CCC API Specification - v2.0.0

Version Control

Version | Date | Author | Comments |

|---|---|---|---|

| 2.0.0 | 24 Jul 2017 | Open Banking Open Data API Team | This is the baseline version. |

Overview

This specification includes all relevant artefacts for the Open Data Business SME Commercial Credit Cards (CCC) API Specification.

Currently, price comparison websites have to obtain their CCC product data either via bank proprietary APIs, via information collected by dedicated data capture agencies or via "screen scraping" (i.e. capturing product web page information and writing scripts to extract relevant data). This work is complex and prone to error, so having a standard API would make the data capture side much easier and allow more third party providers to provide applications that could target particular SME markets.

This endpoint can contain multiple brands owned by a particular banking group. Each brand can own multiple SME Commercial Credit Card products.

CCC

This section covers CCC attributes that will change only under rare circumstances (see CoreProduct section for additional attributes that will be updated regularly).

The following information can be provided:-

- Product Name i.e. the name marketed to the consumers.

- Identification is the unique id created by the financial institution to internally define the product

- Segment – currently only ‘general’

MarketingState

Within our design, we have a concept of a "marketing state" for the product. This concept is required because for any "On Sale" CCC product:-

- The CCC may provide a different offering to the card account holder the longer that they hold a particular CCC

- The financial institution can change any of the CCC attributes over time.

We'll illustrate this with an example.

CMA9Bank has a CCC product that was first advertised on 1/1/2017 and has the following features currently:-

If the card accountholder takes the product, they are offered:

- a promotional 0% Balance Transfer rate for 48 months, then it reverts back to the standard variable rate (e.g. 15.9%)

- a promotional 0% Purchase rate for 6 months, then it reverts back to the standard variable rate (e.g. 15.9%)

The original marketing states can be shown as follows:-

| Identification | PredecessorID | MarketingState | FirstMarketedDate | LastMarketedDate | StateTenureLength | StateTenurePeriod | Notes |

CP1 |

| Promotional | 1/1/2017 | 31/12/9999 | 9 | Month | When an accountholder opens the CCC, they will receive an initial promotional offer lasting 9 months. Attached to this state will be the original initial promotional interest rate information (0% Balance transfer rate, 0% Purchase rate) |

CP2 | CP1 | Promotional | 1/1/2017 | 31/12/9999 | 12 | Month | 9 months after the account has been opened, the customers promotional offer lasting a further 3months is (0% Balance transfer and regular 15.9% Purchase rate) |

CR1 | CP2 | Regular | 1/1/2017 | 31/12/9999 |

|

| After the promotional period has expired, the accountholder will be moved to the regular interest rate for both balance and purchases) |

On 17th July, CMA9Bank are going to change the offer, so that purchase rate are charged at 2% in the first 9 months. The marketing states on 16th July will look like this:-

| Identification | PredecessorID | MarketingState | FirstMarketedDate | LastMarketedDate | StateTenureLength | StateTenurePeriod | Notes |

CP1 |

| Promotional | 1/1/2017 | 16/7/2017 | 9 | Month | When an accountholder opens the CCC, they will receive an initial promotional offer lasting 9 months. Attached to this state will be the original initial promotional interest rate information. (0% Balance transfer rate, 0% Purchase rate) |

CP2 | CP1 | Promotional | 1/1/2017 | 31/12/9999 | 12 | Month | 9 months after the account has been opened, the customers promotional offer lasting a further 3months is (0% Balance transfer and regular 15.9% Purchase rate) |

CR1 | CP2 | Regular | 1/1/2017 | 31/12/9999 |

|

| After the promotional period has expired, the accountholder will be moved to the regular interest rate for both balance and purchases) |

CP3 |

| Promotional | 17/7/2017 | 31/12/9999 | 9 | Month | When an accountholder opens the CCC, they will receive an initial promotional offer lasting 9 months. Attached to this state will be the original initial promotional interest rate information. (0% Balance transfer rate, 2% Purchase rate) |

And on the 17th July, the marketing states will look like this:-

| Identification | PredecessorID | MarketingState | FirstMarketedDate | LastMarketedDate | StateTenureLength | StateTenurePeriod | Notes |

CP2 | CP3 | Promotional | 1/1/2017 | 31/12/9999 | 12 | Month | 9 months after the account has been opened, the customers promotional offer lasting a further 3months is (0% Balance transfer and regular 15.9% Purchase rate) |

CR1 | CP2 | Regular | 1/1/2017 | 31/12/9999 |

|

| After the promotional period has expired, the accountholder will be moved to the regular interest rate for both balance and purchases) |

CP3 |

| Promotional | 17/7/2017 | 31/12/9999 | 9 | Month | When an accountholder opens the CCC, they will receive an initial promotional offer lasting 9 months. Attached to this state will be the original initial promotional interest rate information. (0% Balance transfer rate, 2% Purchase rate) |

Notes:

- PredecessorID is used to sequence the Balance and Purchase interest states offered to the customer when they take out the CCC, it does not record change history.

- FirstMarketedDate and LastMarkedDate cover the period when the particular marketing state was advertised to the customer.

- CMA9 Banks only have to provide information for current (and known future, if they wish) marketing states. There is no open data requirement to provide an audit history of all marketing states that ever applied to the CCC. When the future marketing state becomes the current marketing state, the original marketing state information no longer needs to be published.

- When CP1 Marketing state is replaced by CP3 Marketing state, the PredecessorID in CP2 will also need to be updated to point to CP3, as shown.

- The Identification column is simply for internal bank use. The ID column is required so that we can sequence states.

Core Product

This sections includes information that can change relatively often. Information to be provided includes:-

- Product URL allows a link to the financial institution's website where more detail about the product can be found

- URL to the product's terms & conditions

- Minimum & Maximum Credit Limits on the card

- Maximum days of interest free credit on purchases when paid in full and on time each month

- Sales Access Channels cover all of the channels by which a customer can be sold a CCC ( e.g. Branch, Online )

- Servicing Access Channels cover all of the channels by which a customer can receive service for their CCC. Note: This covers servicing of all aspects of the CCC. Some aspects may not be serviceable via certain channels.

- Card Scheme

- Indicator to show if contactless capable

- Account service fee amount for the card and how often it is charged ( monthly, quarterly, annually)

- Representative APR

- Specify any restrictions on how soon a balance needs to be transferred from opening the account and getting the promotional offer in the notes section

Repayment

Minimum Payment

This is the minimum payment that has to be paid every period ( typically every month ). This amount is the larger of the MinBalanceRepaymentRate applied to the outstanding statement balance or the MinBalanceRepaymentAmount.

Repayment Allocation

The mechanism of allocating of charges for any outstanding balance on a statement may differ between banks. Each bank may apply charges differently to the different balance buckets and hence accruing different charges at different rates. For example an outstanding balance on a credit card statement could be broken down to:

- Interest and fees

- Cash advances transactions ( inc ATM withdrawals and foreign currency purchases)

- Standard rate balance transfer

- Standard rate purchases

- Low promotional rates ( life of balance transfers offers, for example)

- 0% promotional rates

In order for a TPP to offer a service to recommend the a credit it would be necessary to include information on:

- The different balance buckets used

- The rates, fees and charges applied to each balance bucket and

- The order of applying the charges to the balance buckets

This clarification has to be supplied by each Bank in the Notes section ( see TDA decision 059 - https://openbanking.atlassian.net/wiki/display/WOR/059)

An example from the LBG website: ( https://www.lloydsbank.com/credit-cards/terms-and-conditions/credit-cards-terms.asp )

B7.4 How we apply your payments

We use your payments to clear any overdue amounts before we apply them to your latest minimum payment.

We will reduce the amount you owe in the following order:

- any overdue amounts from previous statements; then

- the remaining balance on your statement; then

- any recent transactions not yet shown on your statement

We use your payments to pay off balances charged at the highest interest rate first and so on down to balances with the lowest interest rates. This means the more expensive balances are always paid off first.

If there is more than one type of balance at the same interest rate, they are paid off in the following order: cash transactions, purchases, balance transfers and money transfers, and then default charges (plus any interest or charges incurred as a result of those balances). For each type of balance, your payments will pay off the oldest balance (and related fees, charges or insurance) first.

Non Repayment Fee Charges

Examples

- Default charge when a minimum payment is late

- When a customer goes over the credit limit during the statement period

- A payment is returned unpaid

Use the notes field to indicate what balance type you are allocating the fee to, as well as, indicating how interest is charged on the fee.

Other Fees & Charges

Key Fees & Charges that a customer has to pay can be specified in the Core Product, Repayment and Features & Benefits sections (see above).

The long tail of additional fees & charges that are not associated any of the above areas can be specified in this section.

Details as to any capping (i.e. maximum amount that can be charged to a customer for a particular period) for any fee/charge can also be specified in this section.

Examples could be:

- Cash advance fees

- Non-sterling transaction fees

- Balance Transfer Introductory fee

Use the notes field to indicate what balance type you are allocating the fee to, as well as, indicating how interest is charged on the fee.

Eligibility

In order to get a CCC a mix of qualifications are required for both the Business and Business owners. For example:

- Business : Turnover, Periods company has been trading, Minimum annual returns ( i.e. number years of company accounts that have to be provided), residency (owners, business, incorporated, trading and Tax), BCA required, Legal structure, Credit check

- Business Owner : ID and verification, Credit checks, Previous Bankruptcy, CCJs,

Note eligibility criteria for features & benefits are treated in that section.

Specify any restrictions on Transferring a Balance from another Card in the Notes.

Features & Benefits

In this section, information about any inherent product features or value-added benefits (whether they're charged or not) can be captured.

Benefits can also be grouped together e.g. if a package of benefits is supplied. For any benefits group, benefit details may be individually added or notes simply added to the benefits group.

For a benefits group or for individual benefits, any eligibility criteria required to obtain that benefit can be specified as notes.

Specification

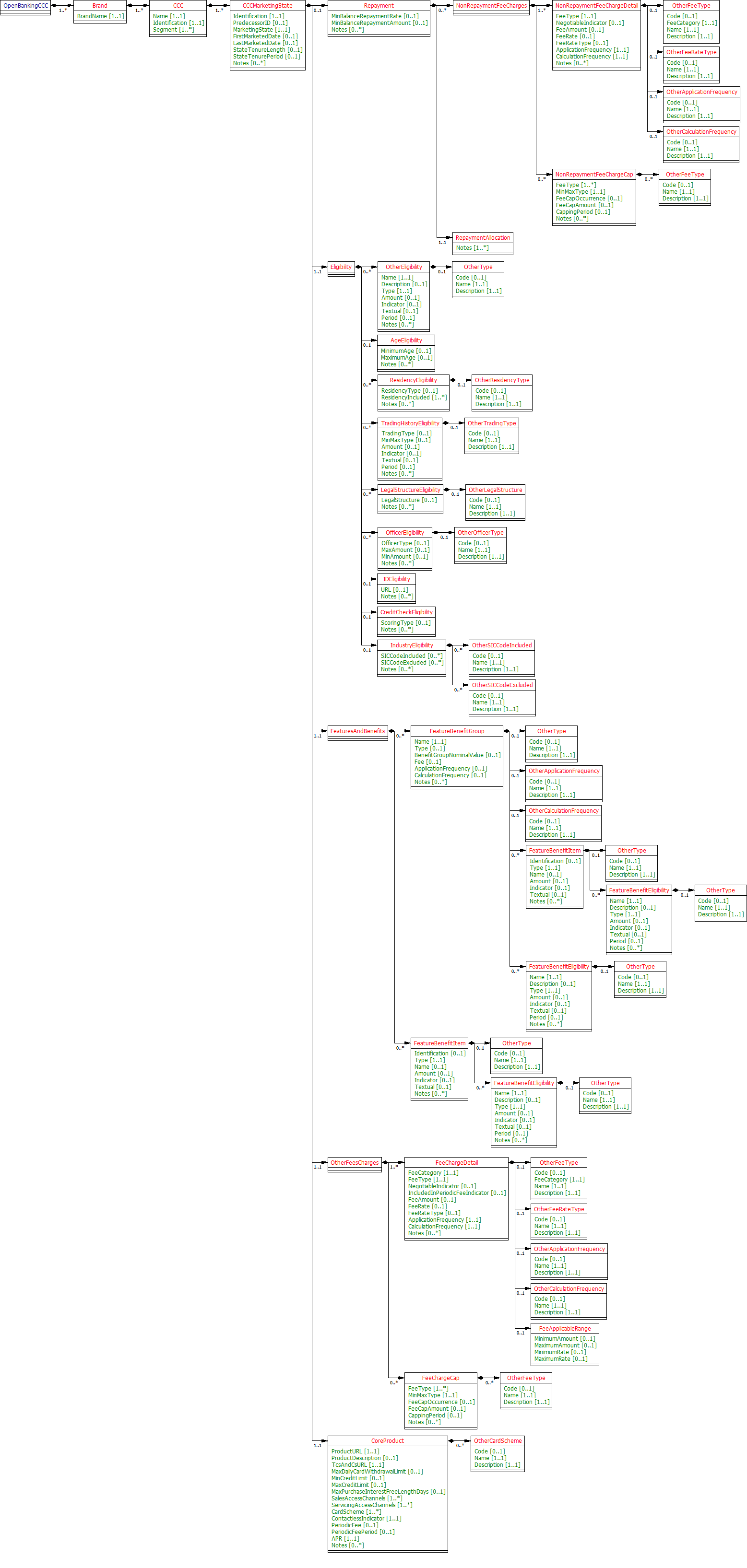

The following UML Class Diagram provides the hierarchical structure of the message in a graphical form, which is easier to digest.

- Data Dictionary - provides detailed descriptions for each field in the message specification along with the associated code lists, constraints and other technical details such as cardinality, any pattern constraints, min, max length etc.

- Swagger - the API specification written using the Swagger API specification format.

Compliance Report

- Compliance Report - highlights changes made to fields & datatypes from v1.x.

Message Implementation Guide

- Message Implementation Guide - provides worked examples of how to implement a particular message specification.

Related content

© Open Banking Limited 2019 | https://www.openbanking.org.uk/open-licence | https://www.openbanking.org.uk