SME Loan API Specification - v2.0.0

Version Control

Version | Date | Author | Comments |

|---|---|---|---|

| 2.0.0 | 24 Jul 2017 | Open Banking Open Data API Team | This is the baseline version. |

Overview

This specification includes all relevant artefacts for the Open Data Business SME Unsecured Loans (SME) API Specification.

Currently, price comparison websites have to obtain their SME Business Loan product data either via bank proprietary APIs, via information collected by dedicated data capture agencies or via "screen scraping" (i.e. capturing product web page information and writing scripts to extract relevant data). This work is complex and prone to error, so having a standard API would make the data capture side much easier and allow more third party providers to provide applications that could target particular consumer markets.

This endpoint can contain multiple brands owned by a particular banking group. Each brand can own multiple SME Unsecured Loan products.

Loan

This section covers SME Unsecured Loan attributes that will change only under rare circumstances (see CoreProduct section for additional attributes that will be updated regularly).

The following information can be provided:-

- Product Name i.e. the name marketed to the consumers.

- Identification is the unique id created by the financial institution to internally define the product

- Segment - allows specification of the type of product e.g. basic, regular, premium

MarketingState

Within our design, we have a concept of a "marketing state" for the product. This concept is required because for any "On Sale" SME Unsecured Loan product:-

- The loan may provide a different offering to the SME loan holder the longer that they hold the product - covered by StateTenureLength & StateTenurePeriod in the example below.

- The financial institution can change any of the Loan attributes that are marketed over time - covered by FirstMarketedDate and LastMarketedDate in the example below.

We'll illustrate this with the following example.

CMA9Bank has an SME Unsecured Loan product that was first advertised and marketed on 1/1/2017 and has the following features currently:-

- If the accountholder takes the product, they are offered a promotional interest rate of 3% for 1st 9 months, then 5% for next 12 months and then it reverts back to the standard variable rate (e.g. 14.9%).

The original marketing states can be shown as follows:-

Identification | PredecessorID | MarketingState | FirstMarketedDate | LastMarketedDate | StateTenureLength | StateTenurePeriod | Notes |

|---|---|---|---|---|---|---|---|

| CP1 | Promotional | 1/1/2017 | 31/12/9999 | 9 | Month | On taking out the loan the initial promotional offer lasts 9 months. Attached to this state will be the original initial promotional interest rate information. | |

| CP2 | CP1 | Promotional | 1/1/2017 | 31/12/9999 | 12 | Month | 9 months into the loan duration, the customer will receive a 2nd promotional offer lasting 12 months |

| CR1 | CP2 | Regular | 1/1/2017 | 31/12/9999 | After the 2nd promotional period has expired, the accountholder will be moved to the regular interest rate. |

On 17th July, CMA9Bank are going to change the offer, so that only 0.3% is paid in the 1st 9 months. The marketing states on 16th July will look like this:-

Identification | PredecessorID | MarketingState | FirstMarketedDate | LastMarketedDate | StateTenureLength | StateTenurePeriod | Notes |

|---|---|---|---|---|---|---|---|

| CP1 | Promotional | 1/1/2017 | 16/7/2017 | 9 | Month | On taking out the loan the initial promotional offer lasts 9 months. Attached to this state will be the original initial promotional interest rate information. | |

| CP2 | CP1 | Promotional | 1/1/2017 | 31/12/9999 | 12 | Month | 9 months into the loan duration, the customer will receive a 2nd promotional offer lasting 12 months |

| CR1 | CP2 | Regular | 1/1/2017 | 31/12/9999 | After the 2nd promotional period has expired, the accountholder will be moved to the regular interest rate. | ||

| CP3 | Promotional | 17/7/2017 | 31/12/9999 | 9 | Month | On taking out the loan the initial promotional offer lasts 9 months. Attached to this, will be the revised initial promotional offer interest rate information. |

And on the 17th July, the marketing states will look like this:-

Identification | PredecessorID | MarketingState | FirstMarketedDate | LastMarketedDate | StateTenureLength | StateTenurePeriod | Notes |

|---|---|---|---|---|---|---|---|

| CP2 | CP3 | Promotional | 1/1/2017 | 31/12/9999 | 12 | Month | 9 months after the account has been opened, the customer will receive a 2nd promotional offer lasting 12 months |

| CR1 | CP2 | Regular | 1/1/2017 | 31/12/9999 | After the 2nd promotional period has expired, the accountholder will be moved to the regular interest rate. | ||

| CP3 | Promotional | 17/7/2017 | 31/12/9999 | 9 | Month | On taking out the loan the initial promotional offer lasts 9 months. Attached to this, will be the revised initial promotional offer interest rate information. |

Notes:

- PredecessorID is used to sequence the creditinterest states offered to the customer when they take out the Loan, it does not record change history.

- FirstMarketedDate and LastMarkedDate cover the period when the particular marketing state was advertised to the customer.

- CMA9 Banks only have to provide information for current (and known future, if they wish) marketing states. There is no open data requirement to provide an audit history of all marketing states that ever applied to the Loan. When the future marketing state becomes the current marketing state, the original marketing state information no longer needs to be published.

- When CP1 Marketing state is replaced by CP3 Marketing state, the PredecessorID in CP2 will also need to be updated to point to CP3, as shown.

- The Identification column is simply for internal bank use. The ID column is required so that we can sequence states.

Core Product

This sections includes information that can change relatively often. Information to be provided includes:-

- Product URL allows a link to the financial institution's website where more detail about the product can be found

- URL to the product's terms & conditions

- Sales Access Channels cover all of the channels by which a customer can be sold a BCA

- Servicing Access Channels cover all of the channels by which a customer can receive service for their BCA. Note: This covers servicing of all aspects of the BCA. Some aspects may not be serviceable via certain channels.

- MonthlyCharge covers any monthly servicing charge that a financial institution may make to a BCA accountholder

Loan Interest

In this section, information about the interest rates that are payable by the SME to the Lender are listed. This section contains headline Representative APR info to be used on comparison websites.

Interest rates are typically standard variable rates, with rates potentially changing during the course of the product lifecycle. In addition to the 'Regular' standard variable rates, some Loan products also provide for more attractive 'Promotional' interest rates which are fixed for a relatively short duration. (see MarketingState section above as to how to represent these).

Loan Repayment

This section allows information to be provided about loan repayment and related fees/charges. Common fees and charges include:-

Early repayment charges

Overpayments with/without extra charges

Interest applicable

Loan setup/arrangement fee

Legal cost fee

Late Payment Fee

BorrowingItem (Return Fees)

Eligibility

In this section, criteria such as residency and trading history restrictions that are necessary for taking out an SME Unsecured Loan product are provided.

Note: eligibility criteria for features & benefits are treated in that section itself (see below).

Features & Benefits

In this section, information about any inherent product features or value-added benefits (whether they're charged or not) can be captured.

Benefits can also be grouped together e.g. if a package of benefits is supplied. For any benefits group, benefit details may be individually added or notes simply added to the benefits group.

For a benefits group or for individual benefits, any eligibility criteria required to obtain that benefit can be specified as notes.

Other Fees & Charges

Key Fees & Charges that a customer has to pay can be specified in the Core Product, Loan Repayment and Features & Benefits sections (see above).

The long tail of additional fees & charges that are not associated to either of these areas can be specified in this section.

Specification

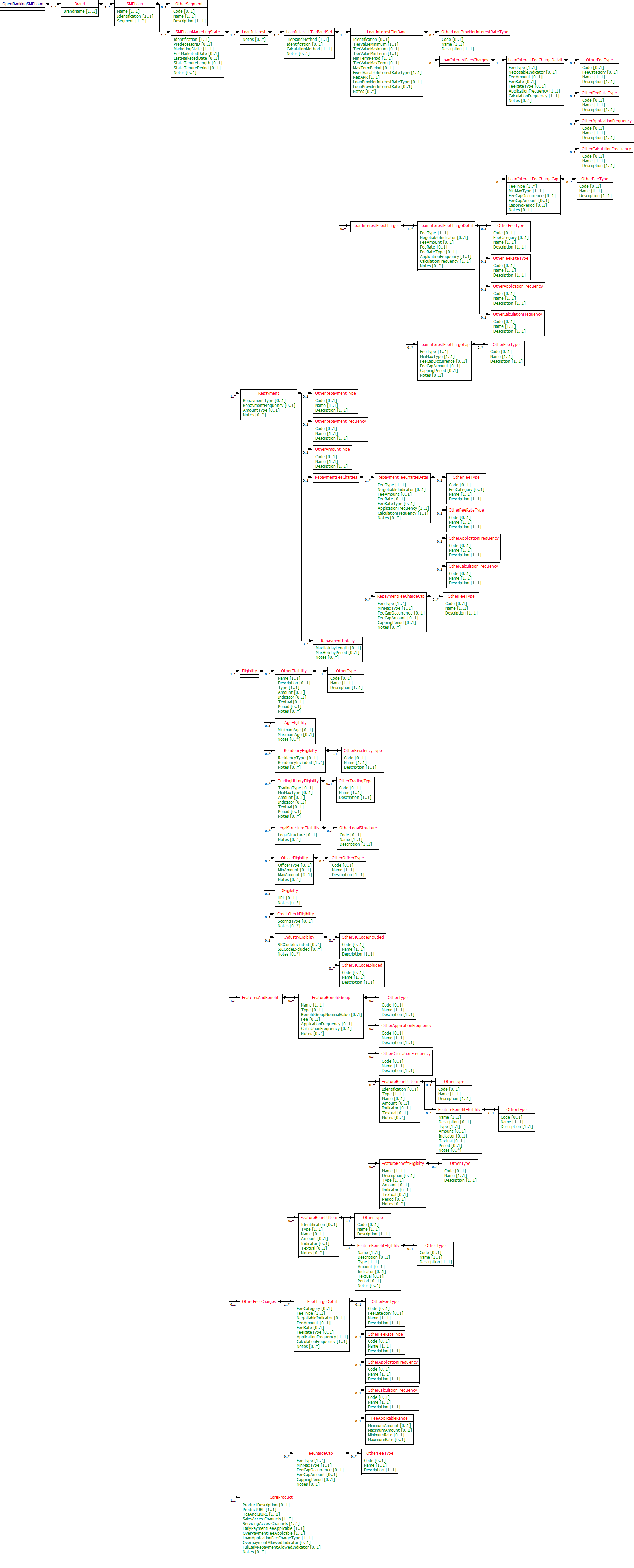

The following UML Class Diagram provides the hierarchical structure of the message in a graphical form, which is easier to digest.

- Data Dictionary - provides detailed descriptions for each field in the message specification along with the associated code lists, constraints and other technical details such as cardinality, any pattern constraints, min, max length etc.

- Swagger - the API specification written using the Swagger API specification format (some known issues which will be fixed in v2.1.0).

Compliance Report

- Compliance Report - highlights changes made to fields & datatypes from v1.x.

Message Implementation Guide

- Message Implementation Guide - provides worked examples of how to implement a particular message specification.

© Open Banking Limited 2019 | https://www.openbanking.org.uk/open-licence | https://www.openbanking.org.uk