AuthorisedIndicator | 0..1 | [True] |

| 3 | BufferAmount |

|

|

| 3 | Notes | 0..* | “Representative example: If you use an arranged overdraft of £1,200 the interest rate we will charge you is 18.9% EAR (variable”) |

| 4 | Identification | 1..1 | “W1” |

| 4 | TierValueMin | 1..1 | 0 |

| 4 | TierValueMax | 0..1 | 25000 |

| 4 | OverdraftInterestChargingCoverage (Enumeration: OB_TierBandType1Code) |

|

|

| 4 | BankGuaranteedIndicator |

|

|

| 4 | EAR | 0..1 | 18.90 |

| 4 | Notes | 0..* | “Up to £25000" |

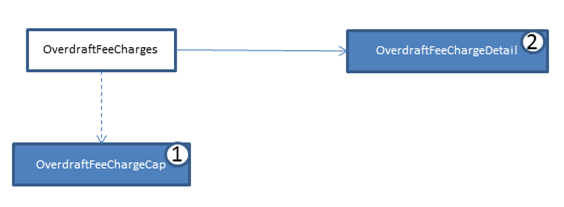

How can I represent overdrafts with periodic & per item fees with caps?

Example: Nationwide FlexDirect

Daily arranged overdraft fee: 50p per day (with £10 buffer amount)

Daily unarranged overdraft fee: £5 per day (capped at £60 per calendar month)

Fee for a paid or unpaid transaction when you have insufficient funds: £5 per transaction (capped at £35 per month)

Section Number | Field | Cardinality | Value(s) |

|---|

| 1 | FeeType Enumeration:OB_OverdraftFeeType1Code | 1..* | [“UnarrangedBorrowing”],[“BorrowingItem”] |

| 1 | OtherFeeType (OtherCodeType) |

|

|

| 1 | OverdraftControlIndicator |

|

|

| 1 | FeeMinMaxType (Enumeration: OB_MinMaxType1Code) | 1..1 | [“Max”],[“Max”] |

| 1 | FeeCapOccurrence |

|

|

| 1 | FeeCapAmount | 0..1 | [60.00],[35.00] |

| 1 | CappingPeriod (Enumeration:OB_Period1Code) | 0..1 | [“Monthly”],[“Monthly”] |

| 1 | Notes |

|

|

| 2 | FeeType(Enumeration:OB_OverdraftFeeType1Code) | 1..1 | [“ArrangedOverdraft”],[“UnarrangedBorrowing”],[“BorrowingItem”] |

| 2 | OtherFeeType (OtherCodeType) |

|

|

| 2 | OverdraftControlIndicator |

|

|

| 2 | IncrementalBorrowingAmount |

|

|

| 2 | FeeAmount | 0..1 | [0.50],[5.00],[5.00] |

| 2 | FeeRate |

|

|

| 2 | FeeRateType (Enumeration: OB_InterestRateType1Code) |

|

|

| 2 | OtherFeeRateType (OtherCodeType) |

|

|

| 2 | ApplicationFrequency (Enumeration: OB_FeeFrequency1Code) | 1..1 | [“Monthly”],[”Monthly”],[Monthly”] |

| 2 | OtherApplicationFrequency (OtherCodeType) |

|

|

| 2 | CalculationFrequency (Enumeration: OB_FeeFrequency1Code) | 1..1 | [“Daily”],[“Daily”],[“PerItem”] |

| 2 | OtherCalculationFrequency (OtherCodeType) |

|

|

| 2 | Notes |

|

|

How can I represent overdrafts with rate-like fees?

Example: LBG Classic Account (post November 2017)

Arranged Overdraft Fee: 1p charged per day per £7 overdrawn

Section Number | Field | Cardinality | Value(s) |

|---|

| 1 | FeeType(Enumeration:OB_OverdraftFeeType1Code) | 1..1 | [“ArrangedOverdraft”],[“UnarrangedBorrowing”],[“BorrowingItem”] |

| 1 | OtherFeeType (OtherCodeType) |

|

|

| 1 | OverdraftControlIndicator |

|

|

| 1 | IncrementalBorrowingAmount | 0..1 | 7.00 |

| 1 | FeeAmount | 0..1 | 0.01 |

| 1 | FeeRate |

|

|

| 1 | FeeRateType (Enumeration: OB_InterestRateType1Code) |

|

|

| 1 | OtherFeeRateType (OtherCodeType) |

|

|

| 1 | ApplicationFrequency (Enumeration: OB_FeeFrequency1Code) | 1..1 | “Monthly” |

| 1 | OtherApplicationFrequency (OtherCodeType) |

|

|

| 1 | CalculationFrequency (Enumeration: OB_FeeFrequency1Code) | 1..1 | “Daily” |

| 1 | OtherCalculationFrequency (OtherCodeType) |

|

|

| 1 | Notes |

|

|

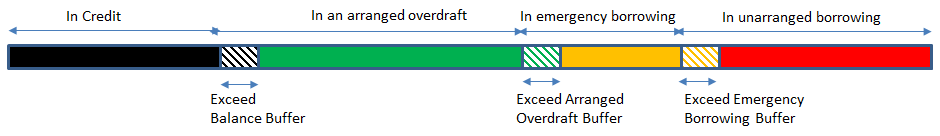

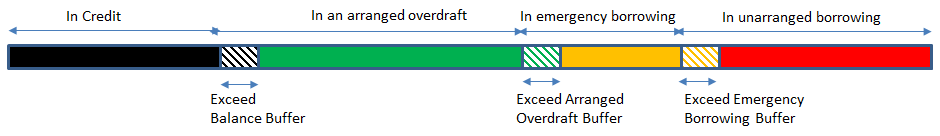

How can I represent an overdraft “buffer amount”?

The diagram above represents the different “credit states” that a PCA can be in, for a sophisticated PCA product – Barclay’s current account. The shaded portions show the “buffer amounts”, which allows an accountholder to exceed a particular credit limit by typically a small amount but be treated as though they’re still in the previous state.

As shown, when an accountholder execeeds their positive balance, they would typically move in to either an arranged overdraft situation or unarranged borrowing. In either case, there may be an “Exceed Balance Buffer” that means that the account will be treated as though they are still in positive balance.

Similarly, if the accountholder exceeds their arranged overdraft limit, this would normally put them in to either an emergency borrowing or unarranged borrowing credit state. However, if the PCA has an exceed arranged overdraft buffer, they will be treated as though they have not exceeded their arranged overdraft limit.

From our analysis, the size of the “Exceed Balance Buffer”, “Exceed Arranged Overdraft Buffer” and “Exceed Emergency Borrowing Buffer” does not vary, for products where these are available.

The size of the buffer amount can be represented in the OverdraftTierBandSet/BufferAmount field.

Additionally the “Exceed Balance Buffer” amount should also be added as an initial tier in the OverdraftTierBand section.

Worked Example

Example: M&S Current Account

Credit Overdraft Limits

- Buffer Amount - £50 – fee free (M&S definition for buffer amount provided at https://bank.marksandspencer.com/pdf/CAOverdraftUpdate.pdf equates to providng an “Exceed Balance Buffer” and an “Exceed Arranged Overdraft Buffer”)

- 0 to £100 (including buffer – effectively 50 to 100) – No overdraft interest

- Above £100 - 15.9% variable.

Section Number | Field | Cardinality

| Value(s) |

|---|

| 1 | Identification | 1..1 | “R1” |

| 1 | MarketingState (Enumeration: OB_MarketingState1Code) | 1..1 | “Regular” |

| 1 | PredecessorID: |

|

|

| 1 | FirstMarketedDate | 0..1 | “1/1/1990” |

| 1 | LastMarketedDate | 0..1 | “31/12/9999” |

| 1 | StateTenureLength |

|

|

| 1 | StateTenurePeriod (Enumeration: OB_Period1Code) |

|

|

| 1 | Notes |

|

|

| 2 | Notes |

|

|

| 2 | T&CsURL |

|

|

| 3 | TierBandMethod (Enumeration:OB_TierBandType1Code) | 1..1 | “Tiered” |

| 3 | OverdraftType (Enumeration: OB_OverdraftType1Code) |

|

|

| 3 | Identification M | 1..1 | “OVD1” |

| 3 | AuthorisedIndicator | 0..1 | [True] |

| 3 | BufferAmount | 0..1 | 15.00 |

| 3 | Notes |

|

|

| 4 | Identification M | 1..1 | [“B1”][“T1”][“T2”] |

| 4 | TierValueMin M | 1..1 | [0][50.01][100.01] |

| 4 | TierValueMax | 0..1 | [50][100][] |

| 4 | OverdraftInterestChargingCoverage (Enumeration: OB_TierBandType1Code) |

|

|

| 4 | BankGuaranteedIndicator |

|

|

| 4 | EAR | 0..1 | [][0][18.90] |

| 4 | Notes |

|

|

How do I deal with “overdraft control” accounts?

Examples: Lloyds Classic Account with overdraft control – showing differences in Returned item fee & fee cap only, with and without control.

| Club Lloyds - Without Control |

|---|

Returned item fees | £10 per item (if payment over £10) |

|---|

Returned item fee cap | 3 per day - If item less than £10, then £0. |

|---|

Section Number | Field | Cardinality | Value(s) |

|---|

| 1 | FeeType (Enumeration:OB_OverdraftFeeType1Code) | 1..* | [BorrowingItem][BorrowingItem] |

| 1 | OtherFeeType (OtherCodeType) |

|

|

| 1 | OverdraftControlIndicator | 0..1 | [True][] |

| 1 | FeeMinMaxType (Enumeration: OB_MinMaxType1Code) | 1..1 | [“Max”][“Max”] |

| 1 | FeeCapOccurrence |

|

|

| 1 | FeeCapAmount | 0..1 | [0.00][0.00] |

| 1 | CappingPeriod (Enumeration:OB_Period1Code) | 0..1 | [“Daily”][“Daily”] |

| 1 | Notes |

|

|

| 2 | FeeType(Enumeration:OB_OverdraftFeeType1Code) | 1..1 | [BorrowingItem][BorrowingItem] |

| 2 | OtherFeeType (OtherCodeType) |

|

|

| 2 | OverdraftControlIndicator | 0..1 | [True][] |

| 2 | SwitchIndicator |

|

|

| 2 | IncrementalBorrowingAmount |

|

|

| 2 | FeeAmount | 0..1 | [0.00][10.00] |

| 2 | FeeRate |

|

|

| 2 | FeeRateType (Enumeration: OB_InterestRateType1Code) |

|

|

| 2 | OtherFeeRateType (OtherCodeType) |

|

|

| 2 | ApplicationFrequency (Enumeration: OB_FeeFrequency1Code) | 1..1 | [“PerItem”][“Monthly”] |

| 2 | OtherApplicationFrequency (OtherCodeType) |

|

|

| 2 | CalculationFrequency (Enumeration: OB_FeeFrequency1Code) | 1..1 | [“PerItem”][“Monthly”] |

| 2 | OtherCalculationFrequency (OtherCodeType) |

|

|

| 2 | Notes |

|

|

With Control

| Club Lloyds - With control |

|---|

Control fee | £10 per month |

|---|

Section Number | Field | Cardinality | Value(s) |

|---|

| 1 | Name | 1..1 | “Overdraft Control” |

| 1 | Type (Enumeration: OB_FeatureBenefitType1Code) | 0..1 | “OverdraftControl” |

| 1 | OtherType (OtherCodeType) |

|

|

| 1 | BenefitGroupNominalValue |

|

|

| 1 | Fee | 0..1 | 10.00 |

| 1 | ApplicationFrequency (Enumeration: OB_Frequency1Code) | 0..1 | “Monthly” |

| 1 | OtherApplicationFrequency (OtherCodeType) |

|

|

| 1 | CalculationFrequency (Enumeration: OB_Frequency1Code) | 0..1 | “Monthly” |

| 1 | OtherCalculationFrequency (Enumeration: OB_Frequency1Code) |

|

|

| 1 | Notes |

|

|

How can I represent unauthorised borrowing fees?

Example: Lloyds Classic Account

“If we don't agree to give you an Unplanned Overdraft, you won't be able to make the payment and you may be charged a fee. We will write to you to tell you we have declined your request. We will charge a £10 fee per item declined over £10 in value, up to a maximum of three Returned Item fees per day.”

Section Number | Field | Cardinality | Value(s) |

|---|

| 1 | FeeType (Enumeration:OB_OverdraftFeeType1Code ) | 1..* | "BorrowingItem" |

| 1 | OtherFeeType (OtherCodeType) |

|

|

| 1 | OverdraftControlIndicator |

|

|

| 1 | MinMaxType (Enumeration: OB_MinMaxType1Code) | 1..1 | "Max" |

| 1 | FeeCapOccurrence | 0..1 | 3 |

| 1 | FeeCapAmount |

|

|

| 1 | CappingPeriod (Enumeration:OB_Period1Code) | 0..1 | "Daily" |

| 1 | Notes |

|

|

| 2 | FeeType(Enumeration:OB_OverdraftFeeType1Code) | 1..1 | "BorrowingItem" |

| 2 | OtherFeeType (OtherCodeType) |

|

|

| 2 | OverdraftControlIndicator |

|

|

| 2 | IncrementalBorrowingAmount |

|

|

| 2 | FeeAmount | 0..1 | 10.00 |

| 2 | FeeRate |

|

|

| 2 | FeeRateType (Enumeration: OB_InterestRateType1Code) |

|

|

| 2 | OtherFeeRateType (OtherCodeType) |

|

|

| 2 | ApplicationFrequency (Enumeration: OB_FeeFrequency1Code) | 1..1 | "Monthly" |

| 2 | OtherApplicationFrequency (OtherCodeType) |

|

|

| 2 | CalculationFrequency (Enumeration: OB_FeeFrequency1Code) | 1..1 | "PerItem" |

| 2 | OtherCalculationFrequency (OtherCodeType) |

|

|

| 2 | Notes |

|

|

What if I wish to restrict who can apply for the account?

Example: HSBC Bank Account

Eligibility requirements

•You need to be 18 years or older

•Your residential address must be within the EU

•You must be able to provide us with certified proof of your identity and address (translated into English if appropriate)

•You must pay at least £500 a month into the account (does not apply if you are under 24 or over 65 years old)

•If you are resident in the UK, you are happy for us to undertake a credit register search

Section Number | Field | Cardinality | Value(s) |

|---|

| 1 | URL | 0..1 | “https://www.hsbc.co.uk/1/PA_esf-ca-app-content/content/pws/content/personal/pdfs/basic-bank-account-identification.pdf” |

| 1 | Notes | 0..* | “You must be able to provide us with certiifed proof of your identity and address (translated into English if appropriate)” |

| 2 | ScoringType (Enumeration: OB_PCACreditScoring1Code)

|

|

|

| 2 | Notes | 0..* | “If you are resident in the UK, you are happy for a credit register search” |

| 3 | Name | 1..1 | “Monthly Deposit” |

| 3 | Description |

|

|

| 3 | Type (Enumeration: OB_PCAEligibilityType1Code) | 1..1 | “MinimumDeposit” |

| 3 | OtherType (OtherCodeType) |

|

|

| 3 | Amount | 0..1 | 500 |

| 3 | Indicator |

|

|

| 3 | Textual |

|

|

| 3 | Period (Enumeration: OB_Frequency1Code) | 0..1 | “Monthly” |

| 3 | Notes | 0..* |

|

| 4 | MinimumAge | 0..1 | 18 |

| 4 | MaximumAge |

|

|

| 4 | Notes |

|

|

| 5 | ResidencyType (OB_ResidencyType1Code)

|

|

|

| 5 | OtherResidencyType (OtherCodeType) |

|

|

| 5 | ResidencyIncluded (enumeration: ISO 3166-2 Country/Region Code) | 1..* | ["UK"],["EU"] |

| 5 | Notes |

|

|

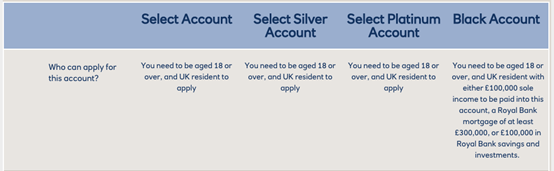

What about benefits packages?

Example: NatWest Reward Silver Account

Lifestyle benefits and Rewards. £12 a month.

European travel insurance, mobile phone insurance, 3% Rewards on 7 types of household bills paid by Direct Debit,

ticket booking Service, tastecard, travel money

Section Number | Field | Cardinality | Value(s) |

|---|

| 1 | Name | 1..1 | “Lifestyle Benefits & Rewards” |

| 1 | Type (Enumeration: OB_FeatureBenefitType1Code) |

|

|

| 1 | OtherType (OtherCodeType) |

|

|

| 1 | BenefitGroupNominalValue: | 0..1 | 300.00 |

| 1 | Fee | 0..1 | 12.00 |

| 1 | ApplicationFrequency (Enumeration: OB_Frequency1Code) | 1..1 | "Monthly" |

| 1 | OtherApplicationFrequency (OtherCodeType) |

|

|

| 1 | CalculationFrequency (Enumeration: OB_Frequency1Code) | 0..1 | "Monthly" |

| 1 | OtherCalculationFrequency (Enumeration: OB_Frequency1Code) |

|

|

| 1 | Notes |

|

|

| 2 | Identification

| 1..1 | [1],[2],[3] |

| 2 | Type (Enumeration: OB_FeatureBenefitType1Code) | 1..1 | [“Travel Insurance”],[“TechnologyInsurance”],[“Rewards”],[“Lifestyle”],[“PreferentialRates”] |

| 2 | OtherType (OtherCodeType) |

|

|

| 2 | Name | 0..1 | [“European travel insurance”],[“Mobile Phone Insurance”],[“3% Rewards on 7 types of household bills paid by direct debit”],[“Ticket Booking Service”],[“Taste card”],[“Travel Money”] |

| 2 | Amount |

|

|

| 2 | Indicator |

|

|

| 2 | Textual |

|

|

| 2 | Notes | 0..* | Add in the accompanying note for each of these benefit items displayed on the website. |